Finding decision-makers in a company means looking beyond C-suite titles. The real work is identifying the entire buying committee---a group that includes influencers, champions, and the people who actually hold the budget.

TL;DR: Forget targeting a single executive by title. Modern B2B deals are won by mapping the full buying committee -- budget holders, influencers, and champions -- then using real-time signals like hiring trends and exec moves to reach them at the right moment.

So, how do you do it? By monitoring real-world business signals. Think hiring trends, new funding, and executive moves. These events show you who has a vested interest in a solution right now. A signal-based approach is what separates connecting with the right people at the perfect time from sending another cold email that gets ignored.

Beyond the C-Suite: Redefining B2B Decision-Makers

Forget the old playbook of targeting a single executive. Modern B2B deals are won by navigating a complex web of stakeholders.

The lone decision-maker is a myth. Today's purchases are driven by consensus within a buying committee. This shift means that traditional, title-based prospecting is no longer effective.

Relying solely on job titles like "VP of Sales" or "CFO" leads to generic messaging that just doesn't land. This old method ignores a simple fact: influence is spread across multiple roles, especially in specialized sectors like B2B SaaS, Life Sciences, and Finance. Sales reps are drowning in data but often lack the right tools to separate noise from genuine opportunity, leading to bad timing and irrelevant outreach.

The Rise of the Buying Committee

The modern sales process is a team sport on both sides. In today's B2B world, identifying decision-makers is tougher than ever. The average purchasing team now includes 11 different people.

Even more telling, 29% of enterprise buying groups now have 10 or more stakeholders. This complexity is exactly why automated tools that track real-world triggers---like executive moves, hiring changes, and org restructures---are becoming essential. They can cut manual research time by a massive 40-60%, letting account executives focus on multi-threading their outreach.

The real challenge isn't just finding a name on an org chart. It's understanding the power dynamics within a target account. Who holds the budget? Who feels the pain most acutely? And who will champion your solution when you're not in the room?

From Static Lists to Dynamic Signals

A signal-based strategy is the only way forward. Instead of asking, "Who should I contact?" the better question is, "Why should I contact them now?"

This guide is your playbook for turning scattered data into actionable intelligence. You'll learn how to:

- Identify the multiple roles within a buying committee, not just the economic buyer.

- Monitor buying signals that scream "window of opportunity."

- Connect with the right people using a message that speaks directly to their current priorities.

Here's a great example of how a platform can visualize the structure of a buying committee within one of your target accounts.

This approach helps revenue teams map out influence from the start, letting them tailor their entire engagement strategy to each key player involved.

See Salesmotion in action

Take a self-guided interactive tour — no signup required.

Using Buying Signals to Uncover Key Players

Decision-makers don't send a press release when they're ready to buy. They leave a trail of digital clues---buying signals---that reveal their priorities and pain points long before they talk to a sales rep. Learning to spot and interpret these signals is the key to finding the right person at the perfect moment.

This approach flips the script from "who should I contact?" to the more powerful "why should I contact them now?" It's all about connecting a specific business event to a relevant problem, which makes your outreach timely and valuable from the first touch.

Decoding Different Types of Buying Signals

Not all signals are created equal. Some are subtle, like an executive appearing on a podcast, while others are impossible to miss, like a massive funding announcement. The skill is knowing what to look for and understanding what each signal means for your sales process.

Let's break down some of the most common triggers:

- Executive Hires: When a company brings on a new VP of Engineering or CRO, it almost always signals a strategic shift. This new leader was hired to solve a problem or drive a new initiative, making them a prime contact for solutions that can help them score an early win.

- Funding Announcements: A fresh round of capital means new budgets and aggressive growth targets. It's a clear sign the company is about to invest heavily in scaling up, whether through new technology, bigger teams, or market expansion.

- Product Launches: A new product launch creates ripples across the organization. The marketing team might need new promotional tools, engineering may need to scale their infrastructure, and the customer support team will need a better way to handle inquiries.

- Job Postings: Open roles for "Salesforce Administrators" or "Cybersecurity Analysts" tell you exactly what tech a company uses and where its priorities lie. These job descriptions are a public roadmap to a company's tech stack and strategic goals.

These signals are the breadcrumbs that lead you straight to the people feeling the most pressure to find solutions. You can dig deeper into how to use these triggers in our complete guide to buying signals in sales.

The Dark Funnel Is Where Decisions Are Made

Let's be real: most of the buying journey happens long before you know a company is looking. B2B decision-makers aren't waiting for your call; they're deep in the 'dark funnel.' Research shows that buyers are 73% of the way through their decision-making process before they ever contact a vendor. This is a huge reason why so much cold outreach falls flat. Modern buying committees, which now average 11 members, have already formed strong opinions through their own research. For more data, you can read the full research on B2B buyer behavior.

By the time a prospect fills out a 'Contact Us' form, they've likely already shortlisted their preferred vendors. Monitoring buying signals lets you enter the conversation much earlier, while opinions are still being formed and you have a real chance to influence the outcome.

Tailoring Your Approach to Industry-Specific Signals

The most powerful signals are often industry-specific. What's a game-changer in Life Sciences might be irrelevant in enterprise SaaS. Understanding these nuances is what separates generic outreach from a message that truly resonates.

For example, a Phase II clinical trial update in the biotech world points to a completely different set of stakeholders than an ARR milestone in SaaS. The clinical trial news involves leaders in Clinical Operations and Regulatory Affairs, while the ARR announcement puts the spotlight on Sales and Finance executives.

Think about these vertical-specific triggers:

- Life Sciences: A regulatory filing with the FDA or a new research partnership announcement.

- Financial Services: A change in compliance regulations or an acquisition of a smaller fintech company.

- Manufacturing: A press release about a new plant expansion or supply chain optimization initiative.

When you align your prospecting with these industry events, you're not just selling---you're showing a deep understanding of your target's world. This builds instant credibility and sets you apart from the noise. This is exactly what modern account intelligence platforms like Salesmotion are built to do: automate this discovery and turn hours of manual research into a steady stream of real-time alerts, so you never miss that critical window of opportunity.

An account contacts view maps the buying committee with roles, seniority, and recent activity — so reps know exactly who to engage and how to multi-thread effectively.

An account contacts view maps the buying committee with roles, seniority, and recent activity — so reps know exactly who to engage and how to multi-thread effectively.

“Salesmotion helps you spot signals from prospect accounts, news items / job hiring alerts etc that indicate that now is a good time to reach out with a well-crafted message.”

Rob Douglas

Director of Sales, icit business intelligence

Mapping Influence and Validating Your Targets

Spotting a buying signal is like seeing smoke on the horizon. Your next move is critical: connecting that signal to the right people. This isn't about blasting a list of VPs with the same generic message. It's about methodically mapping the web of influence within your target account and validating every contact before you reach out.

The goal is to build a contextual org chart---one that reveals not just titles, but real-world relationships and priorities. A simple contact list is a relic of the past. A true map of influence is your modern playbook for winning complex deals.

This process transforms your approach from guesswork into a calculated, multi-threaded engagement plan. You'll know who holds the budget, who champions new technology, and who has the final say.

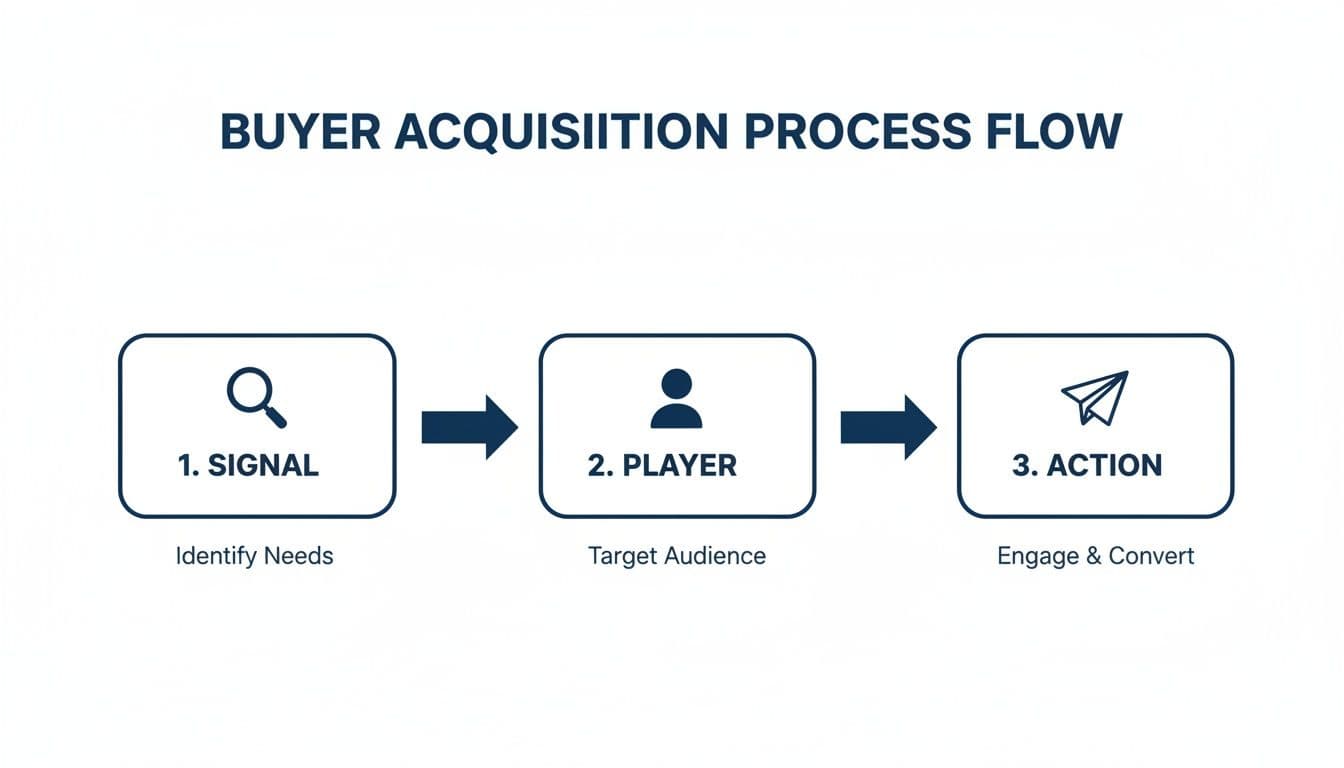

This simple flow breaks down the critical sequence: every effective outreach action starts with a credible signal, which then points you toward the relevant players.

Beyond Just Titles on LinkedIn

LinkedIn is your primary battlefield for mapping influence, but most reps barely scratch the surface. If you're just searching for titles, you're missing the real story. You need to look for the subtle clues that paint a richer picture of who you're dealing with.

Here's how to dig deeper:

- Analyze Recent Posts and Comments: What topics is your potential contact engaging with? Their activity reveals their current priorities far better than a static job description ever could.

- Map Their Connections: Who are they connected to within their own organization? Seeing strong ties between a VP of Operations and a Director of IT suggests a collaborative relationship you can reference.

- Review Group Memberships: Are they part of niche industry groups? This can signal specialized knowledge or a focus on a particular business challenge that your solution might solve.

This deeper analysis helps you build a more accurate hypothesis about who truly matters for your deal. It's about understanding the person, not just their position.

Dissecting Job Postings for Strategic Clues

Job postings are public roadmaps to a company's internal structure and strategic direction. They are a goldmine of information, openly advertising a company's needs, tech stack, and reporting lines.

A posting for a "Senior Data Analyst" that lists "experience with Snowflake and Tableau" and "reporting to the Director of Business Intelligence" tells you three critical things: their tech stack, their focus on data analytics, and the exact reporting structure of a key team. This is invaluable intelligence for tailoring your outreach.

Similarly, a company hiring multiple "Enterprise Account Executives" focused on the financial services vertical clearly signals a strategic push into that market. You can use this insight to connect with the CRO or VP of Sales about their expansion goals.

Stop viewing job postings as just recruitment tools. Start seeing them for what they are: detailed blueprints of a company's challenges, priorities, and internal hierarchy.

The complexity of modern buying committees makes this deep-dive research non-negotiable. According to recent enterprise benchmarks, 87% of B2B buying groups involve four or more decision-makers, which complicates consensus-building. With 29% of enterprise groups hitting 10 or more members, the sprawl is real. Platforms that automate stakeholder identification through org changes and executive moves are becoming vital for precision.

Hunting for Clues in Public and Private Data

To build a complete picture, you need to pull information from a variety of sources. Relying on a single data point is risky; you need to triangulate your findings to confirm who the real players are.

Here's a breakdown of common signal sources and how to interpret the intelligence they provide.

Signal Sources for Identifying Decision Makers

| Signal Source | Information Revealed | Actionable Insight |

|---|---|---|

| Job titles, career history, connections, posts, comments, group memberships | Build a preliminary org chart. Identify priorities based on engagement. Uncover reporting lines and internal relationships. | |

| Job Postings | Tech stack, team structure, strategic priorities, reporting lines, required skills | Pinpoint specific needs and tech gaps. Identify the hiring manager, who is often a key stakeholder with budget. |

| Press Releases | Executive quotes, new initiatives, project leadership, strategic partnerships | Identify the executive sponsor for a major project. Find direct quotes to use for hyper-relevant outreach. |

| SEC Filings (10-K, 8-K) | Official leadership changes, risk factors, major investments, strategic outlook | Confirm the names of C-suite and board members. Understand the company's biggest stated challenges and priorities. |

| Company 'About Us' Page | Official leadership team, departmental heads, board members | Validate the formal hierarchy. Identify key leaders who may not be active on social media. |

| Webinars & Podcasts | Personal insights, challenges, goals, specific project details | Hear executives describe problems in their own words, giving you the perfect material for a personalized message. |

By cross-referencing these sources, you move beyond assumptions and start building a validated map of influence that gives you confidence in your outreach strategy.

Validating Your Findings Across Multiple Sources

A single data point is just a guess. Multiple, corroborating data points create a fact. Once you've built your initial map of influence, the final step is to cross-reference and validate everything. Don't rely solely on LinkedIn.

Here's a quick validation checklist for your key contacts:

- Press Releases & SEC Filings: Do their names appear in official company announcements or financial reports? These documents often name the key executives responsible for major initiatives.

- Company 'About Us' Pages: This seems basic, but it's often overlooked. It confirms the official leadership structure and can reveal key players who aren't active on social media.

- Podcast Interviews & Webinars: Have they spoken publicly about their work? Listening to an executive discuss their challenges in their own words gives you the perfect material for a highly relevant outreach message.

This multi-source validation ensures you're building a true map of influence, not just a contact list. It gives you the confidence to engage with a clear point of view, knowing your message is grounded in solid research. Once you discover that internal advocate, it's crucial to empower them correctly; our guide on champion tracking offers practical steps for what to do next.

Turning Account Intelligence into Compelling Outreach

Finding the right people is a solid start, but it's only half the battle. The real challenge is getting them to listen. This is where you cash in on all your research, turning raw intelligence into outreach that's too relevant to ignore.

Forget about tired, generic templates. The goal is to craft messages rooted in timely, credible triggers. When you do this right, you're showing you've done your homework. You're proving you understand their world, their challenges, and what's happening in their business right now.

It's all about delivering value from the very first touchpoint, making your message feel less like a pitch and more like a necessary conversation. The best sales teams use AI powered sales intelligence to connect these dots and build outreach that truly stands out.

Connecting Signals to Specific Pain Points

The most effective outreach doesn't just mention news; it builds a bridge between that event and a problem you can solve. You have to connect the signal to a specific, implied pain point. This simple shift transforms your message from opportunistic to genuinely insightful.

Let's walk through a real-world scenario. Imagine a mid-sized tech company just announced a major acquisition.

- The Signal: Company X acquires Company Y to expand its product line.

- The Implied Pain: Merging two different tech stacks, customer support systems, and sales processes is an operational nightmare. Think data silos, internal friction, and a choppy customer experience.

- The Outreach Angle: Your message to the VP of Operations isn't, "Congrats on the acquisition!" It's something like this: "Saw the great news about the Company Y acquisition. As you merge two distinct customer support platforms, ensuring a seamless data migration without disrupting service levels is a massive challenge. Our platform specializes in unifying disparate systems to maintain a single source of truth during post-merger integrations."

See the difference? This approach immediately positions you as a strategic partner who gets their immediate reality, not just another vendor.

Multi-Threading Your Message for Different Stakeholders

In any complex deal, you're rarely selling to one person. You're selling to a committee, and each member has their own priorities, metrics, and anxieties. Tailoring your message to each person's unique perspective is non-negotiable if you want to build consensus.

We call this multi-threading, and it's a critical skill for getting buy-in from all the key decision makers in a company.

Think about how different leaders at the same company would view a new software investment:

- Chief Financial Officer (CFO): The CFO is obsessed with ROI, TCO, and budget impact. Your message needs to speak their language, focusing on financial outcomes like "reducing operational costs by 15%" or "improving team productivity to accelerate revenue."

- VP of Engineering: This leader is thinking about integration, security, and technical debt. Your message to them has to address how your solution plugs into their existing stack, its security protocols, and how painless implementation will be.

- Chief Revenue Officer (CRO): The CRO lives and breathes pipeline growth, sales cycle length, and deal velocity. Your outreach should directly connect your solution to their ability to close more deals, faster.

Don't make the rookie mistake of sending the same generic message to everyone. A message that gets a CFO's attention will almost certainly fall flat with an engineering leader. Personalization isn't just about using their first name; it's about speaking their professional language.

By customizing your outreach for each key player, you create multiple entry points and build internal champions who can advocate for your solution from their own unique angle.

From First Touch to a Valued Conversation

Your first email or LinkedIn message sets the tone for the entire relationship. Every touchpoint should offer value, even if they aren't ready to buy today. This could be sharing a relevant industry report, a case study from a similar company, or an insight from their latest press release.

For instance, if you're targeting a company in a highly regulated industry, sending them an article about upcoming compliance changes shows you're plugged into their world. The goal is to evolve from "just another salesperson" into a trusted resource.

This value-first approach is especially critical when trying to get the attention of high-level executives. They are protective of their time and get hundreds of pitches a week. The ones that get a response are those that demonstrate a clear understanding of their priorities and offer a compelling reason to engage now. You can get a deeper look at how to use different data points to build these messages in our guide on B2B intent data.

“Automatic account profile detail I can use to manage my territory. Using Salesmotion AI to generate value statements per persona, account, etc. Using Salesmotion to give me a starting point based on new hires, or news alerts is critical.”

Adam Wainwright

Head of Revenue, Cacheflow

Common Prospecting Mistakes (And How to Fix Them)

Even the sharpest sales pros fall into prospecting traps. Nailing your strategy isn't just about what you do right---it's about sidestepping the missteps that waste time and kill deals before they start.

Think of this as a quick gut-check for your process. Avoiding these common pitfalls is the first step toward turning all that hard-earned research into meaningful conversations.

Mistake 1: The Danger of Title-Gazing

One of the most common blunders is 'title-gazing'---assuming a C-level title automatically makes someone the right person to talk to. Sure, the CFO holds the purse strings, but they're almost never involved in the initial evaluation of a new cybersecurity platform. Your perfect pitch on technical specs will be completely lost on them.

Instead, hunt for roles and responsibilities. The real decision-maker for your solution is probably a Director of IT Security or a Senior DevOps Engineer. These are the people who feel the operational pain your product solves every day, and they're the ones who will champion your solution and build the business case to get executive sign-off.

A C-suite executive is often the final checkpoint, not the starting line. Win them over by finding a strong internal champion who has already done the legwork to prove your value.

Mistake 2: Relying on a Single Data Source

Another major pitfall is putting all your faith in one data source. Relying solely on a contact database or even just LinkedIn gives you a flat, one-dimensional view of an account. People change roles, companies restructure, and priorities shift---often quarterly.

That "VP of Marketing" you found six months ago might be leading a new product innovation team now. Without cross-referencing your info, you risk sending a perfectly good message to a completely irrelevant person.

Good prospecting is about triangulation. You have to validate your intel across multiple sources to build a complete, current picture of the account.

- Official Company News: Cross-reference LinkedIn titles with recent press releases or SEC filings that name project leads.

- Job Postings: A company hiring for a specific role can reveal team structures and priorities that an org chart won't show you.

- Industry Webinars: Hearing an executive speak on a panel gives you direct insight into their current challenges and the exact words they use to describe them.

This multi-source validation is your insurance policy against outdated information. It ensures you're not just guessing---you're operating with a clear, confirmed map of influence.

Mistake 3: Stopping at a Single Contact

Finding one promising contact and putting all your energy there is a recipe for a stalled deal. Today, 87% of B2B buying groups involve four or more people, making single-threaded conversations incredibly risky. If your one point of contact leaves, gets reassigned, or just goes dark, your entire deal evaporates.

This is exactly why multi-threading---building relationships with multiple stakeholders at the same time---is so critical. When you engage the economic buyer, the technical buyer, and a potential end-user all at once, you build broad consensus and keep the momentum going. If one person ghosts you, you have other avenues to keep the conversation alive.

Mistake 4: The Perfect Message at the Wrong Time

Finally, even the most brilliantly researched message will fall flat if the timing is off. Reaching out about scaling sales operations a week after a company announced major layoffs shows a complete lack of awareness. It instantly tanks your credibility and makes you look opportunistic, not helpful.

This is where monitoring buying signals becomes non-negotiable. Connecting your outreach to a recent, relevant event---like a new funding round, a product launch, or an executive hire---is what creates urgency. It gives you a credible "why now" that justifies your outreach and frames your solution as a logical next step.

Bad timing makes you noise; good timing makes you a valuable resource.

Key Takeaways

- The lone decision-maker is a myth; modern B2B deals involve an average of 11 stakeholders, so you must map the full buying committee including influencers, champions, and budget holders.

- A signal-based approach, monitoring events like executive hires, funding rounds, and job postings, tells you not just who to contact but why to contact them right now.

- Validate your targets across multiple sources such as LinkedIn, press releases, SEC filings, and podcasts to avoid relying on stale or incomplete data.

- Multi-threading your outreach with tailored messages for each stakeholder role (CFO, CTO, CRO) builds broad consensus and de-risks your deal from single-point-of-contact failure.

- Common prospecting mistakes like title-gazing, relying on a single data source, and poor timing kill deals before they start; proactive signal monitoring is the fix.

Still Have Questions? Let's Talk Specifics

Even the best-laid plans run into real-world questions. When you're trying to map out a complex account, a few common hurdles always seem to pop up. Let's tackle some of the most frequent questions we hear from revenue teams.

How Many Decision Makers Should I Really Target in One Account?

There's no magic number here. The average B2B buying committee now involves around 11 members, and for big enterprise deals, it's not uncommon to see 10 or more stakeholders get involved.

Instead of chasing a specific headcount, focus on mapping the core roles. Your mission is to identify and engage the key personas who will make or break your deal:

- The Economic Buyer: The person who holds the purse strings.

- The Champion: Your internal advocate, who will sell for you when you're not in the room.

- The Technical Buyer: The one who evaluates the nuts and bolts---integration, security, compliance.

- Key Influencers & Users: The folks whose opinions carry weight and who will live with the solution day-to-day.

A solid starting point is to identify and map 4-6 key individuals across these different functions. From there, you'll learn more about the internal power dynamics and can expand your outreach as you see who else gets pulled into the conversation.

What Are the Best Free Tools for Finding Decision Makers?

While premium platforms like Salesmotion automate this and give you the deepest insights, you can piece together a surprising amount of intelligence without spending a dime.

LinkedIn is the obvious starting point for mapping roles and connections. But don't stop there. A company's own digital footprint is a goldmine. Dig into their "About Us" page, press releases, and any investor relations sections to identify senior leadership.

A great tactic is setting up Google News alerts for your top target accounts. This will flag executive changes, new projects, and other buying signals in real time, delivered right to your inbox. And don't underestimate listening to industry podcasts or watching webinar recordings where executives from your target companies are speaking---it's an incredible source of context on their priorities.

How Do I Know if I've Found the Right Person?

Here's the secret: the "right" decision maker is almost always a group of people. You'll know you've found the right people when your outreach sparks an internal conversation that you're not even a part of.

A classic sign you're on the right track is when your initial contact loops in a colleague from another department. That's a huge signal that you've hit on a relevant pain point that requires cross-functional collaboration to solve.

The ultimate validation is landing a meeting where multiple department heads show up. When the VP of Operations invites the Director of IT to the call without you asking, you know you've successfully connected a business problem to the people empowered to fix it.

Another strong indicator is the quality of their questions. If a contact responds with specific questions about implementation, budget, or security, they're not just kicking tires---they're a serious stakeholder.

How Often Should I Re-Validate My Contacts?

In today's environment, roles and entire team structures can shift in a single quarter. Assuming your account map from six months ago is still accurate is a recipe for wasted effort.

For your highest-priority accounts, you should do a quick validation check at least once per quarter. This doesn't have to be a massive project. It's as simple as:

- Scanning LinkedIn for recent promotions or job changes.

- Reviewing company news for any leadership shake-ups.

- Monitoring job postings for new hires in relevant departments.

For Tier 2 accounts, a semi-annual check-up is usually enough to keep your data fresh. Of course, this is where automated account intelligence platforms really shine, as they handle this continuously and alert you the moment a key change happens. It ensures your account maps are always current and your outreach never lands on an outdated target.

Frequently Asked Questions

How do I find decision makers when a company has no public org chart?

Start with LinkedIn to identify people by role and department, then cross-reference with press releases, SEC filings, webinar appearances, and podcast interviews. Job postings are another goldmine because they reveal reporting structures and team priorities. When official sources are scarce, engaging a lower-level contact and asking thoughtful discovery questions about who else is involved in evaluating solutions can organically uncover the full buying committee.

What is the fastest way to identify the economic buyer in a deal?

The economic buyer is the person who controls the budget and can say "yes" without further approval. The quickest way to identify them is to ask your champion directly: "Who ultimately signs off on this type of investment?" You can also look for clues in SEC filings, earnings call transcripts, and press releases where executives are quoted discussing the specific initiative your solution supports.

Should I reach out to the C-suite first or start lower in the org?

In most cases, starting with a director or VP-level champion who feels the operational pain is more effective than cold-emailing the CEO. These mid-level leaders are closer to the problem, more likely to engage, and can build the internal business case for you. Once you have a champion, they can facilitate a warm introduction to the economic buyer, which is far more effective than a cold approach to the top.

How do I handle it when my main contact leaves the company mid-deal?

This is exactly why multi-threading is critical. If you have relationships with 3 to 5 stakeholders across the buying committee, losing one contact does not kill the deal. Immediately reach out to your other contacts to reaffirm the value and timeline. At the same time, track the departed contact through champion monitoring because their move to a new company could open an entirely new pipeline opportunity for you.

Ready to stop guessing and start knowing exactly who to talk to and when? Salesmotion is an AI-powered account intelligence platform that tracks buying signals across your target accounts and turns them into actionable outreach. Get a demo of Salesmotion and see how you can connect with the right decision makers at the perfect time.