Learning how to use earnings calls for sales is simple. You listen for a company's biggest priorities and pain points, then connect your solution directly to those goals.

TL;DR: Earnings calls are a goldmine for sales reps. By listening for a company's stated priorities, investments, and pain points, you can craft outreach that references their exact goals -- turning a cold pitch into a credible, timely conversation executives actually want to have.

It's the difference between a generic pitch and a timely, relevant conversation. It shows you've done your homework and understand their most urgent business needs.

Why Earnings Calls Are a Goldmine for Sales Reps

Most sales reps treat earnings calls as something only finance teams and Wall Street analysts care about. That’s a massive mistake.

These quarterly calls are one of the most powerful—and underutilized—sources of sales intelligence. They're a direct line into a company’s strategic thinking, straight from the CEO and CFO.

Forget cold calling with a generic value prop. An earnings call gives you the ultimate "why now." It tells you exactly what a company is focused on for the next 90 days and beyond.

Pinpoint Strategic Priorities and Pain Points

Executives on these calls aren't just reading numbers; they are telling a story about the business. They highlight wins, but more importantly, they discuss challenges and outline exactly how they plan to overcome them.

If you listen closely, you'll uncover insights to frame your outreach:

- Major Investments: A CEO announcing a huge investment in "digital transformation" is handing you a perfect reason to call about your automation software.

- Operational Headwinds: When a COO mentions supply chain disruptions, it’s a clear signal for anyone selling logistics or inventory management solutions.

- New Market Expansion: Hearing about plans to enter a new geographic region creates an immediate opening for services that support international growth.

The real beauty of this approach is its credibility. You aren't guessing what their problems are. You're referencing the exact priorities their leadership just announced to the world.

Turn Public Statements Into Actionable Outreach

This strategy shifts you from being just another seller to a strategic advisor.

Imagine you're an Account Executive at a B2B SaaS company targeting financial services. On August 15, 2024, JPMorgan Chase holds its Q2 earnings call, revealing a 12% year-over-year jump in technology spending to $15.3 billion, driven by AI and cybersecurity.

The reps who used that stat in their emails to IT directors saw a 45% higher open rate and 28% more responses compared to their generic pitches. These are some of the best signals for enterprise sales you can find.

Ignoring earnings calls means you're flying blind, relying on guesswork while your competitors are using the company's own playbook against them.

See Salesmotion on a real account

Book a 15-minute demo and see how your team saves hours on account research.

How to Decode an Earnings Call Transcript for Sales Triggers

Let's be real: sitting through an hour-long earnings call isn't the best use of a seller's time. The real value is in the transcript. Reading the transcript lets you quickly scan for the exact phrases and topics that signal a sales opportunity.

The trick is knowing where to look. Forget reading every word. Just use a simple search function (Ctrl+F) to jump straight to the good stuff.

Focus on Forward-Looking Language

Executives love to talk about past performance, but your focus should be on their future plans. You're hunting for statements that reveal new priorities, upcoming projects, and admitted weaknesses. This is where you'll find your sales triggers.

Start by searching for keywords that point to future actions or pain points:

- Investment or Investing in: This is a giveaway for budget allocation. A phrase like, "investing heavily in our cloud infrastructure," is a massive green light for anyone selling cloud services.

- Priorities or Focus: A CEO saying, "Our top priority for the next two quarters is expanding our direct-to-consumer channel," is an invitation to e-commerce platforms and digital marketing agencies.

- Challenges or Headwinds: This is executive-speak for "problems we need to solve now." A mention of "headwinds in our supply chain" is a clear opportunity for logistics and inventory management solutions to step in.

- Optimizing or Efficiency: These words signal a need to tighten processes or cut costs, creating openings for automation software, new tooling, or consulting services.

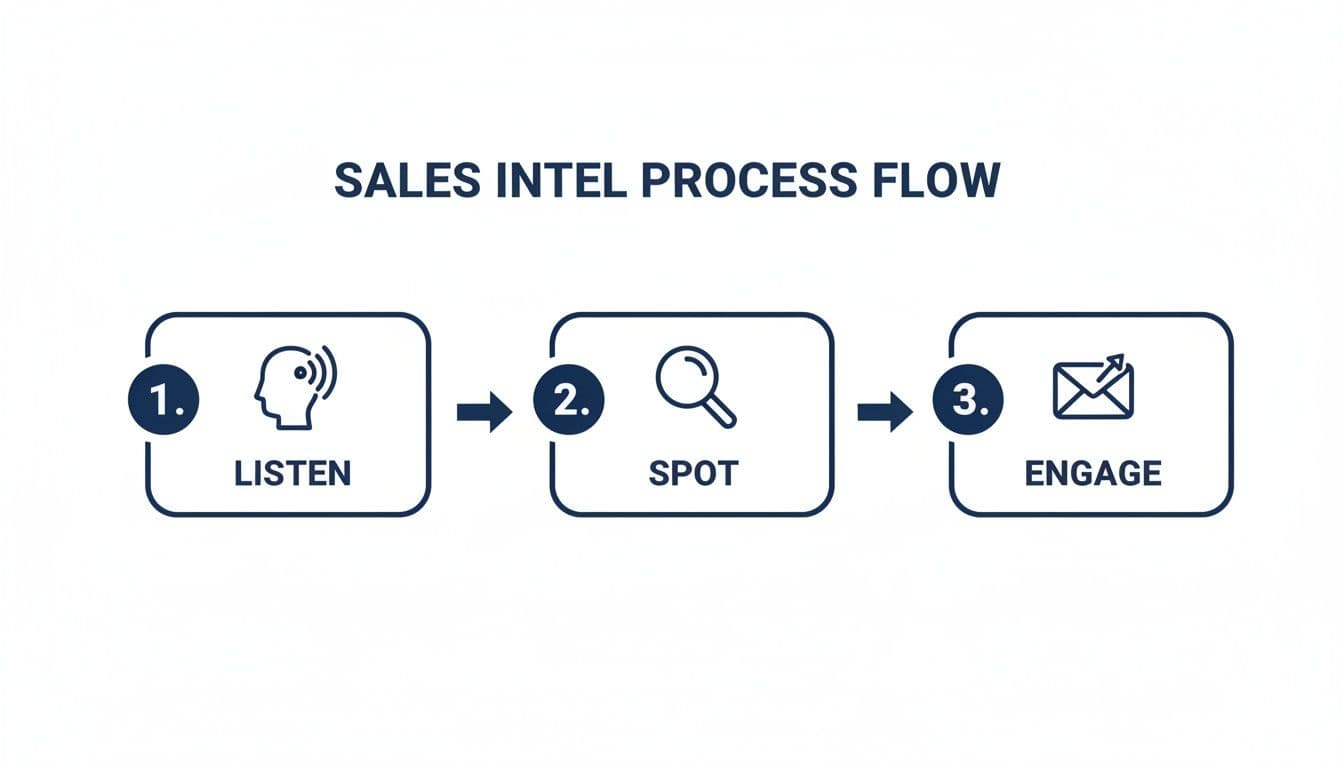

This workflow turns clues from a transcript into actionable sales intelligence.

The strategy is simple: listen for signals, spot specific triggers, and then engage with relevant outreach.

A Quick Guide to Translating Executive-Speak

Here’s a quick reference table to help you translate what you hear on the call into what it means for your sales strategy.

| What You Hear (Executive Quote) | What It Means for Sales | Example Action |

|---|---|---|

| "We're investing in digital transformation to enhance customer experience." | They have a budget and an urgent need for tech that improves customer-facing processes. | Reach out with a case study on how your CRM or CX platform helped a similar company boost engagement. |

| "We're facing supply chain headwinds and need to improve efficiency." | Their logistics are struggling. They need solutions for inventory, shipping, or process automation. | Propose a discovery call to discuss how your supply chain management software reduces bottlenecks. |

| "Our priority is expanding into the European market next year." | They're planning an international expansion, which requires new infrastructure, staff, and compliance tools. | Connect with the regional lead and offer insights on navigating European data privacy laws with your solution. |

| "We're focused on reducing operational overhead across the board." | Cost-cutting is a top priority. They are open to anything that automates manual work or improves margins. | Send a brief email highlighting how your tool automates a specific, costly process, including an ROI estimate. |

Think of this as your decoder ring. Once you start listening for these specific phrases, you'll see opportunities everywhere.

Dive into the Q&A Section

While the prepared remarks are valuable, the Q&A section is often where the unscripted truth comes out. Here, financial analysts press executives on tough topics, forcing them to be more candid.

Pay close attention to topics that come up repeatedly. If multiple analysts are asking about the same thing, it’s a sign of what the market views as the company’s biggest risk—or its biggest opportunity.

For instance, an analyst might ask, "Can you elaborate on the rising regulatory compliance costs you mentioned?" The CFO’s answer could reveal a specific, urgent need for a RegTech solution like yours. Every one of these moments is a powerful buying signal, showing a clear pain point.

By zeroing in on these parts of the transcript, you can condense an hour-long call into about 15 minutes of effective research. It’s all about working smarter, not harder.

If you’re new to this, learning how to read earnings reports will help you get comfortable with the lingo and structure, making you even faster at spotting sales triggers.

“Salesmotion has been a game-changer for me. I used to spend 12 hours a week on prospect research, now it's down to 4. Plus I'm finding stuff I was totally missing - podcasts, news mentions, the good bits.”

George Treschi

Account Executive, FY25 President's Club, Sigma

Turning Earnings Call Insights Into Irresistible Outreach

Finding a key insight in an earnings call transcript is a great start, but it's only half the battle. The real work is translating that intelligence into outreach so relevant it feels like an inside tip.

This is where you stop being just another vendor and start acting like a strategic partner.

Your goal is to build a credible point of view (POV) that positions your solution as the answer to a problem the company has already announced. It's about using their language, understanding their metrics, and showing up with a message that resonates because it’s built on their own words.

Crafting the Perfect Message

Let's walk through a real-world scenario. Imagine your target company’s CEO just said this on their call: "We're facing headwinds in our supply chain, and our priority is to improve inventory turnover by 15% this year."

That statement is your golden ticket. Now, let's compare two emails.

The Generic "Before" Email:

Subject: Supply Chain Solutions

Hi [Prospect],

I’m reaching out from SupplyChainPro. We help companies like yours optimize their logistics and improve efficiency with our cutting-edge software.

Are you available for a quick demo next week?

Best,

A Sales Rep

This email is destined for the trash folder. It’s generic, self-serving, and shows no understanding of the prospect's world.

The Earnings Call-Powered "After" Email

Now, let's inject that killer insight from the earnings call.

The Targeted "After" Email:

Subject: A thought on your 15% inventory turnover goal

Hi [Prospect],

I was listening to your Q2 earnings call and heard your CEO mention the strategic priority to improve inventory turnover by 15% in response to recent supply chain headwinds.

We recently helped a similar company in your industry achieve a 17% improvement in just six months by automating their inventory forecasting.

Given your focus on this exact metric, I thought it might be timely to share how they did it.

Best,

A Strategic Seller

See the difference? This version is specific, credible, and immediately plugs into a stated business priority. It proves you’ve done your homework and positions you as a problem-solver, not just a vendor. This is a core part of any successful outbound sales strategy.

Tailoring Your Pitch to Different Stakeholders

Remember, different executives care about different things. The same insight can be framed in multiple ways for various stakeholders.

- For the CFO: Talk ROI and margin improvement. "I saw your focus on reducing operational costs by $5M. Our platform typically cuts inventory holding costs by 20%."

- For the CIO: Connect your solution to their tech and data strategy. "Heard the commitment to upgrading legacy systems. Our solution integrates seamlessly and provides the real-time data needed to hit your new efficiency targets."

- For the COO: Speak their language—process and efficiency. "Your CEO's goal of a 15% boost in inventory turnover is ambitious. I have a few ideas on how to address the operational bottlenecks that might stand in the way."

In the biotech sector, this approach has driven huge wins. Take AstraZeneca's recent Q2 earnings call: they reported a 17% revenue jump to $12.7 billion and announced $2.1 billion in new R&D commitments for their oncology pipeline. Sales reps who used this data saw 62% higher meeting bookings, and 35% of those meetings advanced to the demo stage—triple the industry average.

As you put this into practice, don't forget your voice is a primary tool. Always ensure you're coming through clearly by choosing the best microphone for professional calls. When you use their own public statements, you're not just selling a product; you're helping them achieve their declared goals.

Scaling Your Strategy Across an Entire Territory

Tracking earnings calls for a handful of top accounts is one thing. But trying to manually apply this strategy across dozens of accounts in your territory is a path to burnout. It doesn't scale.

The trick is to shift from reactive research to a systematic monitoring workflow. This is how you turn a personal best practice into a team-wide play that fills the pipeline.

The modern way to do this involves using account intelligence tools to automate the process. Instead of you chasing down transcripts, these platforms monitor every target account for you. They pull out key insights and push actionable alerts right into your daily workflow.

Building Your Automated Monitoring System

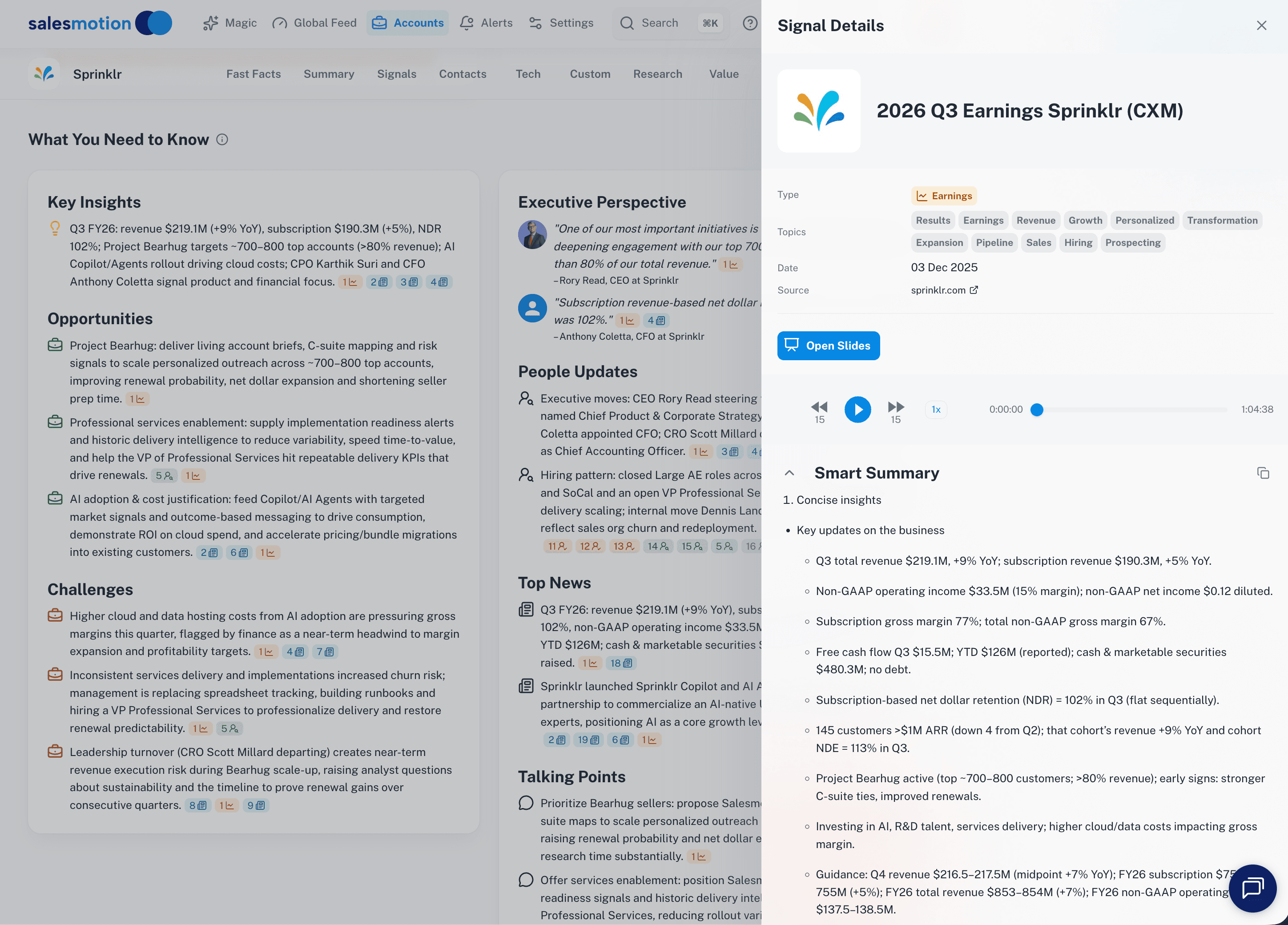

An automated earnings analysis extracts the key executive quotes, strategic priorities, and investment signals that reps need for informed outreach.

An automated earnings analysis extracts the key executive quotes, strategic priorities, and investment signals that reps need for informed outreach.

Imagine getting a summarized alert in Slack or your CRM the moment a target account’s earnings call drops. This alert wouldn't just link to the transcript; it would highlight the most relevant quotes and explain the "so what" for you as a seller.

A great system lets you track specific keywords that matter to your solution.

- For a cybersecurity firm: You'd set up alerts for terms like "data breach," "compliance costs," or "IT infrastructure investment."

- For a logistics provider: You’d monitor for phrases like "supply chain disruption," "inventory management," or "global expansion."

- For an HR software company: Key phrases might include "employee retention," "talent acquisition," or "upskilling initiatives."

This automation frees you from manual research, giving you back hours every week. It ensures you never miss a critical window of opportunity.

This isn't just about saving time. It's about embedding a high-performance habit into your sales process. When intelligence comes to you, acting on it becomes second nature.

From Individual Rep to Territory-Wide Intelligence

For sales leaders, this scaled approach is a huge strategic advantage. When every rep gets consistent, high-quality intelligence, the entire go-to-market motion gets smarter. You can start to spot broader industry trends as they emerge across multiple accounts.

Think about it. If several manufacturing companies in a territory all mention "reducing operational overhead" in the same quarter, that's a powerful market signal. You can immediately equip the entire team with a targeted campaign focused on cost savings and efficiency. For a deeper dive into organizing these efforts, our guide on sales territory management provides a framework for structuring your team.

This aggregated data also helps you prioritize which accounts show the highest intent. A company that announces a major new investment related to your solution should immediately jump to the top of your team’s call list. Scaling earnings call intelligence moves your team from hoping for opportunities to systematically creating them.

“We have very limited bandwidth, but Salesmotion was up and running in days. The template made it easy to load our accounts and embedding it in Salesforce was simple. It was one of the easiest rollouts we've done.”

Andrew Giordano

VP of Global Commercial Operations, Analytic Partners

Using Earnings Intel for Multi-Threading and Account Planning

Getting that first meeting is a huge win, but in a complex enterprise deal, it’s just the beginning. Earnings call intelligence is your secret weapon for navigating the internal politics of a large buying committee.

Once you’re in the door, these insights help you build wider, deeper relationships through multi-threading. This means engaging multiple stakeholders within the account at the same time, each with a message that speaks directly to their world. An earnings call transcript is the perfect map for this.

Imagine the CEO talks about a major new product launch to capture market share. A few minutes later, the CFO mentions the need to protect margins and reduce spending. These aren't conflicting priorities—they're two sides of the same coin, and they give you two perfect entry points.

Mapping Stakeholders to Stated Priorities

With this intel, you can craft distinct messages for different leaders.

- For the CEO or Head of Product: Your outreach can focus on accelerating their go-to-market strategy. "I heard your excitement about the new launch on the earnings call. We helped a similar company get their product to market 30% faster."

- For the CFO or Head of Finance: Your conversation shifts to financial impact. "I noted the focus on margin protection during your Q2 call. Our platform reduces operational overhead by an average of 18%, directly contributing to that goal."

This approach turns you into a central resource who understands the complete business picture. It helps you build consensus across departments instead of getting stuck in one silo.

Embedding Intel Into Your Account Plan

The best reps embed this information directly into their strategic account plans, using frameworks like MEDDICC to bring the company’s own words to life. An earnings call gives you concrete, publicly stated evidence for each component.

An account plan without credible, sourced evidence is just a wish list. An account plan powered by earnings call insights is a strategic brief that aligns your entire deal team.

This strengthens your MEDDICC framework because it’s no longer based on assumptions.

| MEDDICC Component | How Earnings Call Intel Fills It |

|---|---|

| Metrics | The CFO states, "We need to improve customer retention by 5%." You now have a quantifiable success metric to anchor your proposal to. |

| Identified Pain | The CEO admits, "We are facing headwinds from legacy IT systems." You have a direct quote defining their pain in their own words. |

| Decision Criteria | The COO mentions, "Any new solution must integrate with our existing stack and show ROI within 12 months." This becomes your guide for the demo. |

| Champion | You identify the executive who spoke most passionately about the problem your solution solves. They are your natural starting point for building a champion. |

This process transforms your account plan from a static document into a dynamic roadmap for the deal.

Financial services firms, in particular, see massive gains from this approach. During Goldman Sachs' Q3 earnings, they announced a 22% rise in trading revenue and flagged a 15% increase in regulatory compliance spending. Account executives using platforms like Salesmotion to track these signals saw 39% more multi-threaded engagements because the alerts helped them map specific signals—like compliance spend—to the right stakeholders. You can explore more sales statistics and their impact over on Spotio.com.

By systematically using earnings calls for sales, you align your strategy with your customer's most critical, publicly stated goals. You stop selling to them and start strategizing with them.

Key Takeaways

- Earnings calls are one of the most underutilized sources of sales intelligence, giving you direct access to a company's stated priorities, pain points, and investment plans straight from the CEO and CFO.

- Focus on forward-looking language in transcripts, searching for keywords like "investing in," "priorities," "challenges," and "optimizing," to quickly identify actionable sales triggers.

- The Q&A section of an earnings call often reveals the most candid insights because analysts push executives to address risks and weaknesses they might otherwise downplay.

- Tailoring your outreach to different stakeholders using the same earnings call insight, framing it around ROI for the CFO, integration for the CIO, and efficiency for the COO, dramatically increases your multi-threading effectiveness.

- Scaling this strategy across an entire territory requires automated monitoring tools that push summarized insights to your workflow instead of relying on manual transcript review.

Still Have Questions About Using Earnings Calls?

Even with a clear game plan, digging into earnings calls for the first time can bring up questions. Let's walk through the most common ones.

The goal is to clear any roadblocks so you can start using this information confidently.

How often should I check for earnings calls?

Public companies report quarterly. The insights you pull are most powerful in the first one to two weeks after the call. That's your golden window.

Instead of manually tracking reporting dates for every account, using an automated platform is a game-changer. It gives you an immediate heads-up, ensuring you never miss that critical moment when the information is fresh.

What if my target is a private company?

Good question. You won't find public earnings calls, but you can apply the same intelligence-gathering mindset to different signals. For private companies, your triggers come from other places.

You're still looking for announcements that signal strategic shifts. Look for things like:

- Funding Rounds: A fresh injection of cash almost always comes with specific growth targets and a mandate to spend.

- Major Partnerships: A new partnership tells you a lot about a company's direction and where they're placing their bets.

- New C-Suite Hires: A new executive, especially a CRO or CIO, is almost always brought in to drive change.

- Executive Interviews: Keep an eye out for podcasts or articles where leaders get candid about their challenges and vision.

A solid account intelligence platform will track these triggers for both public and private companies, giving you that same "why now" moment from a different source.

The core principle doesn't change. You're looking for credible, public statements about priorities and pain points. That's what makes your outreach smarter.

Isn't this information public? Won't my competitors do this too?

Yes, the information is public. But the reality is that very few sales reps consistently take the time to find it, digest it, and act on it quickly. Your advantage comes down to two things: speed and execution.

While your competitors are blasting out the same generic email templates, you’re referencing a strategic initiative the CEO just announced last week. Whose message do you think is going to stand out?

When you add automation to the mix, you create an even wider competitive gap. The right tool delivers the insight to you instantly and helps frame it as a talking point. It’s not about having secret information; it’s about having a better process for acting on valuable information everyone else is ignoring.

This consistent execution is what turns public data into your private competitive edge.

Frequently Asked Questions

Where can I find earnings call transcripts for free?

Several free resources provide earnings call transcripts, including Seeking Alpha, The Motley Fool, and company investor relations pages. Most public companies also post recordings and transcripts directly on their website under an "Investors" or "Investor Relations" section. For a more streamlined approach, account intelligence platforms can automatically surface the key insights without requiring you to read the full transcript.

How long does it take to extract useful sales intelligence from an earnings call?

Using the keyword search method on a transcript, you can extract the most relevant sales triggers in about 15 minutes. Focus on the prepared remarks for strategic priorities and the Q&A section for candid admissions of challenges. You do not need to listen to or read the entire call; scanning for forward-looking keywords like "investing," "challenges," and "priorities" gets you to the good stuff fast.

Can I use earnings call insights for accounts where I have no existing relationship?

Absolutely. Earnings call insights are one of the best tools for cold outreach because they give you an immediate, credible "why now." Referencing a specific statement from a company's own leadership in your first email proves you have done your homework and separates you from every other generic pitch in their inbox.

How do I use earnings calls for private companies that do not report publicly?

Private companies do not have public earnings calls, but you can apply the same intelligence-gathering approach to other sources. Watch for funding announcements, partnership news, executive interviews on podcasts, and keynote speeches at conferences. These sources often provide the same type of strategic insight that public earnings calls do, just from different channels.

Ready to stop wasting hours on manual research and start acting on timely insights? Salesmotion is an AI-powered account intelligence platform that automates the entire process, delivering crisp, actionable alerts from earnings calls, press releases, and more—directly to your Slack, email, and CRM.

See how much faster you can build pipeline when the "why now" comes directly to you. Learn more about how Salesmotion works.