What Is a Buying Signal? Key Tips to Identify Them Quickly

Discover what is a buying signal and learn how to recognize verbal and digital cues in B2B sales to close deals faster and boost your pipeline.

Understand what is an indirect competitor with B2B examples. Learn why these hidden rivals are a major blind spot and how to beat them.

An indirect competitor is a company that solves the same core customer problem you do, just with a different product or service. This isn't about a head-to-head feature comparison; it's a battle for the same budget and attention.

When you hear "competitor," you probably think of companies selling a nearly identical product. Those are your direct competitors. An indirect competitor is a much stealthier threat because, on the surface, they don't look like you at all.

They offer a different path to the same destination. A classic example is the battle for Friday night entertainment:

This distinction is crucial. While you're busy tracking your direct rivals, an indirect competitor can quietly reshape customer habits and erode your market share.

Here’s a simple breakdown using a common B2B scenario to make the difference clear.

| Characteristic | Direct Competitor (e.g., Salesforce vs. HubSpot) | Indirect Competitor (e.g., Salesforce vs. Spreadsheets) |

|---|---|---|

| Product/Service | Sells a very similar product (CRM software) | Offers a different solution for the same job (manual data tracking) |

| Target Audience | Targets the exact same customer segment | Targets the same customer need, often with a broader user base |

| Value Proposition | Competes on features, performance, and price | Competes on simplicity, cost (or being "free"), and control |

| Customer's View | Sees them as a clear alternative ("Should I buy X or Y?") | Sees them as a different way to solve the problem ("Do I need a CRM or can we just use this spreadsheet?") |

| Marketing | Appears in direct comparison guides and G2 grids | Rarely mentioned in your competitive analyses |

This table shows why indirect competitors are so tricky. They aren't just another vendor; they represent an entirely different approach to solving the problem.

Indirect competitors are dangerous because they often fly under the radar. The taxi industry in the early 2010s is the ultimate cautionary tale. Cab companies were locked in a direct battle with each other, completely blindsided by rideshare apps like Uber.

Taxis solved the need for point-to-point transport, but Uber solved the exact same need with a radically different, tech-first model. This shift proved how an entire industry can be upended by a rival it never saw coming. This guide on direct and indirect competition explores more of these market dynamics.

The real danger of an indirect competitor isn't that they'll out-feature you. It's that they'll make your entire approach irrelevant.

Because they don't fit into a neat competitive box, these rivals are invisible to traditional analysis. They won't show up in your G2 grids or product comparison charts, yet they are constantly vying for your customer's budget. Recognizing this hidden rivalry is the first step toward building a strategy that accounts for the entire competitive landscape.

Let's be direct: your most dangerous competitor probably isn't on your radar.

Sales and marketing teams are trained to obsess over direct rivals. We build battle cards, prep for feature comparisons, and track their every move. But what about the threats that don't fit into such a neat box?

This is the blind spot where deals quietly stall and pipeline vanishes. While you’re sharpening your pitch against another SaaS platform, your prospect is thinking about a completely different path—or doing nothing at all.

In B2B sales, your biggest indirect competitor is almost always the status quo. It’s not another vendor; it’s the prospect’s current way of doing things. This "good enough" solution is a formidable, often invisible, opponent.

What does this hidden rival look like?

These homegrown systems are deeply entrenched. They don't require new budget approval, they don't involve a risky change management process, and your internal champion might have even built them. Prospects rarely bring these up because, in their minds, it's not a "competitor"—it's just "how we do things."

The status quo is the ultimate indirect competitor. It's an invisible force that convinces your prospect that the pain of staying the same is less than the pain of changing.

This leads to the frustrating scenario where a deal loses momentum for no apparent reason. Your champion goes quiet, and the opportunity is lost to "no decision."

This isn't just a stalled deal; it's a loss to an unacknowledged rival. Your messaging about features and benefits can’t land if the prospect secretly believes their current system is good enough. Winning requires you to reframe the conversation from "our product vs. theirs" to "your current pain vs. your future gain."

The challenge is that most sales tech stacks aren't built to spot these internal, process-based competitors. For more on this, check out our analysis of why your sales tech stack isn't enough to uncover these hidden threats.

If you're not actively looking for these invisible rivals, you're fighting a battle you can’t win because you don’t even know you’re in it.

Let's look at how this plays out in the real B2B world. Your biggest rival often isn't another software company—it's the internal, "good enough" solution a prospect has used for years. To win, you have to identify this hidden rival and dismantle its perceived value.

Imagine you sell a project management SaaS platform. Your direct competitors are obvious: Asana or Trello. But on almost every discovery call, your true adversary isn't another software—it's a massive, multi-tabbed spreadsheet.

This spreadsheet is your real competition because it solves the core problem, even if inefficiently. Your sales team's job isn't to prove your features are better than Asana's; it's to prove that the hidden costs of manual tracking and human error in that spreadsheet are far greater than the cost of your software.

Now consider a cybersecurity firm offering managed detection and response (MDR) services. They compete directly with other MDR providers, but a huge part of their market chooses another path: handling security in-house.

Here, the competition is a strategic decision. The prospect believes their internal team is sufficient. To win, your messaging must focus on the risks of a non-specialized team, the gaps in coverage outside of business hours, and the staggering cost of a potential breach versus the predictable cost of your expert service.

Recognizing these internal solutions is the first step. The next is to quantify their hidden costs—wasted hours, missed opportunities, and unmitigated risks—to build a compelling case for change.

To get better at uncovering these competitors, you need to stay on top of broader economic trends and analyze the market landscape and institutional shifts. This bigger picture helps you understand why a company might choose an internal fix over a specialized vendor. For a tactical edge, using the best account research software can surface signals that show when a company is building internally versus looking for an external solution.

Figuring out what an indirect competitor is is one thing. Finding them is another. You have to switch from reactive selling to proactive analysis, learning to read the subtle clues that show a prospect is already solving their problem—just not with you.

These rivals rarely announce themselves. Instead, they leave a trail of breadcrumbs in their day-to-day operations. Your job is to learn how to spot them. This isn't about traditional competitive intelligence; it's about becoming an expert on the internal world of your target accounts.

Here’s how to look past the usual suspects and spot threats before they kill your deal.

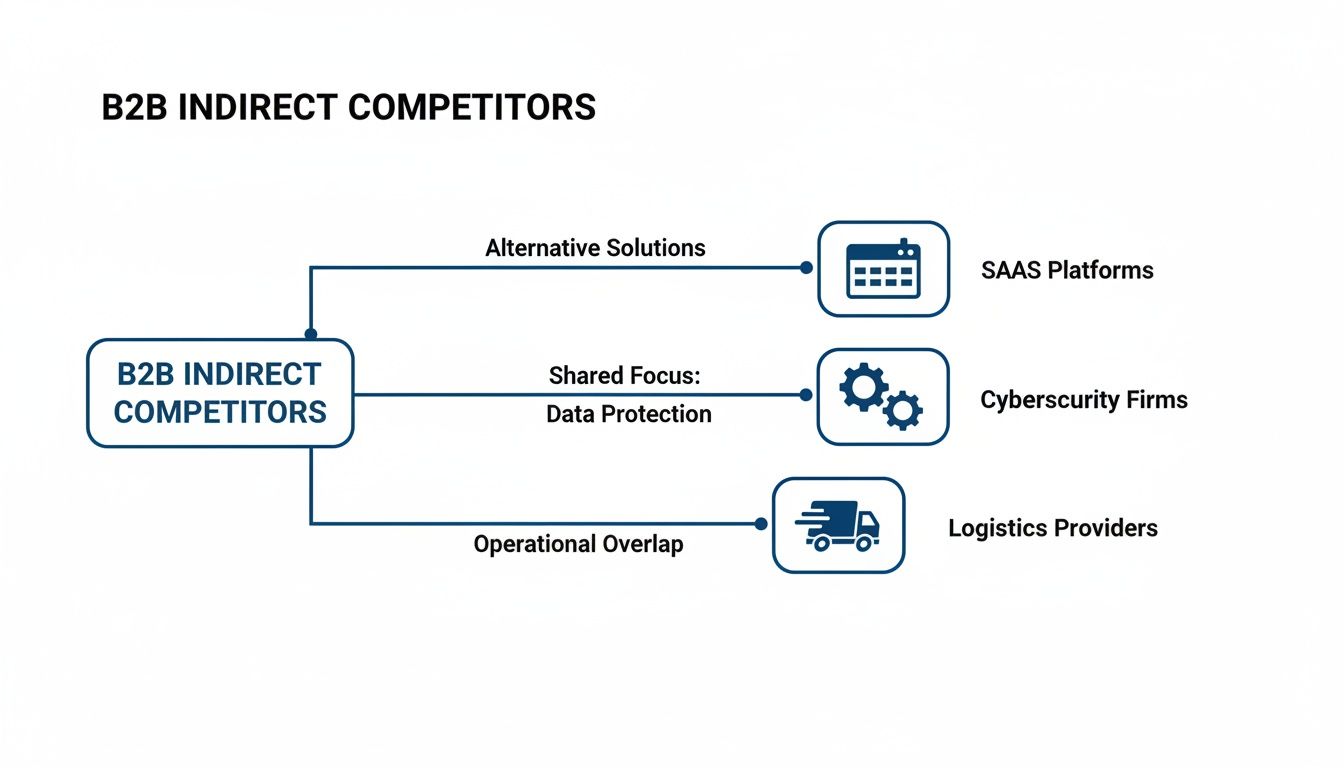

This diagram helps visualize the common B2B indirect competitors you'll encounter.

As the visual shows, the most common—and often underestimated—threat is an internal, "good enough" fix like a pile of spreadsheets or a manual workaround.

Tracking a few key signals can help your revenue teams uncover these hidden competitors before they become a roadblock. This table breaks down what to look for and what it might mean.

| Signal Type | What to Look For | What It Could Mean |

|---|---|---|

| Conversational Clues | Phrases like "we built our own script" or "our intern team handles that." | They are using a manual or homegrown solution that is likely inefficient but familiar. |

| Hiring & Team Changes | Job postings for roles like Data Analysts, Python Developers, or BI Engineers. | They're likely building an in-house solution, investing significant internal resources. |

| Product Launches | Announcements of new features or internal tools that solve part of the problem you address. | They have a dedicated team focused on solving this problem internally. |

| Strategic Partnerships | Press releases about partnerships with data analytics firms or tech consultants. | They are trying to build the capabilities you offer by leaning on an external partner's expertise. |

By watching these indicators, you can start to see the competitive landscape for what it truly is: a complex ecosystem of direct rivals, internal builds, and alternative approaches.

Your best source of intelligence is often right in front of you: your sales calls. Prospects will frequently tell you exactly who you’re up against, even if they don’t call it a "competitor."

Train your ear to catch specific phrases that signal an internal workaround:

These aren't just throwaway lines. They are clear signs that your biggest rival is the status quo. The moment you hear one, your goal should shift from selling features to helping them calculate the hidden costs of their current method.

A company’s hiring activity is a powerful indicator of its strategic priorities. If a target account suddenly posts jobs for data analysts or Python developers, it’s a strong sign they're investing in building a solution, not buying one.

This is a critical signal. An internal build represents a huge investment of time, money, and political capital, making it a formidable indirect competitor. A platform like Salesmotion can put this monitoring on autopilot, alerting you the moment a key account posts roles that suggest an internal build. This gives you a crucial window to intervene.

This kind of information, often called buyer intent data, is essential for timing your outreach perfectly. You can learn more about what is intent data and how it provides these game-changing insights in our detailed guide.

When a prospect hires a team to solve a problem, they are building internal ownership and resistance to outside solutions. Early detection is critical.

Finally, watch public announcements. Press releases about new internal projects, technology initiatives, or strategic partnerships can reveal a company's direction long before it impacts your deal.

For instance, if a logistics company you're prospecting announces a partnership with a data analytics firm, you can bet they're trying to build the exact capabilities your software already provides.

Knowing your indirect competitors is only half the battle. Now you need a practical playbook to win against them. You can't use the same feature-focused battle cards you use against direct rivals. This requires a different approach.

Your goal isn't to out-feature a spreadsheet. It's to reframe the conversation around the hidden costs, risks, and inefficiency of the status quo. You have to make the pain of staying the same feel far greater than the pain of change.

When an indirect competitor is in the mix, your sales team needs to act less like product demonstrators and more like business consultants. The discovery questions you ask are your most powerful tool for exposing the flaws in a prospect’s "good enough" solution.

Instead of asking what features they need, your discovery should focus on quantifying the real cost of their current state.

This pivot moves the discussion from a theoretical purchase to a tangible business problem. When you help a prospect calculate that their "free" spreadsheet is actually costing them $100,000 a year in wasted productivity, the value of your solution suddenly becomes clear.

An indirect competitor thrives in the dark. Your job is to shine a light on the hidden costs, manual errors, and missed opportunities of their "good enough" approach. Once those are visible, your value proposition becomes undeniable.

To build a truly robust strategy, you need to understand every angle of the competitive landscape. A comprehensive guide to building a SWOT competitive analysis can provide the framework you need to map out both direct and indirect threats effectively.

Your marketing content needs to be your salesperson's best friend in this fight. It should be designed specifically to dismantle the "good enough" argument before a sales call happens. This means less focus on feature shootouts and more on illustrating the benefits of moving away from the status quo.

Effective content formats include:

This content gives your internal champion the ammunition they need to build a business case for change, making it much easier to get buy-in.

The best time to engage a prospect is when they are already feeling the pain of their makeshift solution. Market signals are the key to identifying these moments. For instance, a target account might issue a press release announcing a major "digital transformation" initiative.

This is a golden opportunity. That announcement is a public admission that their current processes are broken.

With a platform like Salesmotion, your team gets alerted to these signals the moment they happen. This allows you to craft relevant outreach that positions your solution not as another tool, but as the key to accelerating their strategic goals. You turn a generic cold call into a timely, strategic conversation.

Even with a clear strategy, a few questions always pop up. Let’s tackle the big ones to sharpen your thinking.

Yes, absolutely. This happens all the time, especially with larger organizations.

Think about a tech giant. They might have a SaaS product that competes head-to-head with yours (direct). But their professional services division could be helping your target account build a custom, in-house solution—a massive indirect threat from the same company.

The key is to stop thinking about a company’s logo and start analyzing their offerings on a product-by-product, need-by-need basis.

This isn’t a one-and-done task. The competitive landscape is always shifting. What counts as an indirect competitor today could be irrelevant tomorrow due to new tech or changing customer needs.

Stale competitive intelligence is almost as dangerous as having none at all.

We recommend a formal review of market trends and hidden rivals each quarter. But that’s just the start. This needs to be paired with continuous monitoring of your target accounts for signals like key hires or new partnerships. Automation is a lifesaver for staying ahead.

Simple: they dismiss them entirely. Too many businesses get tunnel vision, obsessing over the rivals they see in industry reports.

They write off things like internal processes, manual workarounds, or "good enough" spreadsheets as not being "real" competition. This creates a massive blind spot.

It allows the status quo to become so entrenched in a prospect's organization that your pitch for a new solution falls flat. By the time you realize the deal has stalled, that invisible competitor has already won. You have to recognize and respect every alternative.

Identifying these signals and turning them into timely, relevant outreach is what separates top performers from the rest. Salesmotion automates this entire process, delivering actionable insights directly to your revenue teams so you can outmaneuver both direct and indirect competitors. Learn more at https://salesmotion.io.

Discover what is a buying signal and learn how to recognize verbal and digital cues in B2B sales to close deals faster and boost your pipeline.

Learn what is intent data and how it helps you find B2B buyers who are ready to purchase. Unlock powerful strategies for your sales and marketing...

Unlock the power of B2B intent data. Learn how it works, why it matters, and how to use it to identify buyers and close deals before your competitors...