Sales intelligence isn't just another buzzword. It's the critical information that gives your sales team context about prospects and customers. It answers why you should talk to someone right now, shifting your team from generic outreach to timely, valuable engagement.

What Is Sales Intelligence Data?

Imagine trying to navigate a new city without a map. That's what B2B sales feels like without the right data. Your team knows the destination—a closed deal—but they have no efficient way to get there. They're stuck making random turns, hitting dead ends, and wasting time on routes that lead nowhere.

Sales intelligence data is your sales team's GPS. It provides the turn-by-turn directions needed to connect with the right person, at the right time, with the right message. Instead of cold calling in the dark, your reps get real-time alerts showing them the fastest path to a meaningful conversation.

This simple shift changes the game. Your team goes from guessing to knowing, and their outreach transforms from an interruption into a relevant, welcome discussion.

The Problem with Doing It by Hand

Without a system for gathering intelligence, reps are left to piece things together manually. They spend hours scrolling through LinkedIn, scanning press releases, and searching for any reason to reach out. This manual research isn't just slow; it's inconsistent and a huge waste of a seller's time.

The result? The crucial "why you, why now" is almost always missing. Outreach is generic, timing is based on luck, and the pipeline remains unpredictable. This is a massive drain on productivity, pulling sellers away from their real job: selling.

Sales intelligence is about turning raw information into a clear competitive advantage. It's the difference between a generic product pitch and a tailored solution that addresses a prospect's immediate, pressing needs.

Let's compare the old way of doing things with an intelligent, data-driven approach.

Manual Prospecting vs. Intelligent Selling

| Aspect | Manual Research (The Old Way) | Sales Intelligence Data (The New Way) |

|---|---|---|

| Time Spent | Hours per day on manual research. | Minutes per day reviewing automated alerts. |

| Timing | Based on guesswork; often too early or too late. | Based on real-time events (triggers), ensuring relevance. |

| Personalization | Generic, based on company size or industry. | Hyper-relevant, based on specific events like funding or new hires. |

| Efficiency | Low. High effort for uncertain, low-quality results. | High. Low effort for high-quality, actionable opportunities. |

| Scalability | Poor. Impossible to manually track hundreds of accounts well. | Excellent. Easily monitor an entire territory with automated systems. |

| Pipeline Quality | Inconsistent and unpredictable. | Consistent and forecastable, filled with in-market buyers. |

| Rep Focus | On finding information. | On having strategic conversations. |

The table makes it clear: relying on manual research is like choosing to walk when a high-speed train is available. The destination might be the same, but the journey is worlds apart in speed, efficiency, and predictability.

A sales intelligence platform like Salesmotion replaces hours of manual research with a real-time feed of buying signals across your entire territory.

A sales intelligence platform like Salesmotion replaces hours of manual research with a real-time feed of buying signals across your entire territory.

A Growing Market for a Reason

This shift toward data-driven selling isn't just a trend; it's a fundamental change in how successful B2B companies operate. The global sales intelligence market was valued at around USD 4 billion as of 2025, a significant jump from USD 2.95 billion in 2022. You can find more details in this sales intelligence market analysis.

That growth shows how much companies are prioritizing data to speed up their pipeline and boost win rates.

It's also important to know that this data is different from other types your team might use. To go deeper on one specific category, check out our guide on what is intent data and see how it fits into a broader intelligence strategy. By arming your team with actionable insights, you equip them to open more doors, build stronger pipeline, and ultimately, close more deals.

See Salesmotion in action

Take a self-guided interactive tour — no signup required.

Finding the Real Triggers in a Sea of Noise

Let's be honest. Your inbox is a firehose of company news, blog alerts, and industry updates. Most of it is just noise. Interesting, maybe, but rarely actionable. True sales intelligence cuts through that static to find the few high-impact signals that create genuine sales opportunities.

Think of it like being a detective. A generic blog post is a footprint in a crowded park; it proves someone was there, but it doesn't lead anywhere. A high-impact signal, on the other hand, is the specific clue left at the scene—it points directly to a person of interest and tells you what to do next.

The goal is to move from passively collecting information to actively identifying the triggers that show a prospect is ready to buy. This is the core of modern, effective selling.

The Anatomy of a High-Impact Sales Trigger

So, what makes a trigger "high-impact"? It's any event that creates a clear and immediate need for a new solution or a major shift in strategy. These events disrupt the status quo, creating a brief window for a truly relevant conversation. Without one, your outreach is just another cold email in a crowded inbox.

These signals fall into a few key categories:

- Financial Events: A new funding round isn't just a press release; it's a giant neon sign that screams, "We have capital to invest in growth!" This could mean scaling operations, hiring new teams, or investing in the exact technology you sell.

- Organizational Shifts: When a new executive joins, they almost always have a mandate to shake things up in their first 90 days. This is a golden opportunity to position your solution as the key to helping them score an early win.

- Strategic Moves: A merger, acquisition, or major product launch causes massive internal disruption and creates new priorities overnight. These moments are ideal for positioning your offering as the tool to help them navigate the chaos.

The trick is to always ask, "So what?" The signal is the event; the intelligence is understanding why that event creates an opportunity for you.

Separating Signals from the Noise

How do you spot the real opportunities? The difference usually comes down to two things: specificity and urgency. Noise is general and passive. A true signal is specific and time-sensitive.

A company publishing a generic blog post on "The Future of AI" is noise. A sudden surge in their job postings for "AI Engineers" is a high-impact signal. The first is content marketing; the second is a strategic, budgeted investment.

This distinction is everything. One indicates a vague interest, while the other shows a specific initiative is funded and in motion. Modern sales intelligence platforms are built to surface these critical, often-missed triggers for you.

Here are a few examples side-by-side:

| Noise (Low-Impact Update) | Signal (High-Impact Trigger) | Why It Matters |

|---|---|---|

| An executive shares an industry article on LinkedIn. | An executive is hired from a competitor to lead a new division. | A new leader brings a new budget and a fresh perspective, creating an opening to influence their strategy. |

| A company announces they'll be at a trade show. | The company announces a $50 million Series B round to expand into Europe. | Fresh capital is earmarked for growth, creating urgent needs for tools and services to support that expansion. |

| A new case study is published on their website. | Their main competitor announces a major acquisition. | A competitive shock forces them to re-evaluate their own strategy, making them more receptive to new ideas. |

| The company's stock price nudges up by 2%. | The CEO mentions "supply chain inefficiencies" on an earnings call. | A publicly stated pain point becomes a direct, credible reason for you to reach out with a specific solution. |

By focusing on these high-impact triggers, you ensure every outreach is backed by a compelling, timely reason to connect. You can explore a deeper dive into the best signals for enterprise sales to see how this works in complex deal cycles. This targeted approach separates top performers from the rest; they don't just sell, they respond to clear market needs as they happen.

“Salesmotion is instrumental in helping me prioritize net-new accounts, understand their strategic initiatives, and cover more ground. With a lot of green-field accounts, I'm heavily leaning on the AI insights to tier my accounts and focus my time. The platform is incredibly intuitive and easy to use.”

Rob Webster

Enterprise Account Executive, Synthesia

Turning Raw Data into Actionable Sales Plays

Having endless streams of sales intelligence data is one thing. Knowing what to do with it is another.

By itself, a raw signal is just noise. The real value comes when you turn that information into a specific, actionable sales play that a rep can execute immediately. This is where modern intelligence platforms shine—they provide the "so what?" context that bridges the gap between raw data and real action.

A funding announcement isn't just news; it's a trigger for a conversation about scaling operations. A new CIO hire is an opportunity to influence their first-year technology roadmap. The platform's job is to connect these dots for the sales team, translating an event into a clear reason to reach out.

This process turns abstract information into a concrete advantage.

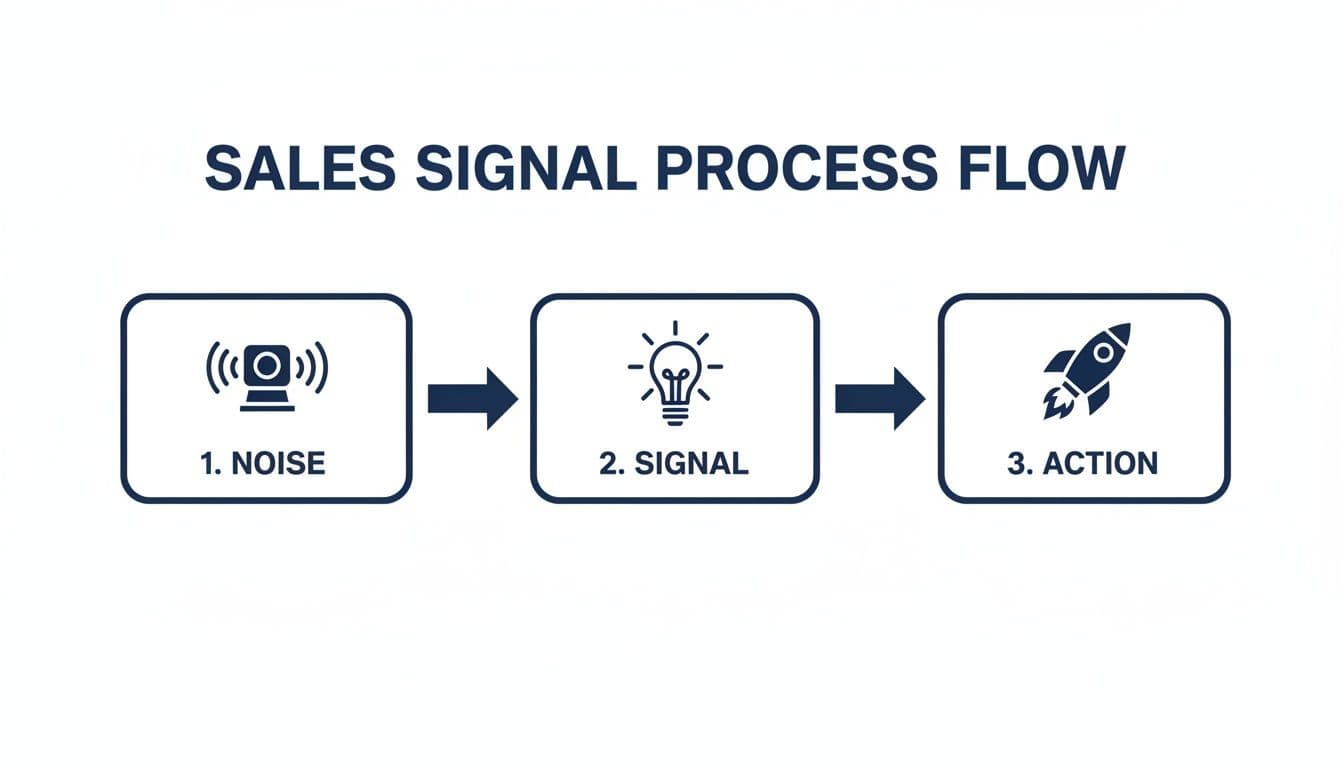

This diagram shows how to transform raw sales signals into concrete actions that drive pipeline.

As you can see, effective sales intelligence isn't about more data. It's about filtering out noise, isolating meaningful signals, and converting them into strategic sales actions.

From Raw Signal to Enriched Insight

The first step in making data useful is enrichment. This is the process of adding layers of context to a raw signal to make it meaningful.

For instance, a basic alert might tell you a target account just hired a new VP of Engineering. An enriched insight adds the details that matter to a seller:

- Who is this person? What's their background? Where did they work before, and what technologies did they use there?

- What's their likely mandate? Are they expected to cut costs, drive innovation, or overhaul the existing tech stack?

- Who else is on their team? Who are the key directors and managers reporting to them that you should also engage?

Of course, before data can become actionable, it needs to be clean. This is where AI data cleaning solutions can be incredibly helpful, ensuring your insights are built on a reliable base. You can also dive deeper into our guide on CRM data enrichment to see how this works inside your existing systems.

Prioritizing What Matters Most

Once your data is enriched, the next challenge is prioritization. An account executive covering 100 accounts could get dozens of signals a day. They can't act on all of them.

This is where AI-powered prioritization becomes a game-changer.

Intelligence platforms don't just show you what's happening; they tell you what matters most right now. By analyzing the signal type, its relevance to your solution, and the seniority of the people involved, the system can score and rank opportunities.

This scoring helps reps focus their time and energy on the triggers most likely to turn into a real conversation. A Director of IT downloading a white paper is interesting. But a newly hired CIO from a competitor who publicly states they are re-evaluating their cybersecurity stack? That's a top-priority, drop-everything-and-call signal.

Delivering Intelligence into the Workflow

The final piece of the puzzle is delivery. The best insights are useless if a sales rep has to leave their primary tools to find them. Actionable intelligence must be delivered directly into their existing workflow, whether that's Slack, email, or right inside the CRM.

This seamless integration drives adoption and efficiency. In fact, by 2026, over 64% of B2B sales organizations are expected to use technology that integrates workflow, data, and analytics. Why? Because reps spend only 29% of their time with clients, with the rest lost to administrative tasks.

AI in sales intelligence automates research and signal detection, reclaiming valuable selling time. It lets teams focus on high-value conversations backed by real-time intelligence. When an alert pops up in Slack with key details and a suggested talk track, it removes all friction, making it easy for the rep to act instantly.

Putting Intelligence Into Your Daily Sales Workflows

So, how does this theory play out in the real world? The true test of sales intelligence data is how easily it weaves into the daily grind of your revenue teams, making them faster and smarter without adding complexity.

When you get it right, this data isn't just another tool to check. It becomes the engine that powers high-performance workflows. For Account Executives (AEs), this means overhauling how they prep for meetings. For Revenue Operations (RevOps), it's about strategically shaping the entire go-to-market motion.

Let's look at some practical, day-in-the-life examples. The contrast between an intelligent workflow and the old way is stark.

The AE Workflow, Reimagined

For an Account Executive, time is their most valuable asset. Every minute spent on manual research is a minute not spent selling. Sales intelligence flips this dynamic by automating the busywork and embedding critical insights right where reps work.

Imagine an AE named Sarah has a critical prospect call in ten minutes.

-

The Old Way: Sarah scrambles. She has five browser tabs open—LinkedIn, the company's news page, a competitor's site, a funding announcement, and her CRM. She's frantically trying to piece together a coherent narrative, hoping to find a compelling "why now." She feels rushed, unprepared, and defaults to a generic pitch.

-

The Intelligent Way: The night before, an automated account brief landed in Sarah's inbox. It pulled the prospect's latest strategic initiatives from their earnings call, summarized a key executive's recent podcast interview, and highlighted relevant pain points. She spends five minutes reviewing this curated intelligence, identifies three powerful talk tracks, and walks into the meeting with confidence.

This isn't just a minor improvement; it's a fundamental change.

Sales intelligence transforms meeting prep from a chaotic, last-minute scramble into a calm, strategic five-minute review. It replaces frantic searching with focused selling.

Another powerful workflow is the trigger-based outreach sequence. When a high-priority account hires a new CIO, an AE gets an instant alert. But instead of just a generic "congrats on the new role" email, the alert provides context on the CIO's past projects and likely priorities. The AE can then launch a hyper-relevant outreach sequence that speaks directly to the challenges of a new leader in their first 90 days.

These workflows remove the guesswork and empower reps to be proactive and relevant. To take it even further, many teams are exploring sales research automation to make these processes even more efficient.

The Strategic Levers for RevOps

While AEs get the tactical, day-to-day benefits, Revenue Operations teams use sales intelligence data to make strategic improvements across the entire revenue engine. RevOps is focused on making the GTM process more efficient, predictable, and scalable—and signals are the key.

Here's a quick breakdown of how intelligence-driven workflows benefit different roles:

Table: Intelligence-Driven Workflows by Role

| Workflow | Primary Beneficiary | Key Outcome |

|---|---|---|

| Trigger-Based Outreach | AEs & SDRs | Higher reply rates and meeting conversion |

| Automated Meeting Briefs | AEs | More strategic conversations; reduced prep time |

| Dynamic Account Scoring | RevOps | Better resource allocation and territory focus |

| Ideal Customer Profile (ICP) Refinement | RevOps & Marketing | Higher-quality MQLs and improved marketing ROI |

| Risk & Churn Alerts | Customer Success & AEs | Proactive retention efforts; expansion opportunities |

| Territory & Account Planning | Sales Leadership & RevOps | Data-driven GTM strategy and fair territory carving |

As you can see, the impact isn't isolated. A RevOps-led initiative like dynamic scoring directly fuels the AE's pipeline with better, more timely opportunities.

One of the most impactful initiatives RevOps can own is building a signal-based lead scoring model. Traditional models rely on static firmographic data (like company size or industry) and simple behavioral data (like website visits). These are helpful, but they often fail to capture true buying intent.

A signal-based model is far more dynamic. It prioritizes accounts based on real-world events that indicate a propensity to buy now.

For example, an account's score might skyrocket if it triggers multiple high-value signals in a short period:

- Hiring Surge: The company posts 15 new roles for a specific engineering team.

- Executive Mention: The CEO mentions "improving operational efficiency" on an earnings call.

- Competitor Event: Their main competitor announces a significant price increase.

By combining these signals, RevOps can build a scoring system that surfaces the accounts most likely to be in-market. This lets them focus marketing spend, assign SDR resources effectively, and ensure AEs are working the best opportunities. It's a shift from reacting to the market to proactively engaging at the perfect moment.

“The Business Development team gets 80 to 90 percent of what they need in 15 minutes. That is a complete shift in how our reps work.”

Andrew Giordano

VP of Global Commercial Operations, Analytic Partners

How Sales Intelligence Wins Deals in the Real World

Generic sales advice doesn't work. B2B selling is anything but generic. The trigger that signals a need for a manufacturing firm is completely different from what gets a SaaS company to buy. This is where sales intelligence data moves from a nice-to-have to a must-have—it lets you tailor your game plan to the specific world your buyer lives in.

A one-size-fits-all approach to triggers leads to irrelevant outreach and wasted effort. Let's get practical and look at how this works on the ground in a few complex B2B verticals. This is about speaking the language and understanding the core business drivers of each industry.

By breaking down these real-world scenarios, you'll see how to turn high-level data into a sharp, competitive edge.

Life Sciences and Healthcare

In the heavily regulated world of life sciences, timing is everything. A single event can unlock millions in budget and create an immediate need for specialized tech and services. Sales teams in this space live and die by their ability to act on very specific signals.

Key triggers to watch for:

- Clinical Trial Milestones: When a company announces a new clinical trial phase (like Phase II or III), it's a massive buying signal. They instantly need everything from patient recruitment services to data management software.

- Regulatory Approvals: An FDA approval isn't just a press release; it's a starting gun for commercialization. This triggers huge investments in new sales teams, marketing campaigns, and supply chain infrastructure.

- New Research Funding: A big grant from the NIH or a private foundation signals a long-term commitment to a specific area of research. This creates immediate opportunities for providers of lab equipment, research software, and specialized services.

For a Contract Research Organization (CRO), an alert that a biotech firm just closed $50 million in Series B funding is a top-tier signal. It's a clear indicator they'll be outsourcing clinical trial activities, and they'll be doing it soon.

B2B SaaS and Enterprise Software

The SaaS world moves at warp speed. Competitors pop up overnight, and buying decisions are often driven by a company's own growth goals and tech stack. Sales intelligence helps you cut through the noise and find the real opportunities.

High-value SaaS triggers are often tied to growth and the tech ecosystem:

- Key Executive Hires: A new VP of Engineering who came from a company known for using AWS is a strong sign they might influence a similar move. You have a window to get in front of that conversation.

- Integration and Partnership Announcements: When a target account partners with a company you already integrate with, you have a powerful and timely reason to connect. Your solution just became more valuable to them overnight.

- Surges in Department-Specific Hiring: If a company suddenly starts hiring ten new sales managers, it's a giveaway they're scaling their go-to-market motion. They're almost certainly in the market for sales enablement, coaching, or CRM-adjacent tools.

Financial Services and Insurance

In finance and insurance, nothing drives spending like regulation and risk. These are urgent, board-level priorities that demand immediate investment in new technology and consulting.

A sales team selling into this vertical should be all over alerts like these:

- New Regulatory Mandates: When a new compliance law (like GDPR or a new financial reporting standard) is announced, it creates a hard deadline for thousands of companies. They have to update their systems, creating a wave of opportunity.

- Mergers and Acquisitions: An M&A event is a catalyst for chaos and opportunity. The combined entity has to integrate different financial systems, creating a massive opening for platforms that can streamline data consolidation, reporting, and compliance.

By focusing on these industry-specific triggers, you ensure every outreach is not just personalized, but deeply relevant to your prospect's most urgent challenges. This is how you turn data into meaningful conversations and, ultimately, closed deals.

Measuring the ROI of Your Sales Intelligence

Investing in a new platform is easy. Proving it actually makes you money is the hard part.

You have to connect your investment in sales intelligence data directly to business outcomes to justify the cost and keep your budget. It's all about translating smarter selling into tangible pipeline growth.

So, how do you prove that better data is driving better results? Track the right metrics—a mix of leading indicators that show early momentum and lagging indicators that prove bottom-line impact. This framework gives you the data points to build a solid business case.

Leading Indicators: The Early Wins

Leading indicators are the earliest signs that your strategy is working. They are the immediate, tactical improvements you'll see in your team's day-to-day activities. Think of them as the early smoke that signals a fire is building.

Key leading metrics to track:

- Increased Meeting Acceptance Rates: When reps use timely, relevant triggers, prospects are far more likely to say yes. Tracking the percentage of meetings booked from signal-based outreach versus generic cold outreach is a powerful early proof point.

- Higher Reply Rates to Outreach: A compelling "why you, why now" message cuts through the noise. Monitor reply rates on sequences built around specific sales intelligence triggers.

- Reduced Time Spent on Manual Research: This is a pure efficiency gain. Survey your reps to quantify the hours saved per week, which can then be translated into a dollar value.

Lagging Indicators: The Bottom-Line Impact

While leading indicators show you're on the right track, lagging indicators are what your CFO and board really care about. These are the revenue-focused outcomes that show up over a full sales cycle and demonstrate a clear return on investment.

The ultimate goal of sales intelligence isn't just to make reps busier; it's to make them more effective. Lagging indicators connect platform usage directly to the metrics that define success for the business.

Essential lagging indicators include:

- Shorter Sales Cycles: By finding in-market buyers sooner and giving reps the context to build trust quickly, deals move through the pipeline faster. Compare the average sales cycle length for deals influenced by intelligence versus those that weren't.

- Increased Average Deal Size: Better insights lead to more strategic conversations. This often uncovers larger problems your solution can solve, naturally leading to bigger contract values.

- Higher Win Rates: Targeting the right accounts at the right time with the right message dramatically improves your odds of winning. This is perhaps the most powerful ROI metric of all.

To quantify the impact, focus on metrics for measuring marketing campaign effectiveness and ROI. By tracking both leading and lagging indicators, you can weave a comprehensive story that proves the value of your sales intelligence investment.

Key Takeaways

- Sales intelligence data is your team's GPS, replacing hours of manual research with real-time alerts that surface the right accounts at the right time with the right message.

- High-impact sales triggers, such as funding rounds, executive hires, and earnings call mentions, are distinguished from noise by their specificity and urgency.

- The shift from manual prospecting to intelligent selling dramatically improves efficiency, scalability, and pipeline quality while freeing reps to focus on strategic conversations.

- Turning raw signals into actionable sales plays requires context; a funding announcement becomes a conversation about scaling, and a new CIO hire becomes an opportunity to influence their technology roadmap.

- Measure adoption with leading indicators like signal response time and personalization rate, then validate with lagging indicators like shorter sales cycles, higher win rates, and increased deal sizes.

Frequently Asked Questions

What is sales intelligence data and how is it different from basic contact data?

Sales intelligence data goes far beyond names, emails, and phone numbers. It includes real-time buying signals like funding announcements, executive hires, and earnings call mentions that reveal why a prospect might need your solution right now. Basic contact data tells you who to call, while sales intelligence tells you when to call and what to say.

How do you distinguish a high-impact sales trigger from noise?

The two key differentiators are specificity and urgency. A company publishing a generic blog post about industry trends is noise, while a sudden surge in job postings for a specific engineering team is a high-impact signal. True triggers point to a funded initiative that is actively in motion, creating a time-sensitive window for relevant outreach.

How accurate is sales intelligence data?

Data accuracy varies by provider, and contact data decays at a rate of over 22% per year as people change jobs. The best platforms maintain accuracy through a combination of AI-driven scraping, cross-referencing multiple public sources like SEC filings and press releases, and human verification. Look for providers who are transparent about their data validation process.

How does sales intelligence integrate with a CRM like Salesforce?

A modern sales intelligence platform should feel like a native extension of your CRM. It automatically enriches existing account and contact records with fresh firmographic and signal data, pushes new relevant contacts into your system when key hires occur, and delivers alerts directly on the account page so reps never have to leave their primary workflow.

What kind of ROI should we expect from sales intelligence?

Teams typically see improvements across both leading and lagging indicators. Early wins include higher meeting acceptance rates and reply rates on signal-based outreach, along with reduced time spent on manual research. Over a full sales cycle, organizations report shorter sales cycles, increased average deal sizes, and higher win rates as reps consistently engage the right accounts at the right time.

Can small teams benefit from sales intelligence, or is it only for large enterprises?

Sales intelligence is often even more impactful for smaller teams. When you have limited resources, you cannot afford to waste time chasing accounts that are not ready to buy. A lean team armed with real-time buying signals can focus every outreach on high-potential prospects, allowing them to compete effectively against much larger sales organizations.

Ready to turn signals into pipeline? Salesmotion is an AI-powered account intelligence platform that delivers actionable context directly into your team's workflow, eliminating manual research and ensuring every outreach is timely and relevant. Learn how Salesmotion can help you win.