TL;DR: Using a SWOT analysis on your competitors is a powerful way to turn market data into a winning strategy. This guide shows you how to pinpoint their weaknesses, spot market opportunities they've missed, and build an actionable plan to outmaneuver them. It’s about moving from simply observing your rivals to actively outsmarting them.

Think of a competitive analysis SWOT as more than just a business school exercise. It's a powerful framework for turning raw market data into a real strategic advantage.

This guide is all about moving beyond the basic theory. We’ll get into the nitty-gritty of pinpointing competitor vulnerabilities, seeing market shifts before they happen, and carving out your unique position to win.

Of course, any good analysis starts with a solid foundation. You'll want to make sure your insights are built on solid ground, which is why we put together our ultimate account research checklist to get you started.

Why SWOT Is Your Secret Weapon for Competitive Analysis

Let's be honest, "SWOT analysis" sounds like something you'd nod off to in a business school lecture. But when you turn this classic framework on your competitors, it becomes a seriously powerful strategic tool. It stops being about listing facts and starts being about dissecting the entire competitive landscape.

A competitive analysis SWOT is all about looking at your rivals through four distinct lenses: their Strengths, Weaknesses, Opportunities, and Threats. For a sales-specific application, see our guide on SWOT analysis for sales. Think of it as building a strategic blueprint to outmaneuver them.

Moving Beyond Simple Observation

It’s easy to look at a competitor and say, "Their product is popular." A surface-level analysis stops there. A SWOT analysis forces you to ask why. Is it genuinely their innovative feature set (a Strength), or is it just aggressive pricing that you could easily beat (a Weakness)?

This structured approach saves you from drowning in a sea of random data points. It neatly organizes your intel into four quadrants, making it way easier to connect the dots and see the bigger picture.

By framing your research within the SWOT model, you turn random competitor data into an organized playbook. It helps you identify where they're vulnerable, anticipate their next move, and spot market gaps they've completely missed.

This isn't some new fad. The SWOT framework has been helping businesses adapt since it was first introduced back in 1965. Its longevity speaks volumes. In fact, one report notes that 72% of executives see adaptability as a top priority—something a SWOT exercise is built to uncover. That’s especially critical when you consider that over 75% of them face unplanned disruptions every single year.

From Blueprint to Action Plan

Ultimately, the goal isn't just to fill out a chart. It’s about building a more resilient and adaptive strategy for your own business. A well-done competitive SWOT gives you the clarity to make informed decisions instead of just reacting to what your rivals do.

You can spot threats on the horizon—like a new technology your competitor is adopting—and reframe them as opportunities for your own business to get ahead. To really get the most out of it, you need to understand the broader context of how to conduct competitive analysis first.

What makes this framework so effective is its beautiful simplicity and focus. It forces you to ask the right questions:

- Strengths: Where does our competitor consistently win? What assets or unique capabilities give them an edge?

- Weaknesses: What are their customers always complaining about? Are there operational cracks or financial issues hiding beneath the surface?

- Opportunities: What market trends are they completely failing to capitalize on? Which customer segments are they ignoring that you could swoop in and serve?

- Threats: What external factors could completely derail their business model? Are new regulations or emerging rivals putting them at risk?

Answering these questions gives you the raw material for a winning strategy. You'll be able to pinpoint exactly where to apply your resources for maximum impact.

See Salesmotion on a real account

Book a 15-minute demo and see how your team saves hours on account research.

Gathering Your Competitive Intelligence

A great analysis is built on great data. Plain and simple. To build a competitive analysis SWOT that actually means something, you have to move beyond a quick skim of your rival's homepage. Real intelligence gathering means digging deep to uncover the story behind their public facade.

Think of yourself as a detective. You're not just observing; you're investigating. You're on the hunt for patterns, vulnerabilities, and unspoken truths that reveal what your competitors are really thinking and planning.

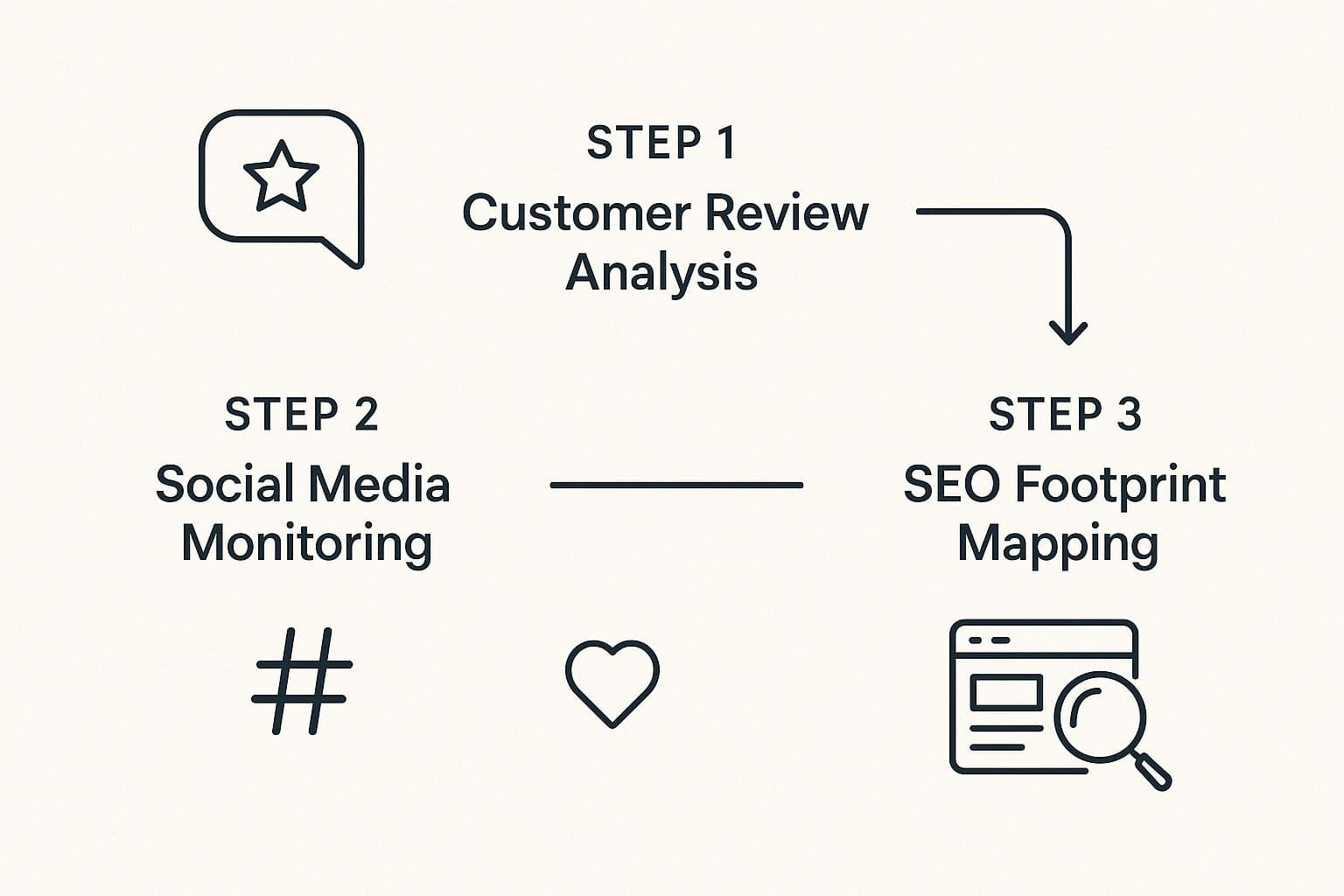

Uncovering the Voice of the Customer

Your competitor's customers are your single greatest source of intelligence. They'll tell you—in their own words—exactly where your rival shines and where they fall painfully short. This stuff is gold for your SWOT matrix.

Start by systematically combing through customer reviews on sites like G2, Capterra, or Trustpilot. Look for recurring themes. Are customers constantly raving about their intuitive interface (a clear Strength)? Or are there endless complaints about terrible customer support and glacial response times (a glaring Weakness)?

Social media is another treasure trove. Monitor their brand mentions, hashtags, and the comment sections on their posts. What do their followers love? What makes them furious? This is unfiltered, raw feedback you just can't find anywhere else.

Don't just read the reviews; analyze the sentiment behind them. A single, detailed complaint about a missing feature from a power user can be more insightful than ten generic five-star ratings.

This qualitative data is crucial, but you need to pair it with hard numbers for the full picture. To really accelerate your efforts, exploring the best competitive intelligence tools can give you a much more comprehensive view of the market. These platforms automate a lot of the grunt work, freeing you up to focus on the analysis itself.

Mapping the Digital Footprint

Beyond what customers are saying, you need to understand your competitor’s operational strategy. This is where you put on your analyst hat and start connecting the dots others might miss.

Before diving in, let's lay out where to find the most valuable data. This checklist covers the essential sources you'll want to tap to get a well-rounded view of any competitor.

Essential Sources for Competitive Intelligence

Use this checklist to gather comprehensive data on your competitors from a variety of sources, ensuring a well-rounded analysis.

| Data Category | Primary Sources | What to Look For |

|---|---|---|

| Customer Sentiment | G2, Capterra, Trustpilot, social media mentions, forums (Reddit) | Recurring praise (Strengths), common complaints (Weaknesses), requested features (Opportunities) |

| Marketing & SEO | SEO tools (Ahrefs, Semrush), company blog, social media content | Target keywords, content pillars, organic traffic trends, ad campaigns, messaging angles |

| Product & Pricing | Pricing page, free trial sign-up, product documentation | Pricing tiers, packaging strategy, discount offers, feature limitations, ease of onboarding |

| Hiring & Talent | LinkedIn job postings, company careers page, Glassdoor | Roles being hired for (e.g., "Enterprise Sales" vs. "SMB"), tech stack requirements, team growth trends |

| Financial Health | Public earnings reports (for public companies), funding announcements | Revenue growth, profitability, major investments, strategic priorities mentioned by the CEO/CFO |

By pulling data from each of these categories, you avoid blind spots and build a much more robust, evidence-based analysis.

Now, let's look at a few of these in more detail.

- SEO and Content Strategy: Use an SEO tool to see which keywords they rank for. This is a direct window into their target audience and market focus. Are they pouring resources into a blog? What topics are they owning?

- Pricing and Packaging: Spend time on their pricing page. Is it transparent or intentionally confusing? Do they push free trials or require a demo? This tells you a ton about their sales motion and target customer.

- Job Postings: This is a fantastic, and often overlooked, source of intel. A sudden flood of openings for enterprise sales reps signals a move upmarket. Hiring more engineers for a specific product gives you a huge clue about their future roadmap.

Combining these digital signals gives you a much clearer picture of their true priorities. For sales teams, this level of detail is non-negotiable. Manually gathering all this can be a massive time sink, which is why many teams now rely on a dedicated sales intelligence platform to automate the process and surface critical insights.

By digging into these diverse sources, you move from assumptions to evidence. You're not just guessing about their weaknesses; you're seeing their customers spell them out for you. You're not just speculating on their strategy; you're seeing it reflected in who they're hiring and where they're spending money. This is the kind of robust data that builds a SWOT analysis that actually wins deals.

“We're no longer fishing. We know who the right customers are, and we can qualify them quickly. Salesmotion has had a direct impact on pipeline quality.”

Andrew Giordano

VP of Global Commercial Operations, Analytic Partners

Building Your Competitive SWOT Matrix

Alright, you've done the digging. Now for the fun part: turning all that hard-won intelligence into a clear, visual framework. This is where your research comes to life, moving from scattered notes into a structured competitive analysis SWOT matrix.

The goal here isn’t just to fill in some boxes. It's to create a strategic snapshot of your rival that tells a story about their real position in the market. Forget generic points like "good marketing." We're getting specific.

This whole process is designed to organize your thinking. By separating what you've found into distinct categories, you'll start to see patterns you would have otherwise missed.

This simple flow shows how raw data from all those different channels—customer feedback, social chatter, their digital footprint—comes together to build the full picture for your SWOT.

Populating the Strengths Quadrant

Strengths are the internal capabilities that give your competitor a serious edge. These are the things they do exceptionally well, the stuff that creates a moat around their business. You need to look way beyond just their product features and think about their entire operation.

Your job is to pinpoint exactly what makes them a formidable player. This could be things like:

- A Fiercely Loyal Customer Base: Do they have a buzzing community or an army of brand advocates who jump to their defense online? That’s a powerful, hard-to-replicate strength.

- Superior Technology Stack: Maybe they built their whole platform on a modern, scalable infrastructure that lets them innovate faster than everyone else.

- Exclusive Partnerships: Do they have strategic alliances that lock up a unique customer segment or give them a distribution channel no one else can touch?

- Exceptional Brand Recognition: Have they poured money into branding to become the default choice in the industry? That's a massive competitive advantage.

Exposing the Weaknesses Quadrant

Weaknesses are the internal factors that put your competitor at a disadvantage. This is where you find the chinks in their armor—the areas you can potentially exploit. This requires an honest, critical eye.

Look for recurring problems or clunky, inefficient operations. A few real-world examples might be:

- Reliance on Outdated Technology: Is their product built on a legacy system that’s a nightmare to update? This kind of weakness slows down their innovation and makes them vulnerable to more agile newcomers.

- Poor Customer Service Reputation: Scour review sites like G2 or Capterra. A clear pattern of complaints about slow support or unresolved issues is a huge weakness you can highlight in your own marketing.

- A Complicated Sales Process: If prospects constantly complain about a lengthy, confusing sales cycle, your own streamlined process becomes a key differentiator. Understanding the journey a buyer takes can uncover these friction points, which is why having solid B2B intent data is so crucial for seeing where prospects get stuck.

Don't mistake a missing feature for a weakness. A true weakness is a fundamental flaw in their business model, operations, or product that actively holds back their growth or infuriates their customers.

Identifying the Opportunities Quadrant

Opportunities are external factors your competitor could use to their advantage but, for whatever reason, are not. These are the market gaps and emerging trends they seem to be completely ignoring. To spot these, you have to look outside their company and at the broader market.

Think about what's changing in your industry right now.

- Underserved Market Segments: Is there a niche audience whose needs aren't being met by the major players? Your competitor might be too focused on the enterprise to notice a booming SMB market.

- New Technology Integration: Could a new technology, like generative AI, fundamentally improve their product? If they're slow to adopt it, that’s a window of opportunity for you.

- Changing Customer Behavior: Are buyers shifting their preferences toward subscription models or on-demand services? A competitor stuck in a traditional sales model is missing a massive opportunity.

Uncovering the Threats Quadrant

Finally, threats are the external factors that could seriously harm your competitor's business. These are the storm clouds on the horizon they might not see coming. This could be anything from regulatory changes to a disruptive new rival that just raised a ton of cash.

Common threats to look for include:

- New Regulations: Could upcoming data privacy laws or industry-specific regulations negatively impact their core business model?

- A Disruptive Startup: Is there a new, well-funded startup entering the market with a completely different approach that makes the incumbent's solution look obsolete?

- Economic Downturn: How would a recession affect their customers' ability to pay? Are they overly exposed to a single industry that's economically sensitive?

To make this process even smoother, many teams use specialized software. The global SWOT Analysis Creator market has grown significantly, driven by the need for better data visualization in strategic planning. Companies like Canva and Lucidchart are key players, offering tools to build and share these matrices effectively. You can discover more about this growing market and how it's shaping strategic planning.

By methodically filling each quadrant with specific, evidence-backed points, you'll build a powerful tool that drives smarter strategic decisions.

From Analysis to Actionable Strategy

Let's be honest—an insightful analysis that just sits in a slide deck is worthless. Your beautifully crafted competitive SWOT matrix is a fantastic starting point, but it's not the finish line. This is where we bridge the gap between what you've learned and what you’re actually going to do about it.

The real magic happens when you move beyond just listing bullet points and start connecting the dots to create clear strategic moves. A powerful, if simple, way to do this is with a TOWS analysis, which is a practical extension of your SWOT. It forces you to pair up your internal factors with external ones to answer some tough, critical questions.

Introducing the TOWS Matrix

Think of the TOWS framework as the tool that turns your competitive analysis SWOT into a strategic playbook. Instead of looking at each of your four quadrants in isolation, you start combining them to spark new ideas and map out specific initiatives. It's a structured way to make sure no insight goes to waste.

You'll end up creating four distinct types of strategies:

- Strengths-Opportunities (SO): How can we use our internal strengths to jump on external opportunities? This is your aggressive, growth-oriented playbook.

- Weaknesses-Opportunities (WO): How can we shore up our weaknesses by taking advantage of the opportunities out there? Think of this as a developmental strategy.

- Strengths-Threats (ST): How can we leverage what we do best to neutralize or minimize external threats? This is where you play defense.

- Weaknesses-Threats (WT): How do we minimize our weak spots to avoid getting blindsided by potential threats? This is all about risk mitigation.

This isn't just an academic exercise. It’s a method for creating a prioritized list of concrete actions you can take, based directly on what you've learned about the competition.

Consider the story of General Motors during the 2008 economic crisis. The company used a SWOT to stare down its vulnerability to high gas prices (a huge threat) and its bloated brand portfolio (a glaring weakness).

By pairing this with its core engineering strengths (like Chevrolet and Cadillac), GM executed a powerful strategy. They slashed costs and poured money into fuel-efficient vehicles, aligning with new consumer preferences (a massive opportunity) and setting the stage for a major recovery.

From Quadrants to Campaigns

Let’s bring this to life with a real-world B2B SaaS scenario. Imagine your analysis of a major competitor uncovered these two gems:

- Their Weakness: Customer reviews constantly drag their slow, painful onboarding process.

- Your Strength: Your company is famous for its world-class customer success team and ridiculously smooth implementation.

This is a classic Strengths-Weaknesses pairing. The actionable strategy isn't just to "have good customer service." It's to launch a targeted marketing campaign with messaging like, "Tired of waiting weeks to get started? Go live with us in 48 hours." You’d spin up case studies that specifically highlight your rapid, white-glove onboarding experience.

Now let's try another one:

- Their Threat: A new data privacy regulation is on the horizon that will directly impact their core data collection method.

- Your Strength: Your platform was built from the ground up with compliance and data security at its core.

The Strengths-Threats strategy here is to get out ahead of the narrative. You publish thought leadership content, host webinars on the new regulation, and position your company as the safe, compliant choice long before your competitor can react.

This process transforms your analysis from a static document into a dynamic tool for making smart decisions. Each pairing should result in a tangible initiative you can hand off to your sales, marketing, or product teams. It's a critical piece of any effective go-to-market motion and ties directly into how teams build their overall account planning strategies.

By turning insights into action, you guarantee your competitive research delivers a real, measurable return.

“The Business Development team gets 80 to 90 percent of what they need in 15 minutes. That is a complete shift in how our reps work.”

Andrew Giordano

VP of Global Commercial Operations, Analytic Partners

Common Mistakes to Avoid in Your Analysis

Even the most buttoned-up competitive analysis SWOT can get derailed by a few common, completely avoidable mistakes. One of the biggest traps I see people fall into is being way too vague.

Simply listing "good brand" as a competitor's strength is pretty much useless. It doesn't tell you anything actionable.

You have to dig deeper. What makes their brand good? Is it their sharp, consistent messaging? Their fiercely loyal customer base? A massive, highly engaged social media following? The more specific you get, the more your insights actually turn into something you can use.

Confusing Internal and External Factors

Another classic blunder is mixing up the quadrants. It sounds simple, but it happens all the time.

A strength is something internal that your competitor controls, like a world-class engineering team or a patent portfolio. An opportunity is an external market condition they can jump on, like a new, underserved customer segment popping up.

Getting these crossed can seriously mess up your strategy. For example:

- Before (Incorrect): Listing "growing market" as a Strength.

- After (Correct): Identifying the "growing market" as an Opportunity, and then figuring out if the competitor has the internal Strengths (like a scalable sales team) to actually capture it.

Your SWOT analysis is not a static document. Treat it as a living framework that you revisit and update, ideally every quarter. Market conditions change, competitors pivot, and what was a threat yesterday might be an opportunity today.

Finally, don't let your analysis become a one-and-done report that gathers dust in a folder somewhere. Markets are constantly shifting. Revisit your SWOT regularly to keep your strategy sharp and relevant. This ensures your insights reflect what's happening right now, not six months ago.

Key Takeaways

- A competitive SWOT analysis transforms raw market data into an actionable strategic blueprint by dissecting rival Strengths, Weaknesses, Opportunities, and Threats through four distinct lenses.

- The most valuable competitive intelligence comes from customer reviews on G2 and Capterra, job postings that reveal strategic priorities, SEO data showing target audiences, and pricing pages exposing sales motions.

- Use the TOWS matrix to turn analysis into action by pairing internal factors with external ones -- for example, combining your onboarding strength with a competitor's known onboarding weakness to launch targeted campaigns.

- Avoid common mistakes like being too vague ("good brand" is useless), confusing internal factors with external ones, and treating the analysis as a one-time exercise instead of a living framework updated quarterly.

- Specificity drives actionability: every insight in your SWOT matrix should be evidence-backed and precise enough to generate a concrete initiative for your sales, marketing, or product team.

Frequently Asked Questions

1. How often should I do a competitive SWOT analysis?

Aim to refresh your analysis at least quarterly to stay current. However, you should conduct an immediate update if a major event occurs, such as a competitor launching a game-changing product, a new rival entering the market, or significant regulatory changes that impact your industry.

2. What's the main difference between a Weakness and a Threat?

It's about control. Weaknesses are internal factors your competitor can control, like a clunky user interface, poor customer support, or high employee turnover. Threats are external factors they can't control, such as a looming economic recession, a disruptive new technology, or shifting consumer behavior.

3. How many competitors should I analyze?

Don't boil the ocean. Focusing on 3 to 5 key competitors provides deep, actionable insights without causing analysis paralysis. A good mix includes direct competitors (offering a similar product), indirect competitors (solving the same problem differently), and emerging competitors (innovative startups to watch).

4. Can I use a SWOT analysis for my own company?

Absolutely! While this guide focuses on competitive analysis, the SWOT framework is an incredibly powerful tool for internal strategic planning. Applying it to your own business helps you clarify your advantages, address your shortcomings, capitalize on market opportunities, and prepare for potential threats.

Stop wasting hours on manual research and start winning more deals. Salesmotion delivers AI-powered account intelligence directly to your sales team, transforming raw market signals into actionable insights and strategic points of view. Discover how Salesmotion can grow your pipeline.