→ TL;DR: The best account research software isn't about having the most data; it's about getting the right insights at the right time. For scalable, real-time insights that tell you why to engage an account now, Salesmotion leads the pack by turning public data into actionable sales narratives. For pure contact data, ZoomInfo and Apollo.io are strong. For intent signals, 6sense and Demandbase are key players. Manual research or basic AI like ChatGPT won't scale for serious GTM teams.

→ Who this list is for: This guide is for B2B revenue leaders—VPs of Sales, Sales Ops, and Marketing—and the frontline reps (SDRs and AEs) they support. If you're tired of manual research, static data, or intent signals that don't tell the full story, you're in the right place. We're cutting through the noise to help you find a tool that fits your specific go-to-market strategy.

→ Scenarios (not categories): Instead of just listing tools, think about your primary challenge.

- "I need to prioritize thousands of accounts and know who is ready to buy." You're looking for intent-based platforms like 6sense or Demandbase. These tools track online research behavior to identify in-market accounts, but they often lack the "why" behind the intent.

- "I need a quick, specific answer for one account right now." Generative AI tools like ChatGPT can pull information on demand. It's great for one-off queries but doesn't scale, lacks a structured GTM framework, and requires manual prompting for every account.

- "I need to build a comprehensive, personalized outreach plan for a strategic account." This is where manual research often comes in, but it's incredibly slow and cumbersome. You're digging through earnings calls, news, and SEC filings yourself.

- "I need to scale personalized outreach for my whole team with timely, relevant insights." This is the sweet spot for a research automation platform like Salesmotion, which continuously monitors sources and pushes structured, narrative-driven insights into your reps' workflow.

→ Short picks with “best for” and 1‑2 proof lines:

- Salesmotion: Best for scaling real-time, relevant outreach with AI. It turns public signals into actionable sales narratives and saves reps over 8 hours a week.

- ZoomInfo: Best for US-based contact data. Its strength is a massive database of direct-dial phone numbers and company org charts.

- LinkedIn Sales Navigator: Best for relationship-based selling. Unmatched for mapping connections and identifying warm introduction paths.

- Apollo.io: Best for an all-in-one prospecting and engagement tool. Combines a large contact database with built-in sequencing at an affordable price point.

- 6sense: Best for enterprise ABM teams needing predictive intent. Excels at identifying anonymous buying signals to prioritize in-market accounts.

- Crunchbase: Best for tracking funding and startup growth signals. The go-to source for identifying recently funded companies ripe for outreach.

In-Depth Look at The Top Account Research Tools

Here's a breakdown of the leading platforms, what they do best, and who they're for. For a deeper dive into crafting a solid research strategy, check out this ultimate account research checklist.

1. Salesmotion

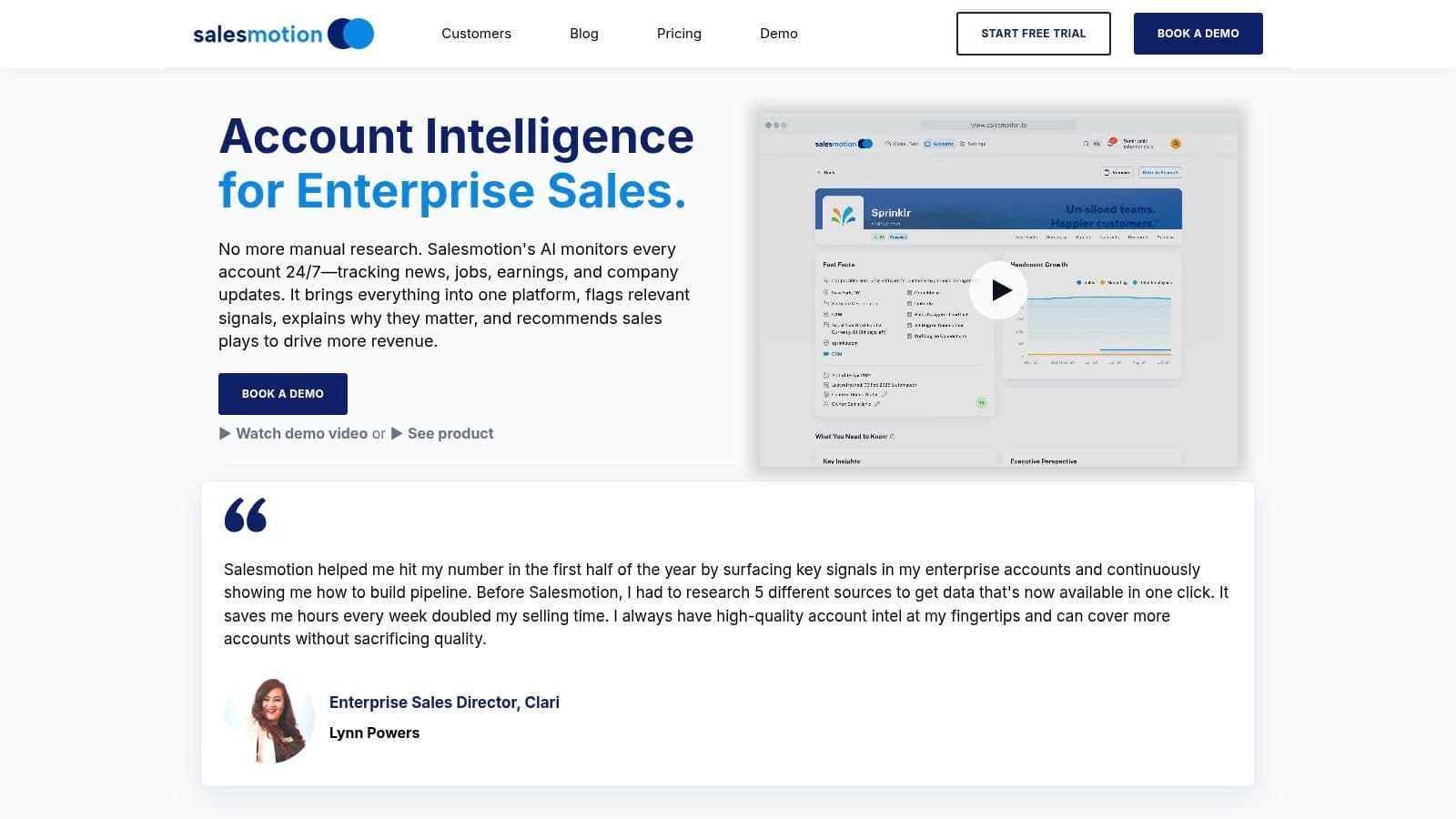

Salesmotion automates the tedious work of account research, acting as an AI intelligence engine that continuously scans over 1,000 public sources—earnings calls, SEC filings, podcasts, news, and job postings. It doesn't just give you data; it delivers actionable signals and narrative-driven insights (like account briefs, executive profiles, and SWOT analyses) directly into your CRM or Slack. This allows sales teams to build a compelling "why now" message for every single outreach.

- G2 Rating: 5.0 out of 5 stars

- Best for: Scaling real-time, relevant outreach with AI-generated insights.

- Key Advantage: It synthesizes raw data into ready-to-use sales assets, saving reps over eight hours per week and boosting pipeline creation by nearly 40%. It bridges the gap between raw data and effective selling.

- Limitations: Integrations with some sales engagement tools (like Gong or Salesloft) are on the roadmap. Pricing is not public.

- Website: https://salesmotion.io

2. ZoomInfo

ZoomInfo is a giant in the B2B intelligence space, known for its extensive database of contacts and companies, particularly in the US. Its primary value is providing direct-dial phone numbers and detailed organizational charts, making it a powerhouse for teams focused on high-volume outbound calling. Its platform includes intent signals and robust data enrichment features that integrate seamlessly with major CRMs.

- G2 Rating: 4.4 out of 5 stars

- Best for: Mid-market and enterprise teams needing a deep well of US-centric contact data.

- Key Advantage: The sheer volume and accuracy of its US direct-dial phone data are hard to beat.

- Limitations: International data can be less comprehensive. Contracts are typically annual and non-cancellable, and the pricing can be complex and costly.

- Further Reading: See how it stacks up in this sales intelligence platform comparison.

3. LinkedIn Sales Navigator

LinkedIn Sales Navigator leverages the world's largest professional network for powerful account and lead research. It excels at mapping relationships and buying committees, helping you find warm introduction paths through its TeamLink feature. It’s less about bulk contact data and more about the human context—tracking job changes, shared connections, and content engagement to create timely outreach triggers.

- G2 Rating: 4.3 out of 5 stars

- Best for: Sales teams prioritizing relationship-based selling and account mapping.

- Key Advantage: Unparalleled ability to surface relationship context and warm paths into target accounts.

- Limitations: Not a contact database; you can't export large lists of contacts. Deep CRM integration is reserved for the most expensive tier.

4. Crunchbase

Crunchbase is the definitive source for information on private companies, startups, and the venture capital ecosystem. Its strength is its comprehensive database of funding rounds, investors, and acquisitions. For teams selling to high-growth tech companies, Crunchbase provides the critical growth signals—like a recent funding round—that indicate a prime opportunity to engage.

- G2 Rating: 4.5 out of 5 stars

- Best for: Sales teams targeting startups, tech companies, and venture-backed businesses.

- Key Advantage: Excellent for tracking funding trends and identifying companies with fresh capital to spend.

- Limitations: Contact data is less extensive than specialized sales intelligence tools.

- Further Reading: It's a top option in this comparison of free account research tools.

5. 6sense

6sense is a leading account engagement platform that uses predictive AI to find accounts that are actively researching solutions like yours. It analyzes anonymous intent signals from across the web to identify "in-market" accounts before they ever contact you, making it a cornerstone for modern Account-Based Marketing (ABM) strategies. It helps revenue teams focus their efforts on accounts with the highest propensity to buy.

- G2 Rating: 4.5 out of 5 stars

- Best for: Enterprise marketing and sales teams running sophisticated ABM programs.

- Key Advantage: Its predictive models are excellent at prioritizing accounts based on anonymous buying intent.

- Limitations: It tells you who is looking but often lacks the specific context or narrative for why. Enterprise plans require a significant budget.

6. Demandbase

Demandbase offers a unified Account-Based Experience (ABX) platform that combines account intelligence with marketing and sales activation tools. It merges firmographic data (from its acquisition of InsideView) with intent signals and advertising capabilities, allowing revenue teams to orchestrate coordinated, account-centric campaigns. It provides a holistic view of an account's journey, from awareness to engagement.

- G2 Rating: 4.4 out of 5 stars

- Best for: Enterprise revenue teams seeking a unified platform for both sales and marketing ABM activation.

- Key Advantage: Strong combination of data and activation tools for running cross-departmental GTM plays.

- Limitations: Similar to other intent platforms, it's strong on the "who" but can be light on the contextual "why." The platform is geared toward enterprise budgets and delivers maximum value when both sales and marketing adopt it.

Additional Tools to Consider

- Manual Research: The original method. Digging through 10-Ks, news sites, and LinkedIn profiles. It’s incredibly insightful but completely unscalable and prone to burnout.

- ChatGPT & Generative AI: Excellent for on-demand, specific questions ("Summarize Apple's latest earnings call"). However, it doesn't scale for an entire team, lacks proactive signal monitoring, and can't be integrated into a structured GTM workflow without significant engineering effort.

- Bombora: The leading provider of B2B intent data, sourced from a cooperative of publisher websites. It's not a standalone platform but provides the raw intent signals that power many other tools. Learn more in this guide to B2B intent data.

- PitchBook: The gold standard for data on private capital markets (VC, PE, M&A). Essential for teams selling into the finance ecosystem or targeting companies based on financial events.

See Salesmotion in action

Take a self-guided interactive tour — no signup required.

Comparison Grid

| Product | Core features | Value & ROI | Best for | Differentiator | Pricing |

|---|---|---|---|---|---|

| Salesmotion (Recommended) | 24/7 multi-source signals (earnings, SEC, news, jobs, podcasts), auto-generated briefs, exec profiles, SWOTs, CRM/Slack integrations | Saves >8 hrs/rep/week, ~40% pipeline uplift, 30% less planning | SDRs, AEs, Sales Ops, ABM/Marketing | Narrative POVs tied to value props, source-backed insights, rapid setup (minutes–48h) | Free trial & guided demo; pricing on request |

| ZoomInfo | Large US contact/company DB, direct dials, org charts, enrichment, integrations | Deep contact reach, mature admin controls | Mid-market → enterprise sales & ABM | Extensive phone/contact data, broad product ecosystem | Quote-based; often annual contracts |

| LinkedIn Sales Navigator | LinkedIn graph search, TeamLink, alerts, Smart Links, CRM sync (higher tiers) | Warm introductions, relationship context, timely alerts | Account mapping, relationship-driven sellers | Unmatched relationship/warm-path intel | Subscription tiers; advanced features on top plans |

| Crunchbase | Funding, investors, growth signals, saved lists & alerts, exports | Strong startup discovery and TAM building | BD, startup/scaleup-focused SDRs & AEs | Investor/funding-centric company insights | Pro available monthly; paid plans for exports |

| 6sense | Predictive AI scoring, intent, technographics, Buyer Discovery | Mature ABM prioritization, in-market account ID | ABM teams, enterprise prioritization | Predictive models + Buyer Discovery workflows | Free limited tier; enterprise quote-based |

| Demandbase | ABM/ABX, Data Cloud, advertising, enrichment, CRM/MAP integrations | Unified sales+marketing activation, account-level targeting | Enterprise ABM and cross-team programs | Combined data + activation, InsideView lineage | Quote-based, enterprise packaging |

“Salesmotion has been a game-changer for me. I used to spend 12 hours a week on prospect research, now it's down to 4. Plus I'm finding stuff I was totally missing - podcasts, news mentions, the good bits.”

George Treschi

Account Executive, FY25 President's Club, Sigma

When our tool is not a fit

Salesmotion delivers the most value for B2B revenue teams focused on strategic, insight-led selling into mid-market and enterprise accounts.

Our platform may not be the right fit if:

- You primarily need a list-building tool for high-volume, low-personalization outreach. Tools like Apollo.io or ZoomInfo are built for that motion.

- Your sales process does not rely on personalization or understanding a prospect's business context.

- You are a solopreneur or a very small team with a limited budget that can be served by manual research or free tools.

Ready to Scale Your Account Intelligence?

The right account research software transforms your sales team from reactive to proactive. Instead of just chasing leads, they can engage the right accounts with the right message at the right time.

For teams looking to move beyond static data and surface the "why now" for every deal, Salesmotion provides the real-time, narrative-driven intelligence needed to win. If you're tired of manual research and want to empower your reps with actionable insights, let's talk.

Talk to us if you're in a scenario where you need to scale personalized outreach for your entire team.

See how Salesmotion can help you close bigger deals, faster.

“The Business Development team gets 80 to 90 percent of what they need in 15 minutes. That is a complete shift in how our reps work.”

Andrew Giordano

VP of Global Commercial Operations, Analytic Partners

Key Takeaways

- The best account research software delivers the right insights at the right time -- not just more data. Signal-based intelligence that explains "why now" outperforms raw contact databases for strategic selling.

- Match your tool to your primary challenge: intent platforms like 6sense for prioritizing in-market accounts, contact databases like ZoomInfo for high-volume outbound, or research automation platforms like Salesmotion for scaling personalized, narrative-driven outreach.

- Manual research and generative AI like ChatGPT are useful for one-off queries but do not scale for entire sales teams and cannot proactively monitor accounts or integrate into GTM workflows.

- Salesmotion bridges the gap between raw data and effective selling by continuously scanning 1,000+ public sources and delivering actionable sales narratives, saving reps over 8 hours per week.

- Key ROI metrics to track include reduction in manual research time per rep, meeting booking rates, pipeline velocity, and average deal size improvement.

Frequently Asked Questions

What is the difference between account research software and a contact database?

A contact database like ZoomInfo or Apollo.io primarily provides names, emails, and phone numbers. Account research software goes deeper, offering insights into a company's strategic priorities, recent events like funding or leadership changes, and buying intent. The goal is to understand why and when to reach out, not just who to contact.

Can I use ChatGPT instead of dedicated account research software?

ChatGPT is useful for answering specific, on-demand questions about a single account, but it does not scale for an entire sales team. It cannot proactively monitor thousands of accounts for buying signals, structure data into a GTM workflow, or integrate directly into your CRM to trigger actions automatically.

What is the difference between intent data and signal-based intelligence?

Intent data from platforms like 6sense tells you an account is researching a topic, which is useful for prioritization. Signal-based intelligence goes further by analyzing public sources like earnings calls, news, and job postings to explain the specific business context and pain points driving that research, giving reps the narrative they need for relevant outreach.

How long does it take to implement account research software?

Implementation times vary widely depending on the platform. Basic contact databases can be running in hours, while complex ABM suites may take weeks or months. Research automation platforms like Salesmotion are designed for rapid deployment, often going live within 48 hours by connecting to public data sources and integrating with your CRM.

How should I measure the ROI of account research software?

Track reduction in time spent on manual research per rep, increase in meeting booking rates, improvement in pipeline velocity from opportunity creation to close, and changes in average deal size. The best platforms should demonstrate clear, measurable improvements across these metrics within the first quarter of use.