Imagine knowing a target account is ready to buy before they contact you. That's the power of market intelligence software. It’s like having a 24/7 team of analysts watching your market, listening for critical business events, and alerting you the moment an opportunity opens up.

What Is Market Intelligence Software?

Market intelligence software is a platform built to automatically find crucial business signals across your target accounts. It goes far beyond simple news alerts by using AI to spot commercially relevant events—like a new funding round, a key executive hire, or a major product launch—and turns that noise into a real competitive advantage.

This technology solves a persistent and costly problem for every B2B revenue team: the manual research tax. Sales reps can easily burn hours every week piecing together account information from press releases, LinkedIn, financial news, and industry blogs. This tedious work drains valuable selling time and often leads to inconsistent, surface-level insights.

Market intelligence software eliminates this inefficiency. Instead of reps hunting for data, the platform delivers curated, actionable context directly into the tools they already use, like Slack, email, or your CRM.

From Data Collection to Actionable Insight

The real value of this software isn't just in gathering data; it's in translating that data into a clear "so what" for your team. A traditional news feed might tell you a company hired a new CTO. A market intelligence platform, however, tells you why that matters: the new CTO has a track record of investing in cybersecurity, creating a perfect opening for your outreach.

This shift from raw information to structured intelligence directly impacts revenue growth. It helps your team:

- Improve Timing: Engage accounts the moment a business need arises.

- Increase Relevance: Craft personalized messages based on real, timely events.

- Prioritize Efforts: Focus on accounts that are actively showing buying signals.

- Boost Efficiency: Free up reps to spend more time building relationships and closing deals.

The difference in day-to-day operations is huge. We're talking about a fundamental shift from reactive selling to proactive, intelligence-led engagement.

To make this clear, let's compare the old, manual approach with the new, automated one.

Manual Research vs. Market Intelligence Software

| Activity | The Old Way (Manual Approach) | The New Way (Market Intelligence Software) |

|---|---|---|

| Finding Opportunities | Sifting through news sites, social media, and press releases. | AI-driven alerts for key events like funding or new hires. |

| Account Research | Manually compiling data from 10+ sources for a single account. | Consolidated account context and history delivered in one place. |

| Personalization | Using generic, static info like industry or company size. | Crafting outreach based on timely, specific business triggers. |

| Timing | Guessing when an account might have a need. | Engaging accounts the moment a relevant signal is detected. |

| Rep Productivity | 5-10 hours per week spent on non-selling research tasks. | Less than 1 hour per week; more time spent on selling. |

The table says it all. You're trading hours of frustrating, low-value work for automated, high-impact insights that help you sell more. It’s a no-brainer.

A Rapidly Growing Priority

The move toward automated, AI-driven insights reflects a massive shift in business strategy. The global data intelligence market was estimated at USD 18.85 billion in 2024 and is projected to hit USD 71.74 billion by 2033, growing at a remarkable 16.4% annually. This explosive growth shows just how much organizations are prioritizing tools that provide a clear, data-backed edge in a crowded marketplace. You can discover more insights about the data intelligence market's growth on Grand View Research.

Ultimately, market intelligence software transforms generic outreach into timely, relevant conversations. By arming your team with the right information at the right time, you can stop guessing what your buyers care about and start engaging them with insights that lead to real revenue.

See Salesmotion in action

Take a self-guided interactive tour — no signup required.

Understanding the Core Capabilities That Drive Revenue

Good market intelligence software doesn’t just dump a mountain of data on your desk. It turns raw information into a real competitive edge. Think of it less like a search engine and more like a strategic advisor, whispering who to call, when to call them, and exactly what to say.

This is all done through a few core capabilities that work together. They're designed to find the signal in the noise, give you the context that matters, and deliver those insights right into your team's daily routine, making them easy to act on.

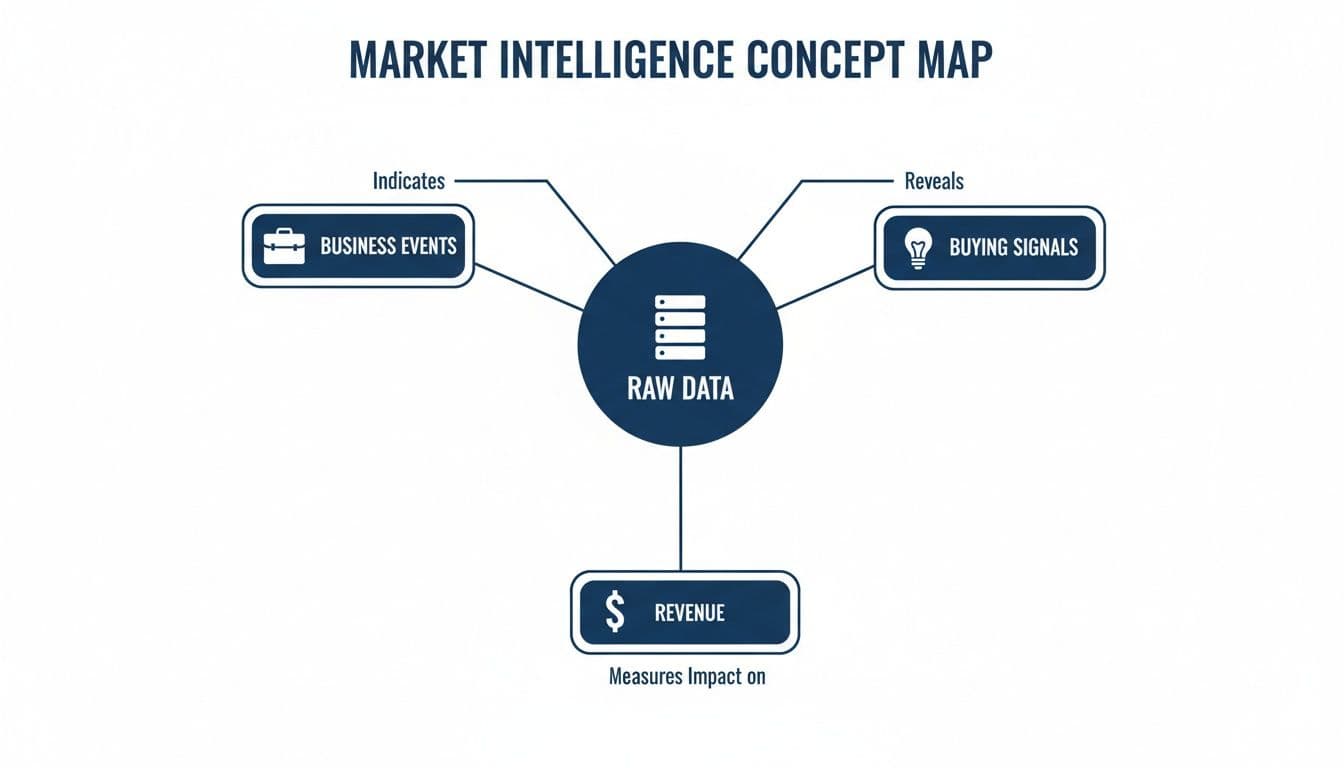

The diagram below shows how these platforms turn messy, raw data into clear, revenue-generating activities. It starts with a business event, surfaces a buying signal, and measures the impact on your pipeline.

As you can see, the process is all about refining broad data into precise, high-value opportunities for your sales and marketing teams.

Always-On Signal Monitoring

The heart of any powerful market intelligence tool is its ability to constantly monitor the market for buying signals. This is a 24/7, automated process that watches your target accounts for commercially relevant events.

These aren't just random news alerts. The software is specifically tuned to spot triggers that point to a potential need or a newly freed-up budget, such as:

- Funding Announcements: A fresh round of capital almost always means new spending on growth.

- Hiring Surges: A company staffing up on engineers might need new development tools. A wave of new sales hires? They're probably looking for CRM or enablement software.

- Executive Moves: A new CIO or CMO often brings in their preferred vendors and has a mandate to shake things up, creating a perfect window of opportunity.

- Tech Stack Changes: When a company removes a competitor's product, it creates an immediate opening for a conversation.

Instead of your reps burning hours digging for these nuggets, the platform serves them up automatically. This proactive monitoring ensures you never miss a critical window to engage.

Automated Account Context

Data without context is just noise. The real value is translating a raw signal into a clear "so what?" for your sales team. It answers the crucial question: Why does this matter to me right now?

The best platforms don't just tell you that a company received funding. They tell you the funding is earmarked for international expansion, which aligns perfectly with your global logistics solution. That’s the difference between information and intelligence.

This automated context saves reps from having to connect the dots themselves. It gives them the backstory and talking points they need for a relevant conversation, directly linking the market event to a pain point your product solves. For a deeper dive, you can learn more about how to interpret these triggers in our guide to B2B intent data.

Real-Time Workflow Alerting

Intelligence is useless if it’s buried in another dashboard nobody checks. That's why top-tier market intelligence software pushes alerts directly into the tools your team already lives in.

Imagine a sales rep getting an instant Slack notification: "Target account Acme Corp just announced a new partnership with a major cloud provider. Their press release mentions a focus on data security. Here is the link and a suggested outreach angle."

This real-time delivery ensures insights are seen and acted upon immediately. By integrating with tools like Slack, Microsoft Teams, email, and your CRM, the platform makes intelligence a natural part of the daily workflow, not another chore.

Seamless Tech Stack Integrations

Finally, these platforms have to plug seamlessly into your existing technology. Strong integrations are non-negotiable because they're what make the intelligence actionable.

When market intelligence software integrates with your CRM, it can automatically enrich account records with the latest signals, update contact info for new executives, and even help prioritize accounts based on recent activity. When connected to a sales engagement tool, a trigger can automatically enroll a prospect into a highly personalized outreach sequence.

This level of integration transforms the platform from a simple monitoring tool into the central nervous system of your revenue engine, ensuring every piece of intelligence drives a concrete, measurable action.

“The account and contact signals are key for reaching out at important times, and the value-add messaging it creates unique to every contact helps save time and efficiency.”

Daniel Pitman

Mid-Market Account Executive, Black Swan Data

How Top B2B Revenue Teams Use Market Intelligence

Knowing what market intelligence software can do is one thing. Seeing how elite revenue teams use it to crush their numbers is another. The best B2B teams don't just consume intelligence; they build structured, repeatable plays around it. They are masters at turning raw signals into specific actions that generate pipeline and shorten sales cycles.

These teams have moved beyond generic outreach and random prospecting. They use automated insights to engage the right accounts with the right message at the exact right time. This signal-driven approach is what separates high-growth players from everyone else.

Let's break down four practical, real-world workflows that top teams run to turn market intelligence into measurable revenue.

Trigger-Based Outbound

This is one of the most powerful plays in the modern sales toolkit. Instead of cold calling a list, reps use a specific business event—a "trigger"—as a timely and relevant reason to get in touch. The software spots the signal, alerts the right person, and often provides a suggested talk track.

Imagine your platform detects that a target account just launched a new AI product. That signal can automatically kick off a tailored outreach sequence. The first email isn't a generic pitch; it's a hyper-relevant message congratulating them on the launch and connecting it directly to a pain point your solution solves for companies scaling new AI initiatives.

Common triggers for this play include:

- New Funding Rounds: An immediate sign of fresh budget and aggressive growth plans.

- Key Executive Hires: A new VP of Sales is the perfect entry point to introduce sales enablement tools.

- Mergers and Acquisitions: M&A activity almost always creates an urgent need for new systems to consolidate operations.

This approach dramatically increases response rates because the outreach is rooted in a real event the prospect is already thinking about. It's the difference between interrupting their day and joining a conversation already happening in their head.

Automated Meeting Preparation

Let’s be honest: even the best reps struggle to find time for deep pre-call research. Market intelligence software solves this by delivering automated, just-in-time meeting briefs. A few minutes before a call, a rep gets a concise summary of the account's latest happenings delivered right to their inbox or Slack.

This isn't just a list of news articles. A good brief synthesizes the important information, like:

- Recent strategic initiatives mentioned in an earnings call.

- A new partnership announcement relevant to your solution.

- Key quotes from a podcast interview with the executive they're about to meet.

This allows the rep to walk into the meeting armed with sharp, relevant questions and talking points. It transforms the conversation from a generic discovery call into a strategic discussion about their immediate business priorities, building credibility and trust from the first minute.

Strategic Account Planning

Static account plans created once a quarter are outdated the moment they're finished. Top revenue teams use market intelligence to create living, breathing account plans that evolve as new signals emerge.

The platform continuously feeds new insights into the account record in your CRM. A signal about a competitor being displaced or a new expansion plan can automatically update the account strategy. This ensures every interaction is based on the most current context, not stale information from three months ago.

For instance, a signal that a target account is hiring many data scientists should immediately inform your account plan. The strategy can shift to focus on your product's advanced analytics features, and reps can start connecting with the new data science leaders. To get a better feel for which signals really move the needle, check out our guide on the best signals for enterprise sales.

RevOps Prioritization and Scoring

For Revenue Operations teams, market intelligence provides the data needed to point your resources in the right direction. Instead of treating all target accounts equally, RevOps can use signal-based scoring to prioritize the ones most likely to buy.

Accounts showing a high volume of positive buying signals—like recent funding, multiple executive hires in a key department, and a competitor mention in their 10-K filing—can be automatically assigned a higher priority score. This data-driven approach ensures that your most expensive resource—your sales team's time—is spent on the accounts with the highest probability of closing.

This workflow moves prioritization from guesswork to science. It allows leaders to direct marketing spend, sales outreach, and executive attention to the opportunities that will have the biggest impact on pipeline, leading to more accurate forecasting and more efficient growth.

Finding Buying Signals in Different Industries

Market intelligence isn't a one-size-fits-all game. A buying signal that’s a game-changer in the tech world might be irrelevant in manufacturing. The best revenue teams understand this, and they use their intelligence software to track the specific triggers that matter to their buyers.

While generic signals like a new funding round are great starting points, the real edge comes from knowing the subtle events that signal "opportunity" within a specific vertical. Think of it this way: a seismograph is useful, but a doctor uses a stethoscope. Both detect vibrations, but they’re tuned for entirely different purposes.

This tailored approach is what turns a good intelligence tool into an essential part of your revenue engine. Let's look at the distinct buying signals across a few key B2B industries.

Life Sciences and Healthcare

In the highly regulated worlds of life sciences and healthcare, timing and context are everything. A sales team that understands the industry's unique lifecycle—from research to regulatory approval to commercialization—can engage prospects with incredible precision. The right software helps you monitor for specific, high-value triggers that your competitors will miss.

Key signals to watch for include:

- Clinical Trial Milestones: A company announcing the start of Phase II or III trials often has an immediate need for new services, from contract research support to patient recruitment technology.

- Regulatory Shifts: New FDA guidelines or approvals can create instant demand for compliance software, consulting services, or updated medical equipment.

- M&A Activity: When a large pharma company acquires a smaller biotech firm, it almost always triggers a need to consolidate systems, processes, and vendors.

By tracking these events, a sales rep can move from a generic "checking in" call to a strategic conversation about helping a company navigate its next critical growth phase.

B2B SaaS and Enterprise Software

The SaaS landscape moves at lightning speed. Product launches, leadership changes, and new integrations happen daily, creating constant windows of opportunity. For teams selling to other software companies, market intelligence is about spotting the signals of growth, expansion, and strategic pivots.

The most valuable triggers in SaaS are often tied to scale and strategy:

- ARR Milestones: A company announcing it has crossed a major Annual Recurring Revenue threshold (like $50 million or $100 million) is a clear sign they are investing heavily in new tools to support that growth.

- New Integrations: When a company announces a new integration with a major platform like Salesforce or AWS, it signals their strategic direction and opens the door for complementary solutions to plug into their ecosystem.

- Leadership Changes: A new Head of Sales or CMO is almost always hired with a mandate to drive change, making them highly receptive to new technologies and ideas within their first 90 days.

IT Services and Financial Services

For IT services, consulting firms, and financial services providers, deals are often large, complex, and built on relationships. Winning here depends on demonstrating a deep understanding of a client's challenges and strategic goals. Intelligence is about identifying major projects and compliance pressures before your competitors do.

Look for signals like:

- Major Project Wins: A global systems integrator winning a massive digital transformation project creates downstream opportunities for specialized software vendors and subcontractors.

- Compliance Deadlines: New financial regulations (like updated anti-money laundering rules) create an urgent, non-negotiable need for new compliance software and advisory services.

- Supply Chain Expansions: In manufacturing, a company opening a new plant or expanding its supply chain is a prime indicator they'll need new logistics software and industrial equipment.

This reliance on data is happening across the business world. The global business intelligence software market was valued at USD 26.25 billion and is projected to hit USD 42.67 billion by 2032, with North America leading the charge. You can read the full research about business intelligence market trends. This growth underscores the universal need for smarter, faster insights, no matter your industry.

“All of the vendors that I've worked with, all of the onboarding that I have had to deal with, I will say, hands down, Salesmotion was the easiest that I have had.”

Lyndsay Thomson

Head of Sales Operations, Cytel

Choosing the Right Market Intelligence Platform

With so many market intelligence tools available, picking the right one can feel overwhelming. But this isn't just about adding another piece of software to your tech stack; it’s about fundamentally changing how your entire revenue team operates. The goal is to find a solution that delivers clear, actionable context—not just more data noise that creates busywork for your reps.

Making a smart decision means looking past the flashy demos and digging into the core components that will actually drive results. When comparing platforms, you'll want to be systematic, much like you would when researching the best competitive analysis tools. This ensures you end up with a partner that truly fits your needs.

Focus on Data Quality and Breadth

The foundation of any market intelligence software is its data. If the data is stale, wrong, or too narrow, the insights will be useless. You have to ask tough questions about where vendors get their information and, more importantly, how they process it.

A top-tier platform won't just scrape one or two sources. It will pull from a wide array of channels to build a complete, 360-degree view of your target accounts. This should include:

- Financial Sources: Earnings calls, SEC filings (especially 10-Ks), and funding announcements provide hard numbers and strategic direction straight from the source.

- Company Communications: Press releases, product launch announcements, and new partnership details show what’s top of mind for a company right now.

- Human Intelligence: Executive interviews, podcast appearances, and key LinkedIn activity offer the qualitative, human-centric insights into what leadership is thinking.

The key here is diversity. Relying on just one data stream creates massive blind spots. A platform that can synthesize information from multiple, varied sources is far more likely to surface the nuanced signals that lead to tangible opportunities.

Evaluate the AI Engine and User Experience

Having great data is only half the battle. The platform's AI engine is what turns that mountain of raw data into something your team can actually use. Does the software just flag a news article, or does it explain the "so what" for your sales team? The best systems use sophisticated AI to filter out noise, pinpoint commercially relevant events, and deliver the crucial context your reps need to take action.

But power is useless without usability. Your reps are busy, and they won’t tolerate a steep learning curve or a clunky interface. A powerful tool that nobody uses is an expensive paperweight.

A great market intelligence platform should feel like a helpful assistant, not another complex system to learn. It should deliver value from day one, with insights flowing directly into the tools your team already uses every day.

When you're looking at your options, a key question to ask is whether a tool is just a data provider or a comprehensive intelligence solution. For a deeper dive on this distinction, our guide on choosing a sales intelligence platform can offer some extra clarity.

To help you cut through the noise, here's a checklist you can use to compare platforms and make an informed decision for your team.

Key Evaluation Criteria for Market Intelligence Software

| Criteria | What to Look For | Why It Matters |

|---|---|---|

| Data Sources | Diverse sources (financial, company, human). Real-time updates. | Prevents blind spots and ensures you get a complete, up-to-date picture of your accounts. |

| AI & Signal Quality | Contextual summaries ("the so what"), noise filtering, commercially relevant event detection. | Turns raw data into actionable insights your reps can use immediately, saving them hours of research. |

| User Experience (UX) | Intuitive interface, minimal training required, clear data visualization. | High adoption is everything. If it's not easy to use, your team won't use it, and you'll see zero ROI. |

| Integrations | Native, deep integrations with your CRM, Slack/Teams, and sales engagement tools. | Ensures insights are delivered where your team works, making them actionable instead of just informational. |

| Customization | Ability to tailor signal types, alerts, and reporting to your specific ICP and GTM motion. | A one-size-fits-all approach doesn't work. The platform must adapt to your business, not the other way around. |

| Support & Partnership | Dedicated customer success manager, strategic guidance, responsive technical support. | You're not just buying software; you're buying a partnership. Good support ensures you get maximum value. |

A systematic evaluation using these criteria will help you see beyond the marketing and choose a platform that truly empowers your revenue team.

Prioritize Seamless Integrations

Finally, the right market intelligence software has to play nicely with your existing tech stack. Intelligence is most powerful when it’s right there, in the moment, ready to be used. If your reps have to log into yet another dashboard to find what they need, adoption will plummet.

Look for deep, native integrations with the core tools your revenue team lives in every day:

- CRM: Automatically enriching account and contact records in Salesforce or HubSpot with the latest signals.

- Communication: Pushing real-time alerts directly into the right Slack or Microsoft Teams channels.

- Sales Engagement: Triggering automated, personalized outreach sequences based on specific market events.

These integrations are non-negotiable. They're what transforms the platform from a passive research tool into an active, breathing part of your revenue engine, ensuring valuable insights are never missed and are always put to good use.

Measuring the ROI of Your Intelligence Platform

Investing in new tech is one thing. Proving its value to leadership is another. How do you go beyond a few happy reps saying "this is great" and show that your market intelligence software is actually delivering a return?

The key is to draw a straight line from the platform's capabilities to the key performance indicators (KPIs) your revenue teams live by. This isn't about vanity metrics. It's about measuring the real-world impact on sales velocity, operational efficiency, and marketing effectiveness.

Key Metrics for Sales Teams

For your sales reps and managers, ROI is all about pipeline. The right intelligence platform directly boosts their most critical numbers by making their outreach smarter, timelier, and far more relevant.

Here are the sales metrics you should be tracking:

- Increased Meeting Booking Rates: When a rep reaches out with a timely buying signal as the "why you, why now," prospects listen. Track the percentage of meetings booked from this signal-based outreach and compare it to your generic cold calls. The difference will be stark.

- Shorter Sales Cycles: Getting in the door at the perfect moment with the right context speeds everything up. Measure the average time from first touch to a signed deal for accounts engaged using intelligence-driven plays.

- Higher Win Rates: A well-prepared rep who walks into a conversation already knowing the prospect's immediate priorities has a massive advantage. These strategic conversations naturally lead to higher conversion rates from the first meeting to a closed-won deal.

RevOps and Marketing KPIs

For Revenue Operations and Marketing, value comes from slashing inefficiencies and sharpening targeting. RevOps can finally ditch the guesswork and build a data-driven model for where to point the sales team. Marketing can craft campaigns that people actually open.

An effective market intelligence platform should significantly reduce the "manual research tax"—the countless hours reps waste piecing together account information before they can even pick up the phone. This reclaimed time is a direct and easily quantifiable efficiency gain.

Important KPIs for these teams are:

- Improved Account Prioritization: RevOps can measure the pipeline generated from accounts tagged as "high-priority" based on real-time signal activity. Is your team chasing the right logos? Now you'll know.

- Reduced Manual Research Time: This one is simple but powerful. Survey your reps. Ask how many hours they're saving each week on pre-call research and account planning. Multiply that by their hourly cost for an instant ROI calculation.

- Higher Campaign Engagement: Marketing can move beyond generic blasts. Track open rates, click-throughs, and conversions on campaigns built around specific market signals, like a competitor's stumble or a target account's new product launch. For a deeper dive, check out our guide on essential account-based marketing metrics.

The strategic value of business intelligence is no secret. Recent data shows a whopping 94% of organizations see it as critical or very important for their success. The market for these tools is exploding, with the cloud-based segment alone projected to hit USD 15.2 billion by 2026.

You can discover more insights about business intelligence growth on Scoop.market.us. By tying your market intelligence software directly to these core business metrics, you can clearly prove your contribution to that success.

Key Takeaways

- Market intelligence software automates the discovery of buying signals like funding rounds, executive hires, and product launches, replacing hours of manual research with real-time, AI-driven alerts.

- The core value lies in turning raw data into actionable context -- not just telling you what happened, but explaining why it matters for your sales team right now.

- Top revenue teams build structured, repeatable plays around triggers such as new funding, leadership changes, and M&A activity to dramatically increase response rates.

- Seamless integration with your CRM, Slack, and sales engagement tools is non-negotiable; intelligence buried in a separate dashboard will never be acted on.

- When evaluating platforms, prioritize data source diversity, AI-driven signal quality, and ease of use over feature count to ensure high adoption and real ROI.

- ROI is measured through concrete KPIs like increased meeting booking rates, shorter sales cycles, higher win rates, and reduced manual research time.

Frequently Asked Questions

It's natural to have questions when you're looking at a new category of sales tech. Getting straight answers is the best way to figure out if market intelligence software is right for your team. Here are a few of the most common ones we hear.

How is this different from Google Alerts or a news feed?

This is a great question because it gets right to the core of what makes this software so valuable. While a tool like Google Alerts or a basic news feed tells you that something happened, they completely miss the "so what?" for your sales team.

They serve up raw, unfiltered information, and it's on your reps to sift through the noise to find something commercially relevant. It’s like hearing a car alarm go off down the street versus getting a specific notification that someone is trying to break into your car.

Market intelligence software, on the other hand, is purpose-built to deliver curated, actionable business context. It uses AI to pinpoint the exact signals that indicate a buying opportunity—like a new funding round earmarked for expansion or a strategic leadership change—and tells your team why it matters right now. Instead of just a link to an article, your reps get a concise insight delivered right into their workflow with ideas on how to use it.

What does the implementation process look like?

Getting started with a modern market intelligence platform is designed to be quick and painless. Forget the horror stories of long, complicated setups that demand weeks of engineering support. The whole point is to get value into your team's hands as fast as possible.

Typically, it’s just a few straightforward steps:

- Connect Your CRM: Sync your Salesforce or HubSpot to automatically pull in your target account lists.

- Configure Your Signals: Choose the specific business events and company changes you want to track for those accounts.

- Set Up Alerts: Decide where you want the insights sent—Slack channels, email, or directly into your CRM records.

The entire process often takes just a few hours, not weeks. This means your reps can start getting timely, high-impact alerts on their most important accounts the very same day.

Can this software integrate with our existing sales tools?

Absolutely. In fact, you should consider seamless integration a non-negotiable feature. These tools aren't meant to be another isolated dashboard your team has to remember to check. They're built to plug directly into your team's existing, day-to-day workflow.

The real power of market intelligence is unlocked when it becomes a natural part of your revenue engine. The software should feel like a native feature of the tools your team already relies on, making it effortless to act on timely signals.

They're designed to connect with the most critical parts of your tech stack, including:

- CRMs like Salesforce and HubSpot

- Communication tools like Slack and Microsoft Teams

- Sales engagement platforms for automating outreach

This deep integration ensures intelligence is delivered right where your reps are already working. It makes acting on fresh buying signals an easy, frictionless part of their process instead of another disruptive chore.

Stop chasing stale leads and start engaging accounts the moment they show intent. Salesmotion delivers the actionable intelligence your B2B revenue team needs to win more deals, faster. See how Salesmotion can transform your outreach today.