Let's cut through the jargon. Sales intelligence is the process of collecting and analyzing data to create actionable insights for sales teams. Think of it as a GPS for your reps, pointing them toward the right prospects at the perfect time with the right message.

What Is Sales Intelligence in Simple Terms

Imagine giving your sales team a data-driven roadmap to their next deal instead of letting them fly blind with cold calls and generic emails. That's sales intelligence.

It transforms raw information—like company news, hiring trends, and technology usage—into a clear picture of a prospect's needs and readiness to buy. It’s not just about finding a phone number; it’s about understanding the "why now" for every outreach.

Modern platforms automate this research, freeing up sellers to focus on what they do best: building relationships and closing deals.

Here’s a quick breakdown of what sales intelligence means for a B2B revenue team.

| Sales Intelligence at a Glance | ||

|---|---|---|

| Aspect | Description | Why It Matters |

| Core Function | Collects, analyzes, and presents data about prospects and customers. | It replaces guesswork with a data-driven strategy for who to contact and when. |

| Key Data Points | Firmographics, technographics, buying signals, and contact information. | This data provides a 360-degree view of an account's needs and context. |

| Main Goal | To help sales teams engage the right accounts at the right time with the right message. | It improves efficiency and boosts the chances of closing a deal. |

| Analogy | A GPS for sales. | It guides reps directly to the most promising opportunities, avoiding dead ends. |

Ultimately, this isn't just about more data; it's about smarter, more strategic selling.

The Core Components

So, how does it work? Sales intelligence platforms track specific signals that indicate an emerging opportunity. A dedicated banking sales intelligence platform, for example, focuses on signals unique to the financial services industry.

Generally, these systems track a few key data types:

- Firmographic Data: The basics. Think company details like industry, size, revenue, and location. This data helps you build and refine your ideal customer profile (ICP).

- Technographic Data: This reveals a company's technology stack. It’s a goldmine for identifying integration opportunities or competitive openings.

- Buying Signals: These are the real game-changers. Trigger events like a new funding round, an executive hire, or an office expansion all signal a potential need for your solution.

This dashboard visualizes how different buying signals are prioritized across target accounts.

The key takeaway is that these platforms turn chaotic market activity into a clear, prioritized list of who to talk to right now. This strategic focus ensures no high-value signal gets missed.

Not long ago, sales intelligence was a luxury. That idea is officially dead. The modern B2B sales landscape is too fast, complex, and competitive to rely on gut feelings and manual Google searches.

Data-driven selling isn't a passing fad; it's a fundamental shift in how top revenue teams operate. Without a systematic way to monitor target accounts and act on timely buying signals, reps are flying blind. They waste countless hours chasing low-probability leads while missing the critical window with accounts actively looking for a solution.

Let’s be blunt: your competitors are already using these tools. They're getting to your ideal customers first because they get an alert the moment a buying signal appears.

The Market Is Proving Its Value

The explosive growth of sales intelligence platforms tells the story. This isn't just another tool in the sales stack; it's a market-wide admission that timely, actionable data is the new currency in B2B sales.

The global sales intelligence market was valued at around USD 4.85 billion in 2025 and is projected to skyrocket to USD 12.45 billion by 2034. That's a clear signal that data-driven decision-making is directly tied to winning deals. You can find more numbers from Fortune Business Insights on the sales intelligence market.

The takeaway is simple. If you're not adopting a signal-based selling approach, you're falling behind.

From Data Overload to Actionable Insight

The problem sales intelligence solves isn't a lack of information—it's too much of it. Reps can easily drown in news articles, LinkedIn updates, and financial reports. Finding the one piece of information that signals a real opportunity is like searching for a needle in a haystack.

Sales intelligence platforms find that needle for you. They sift through messy, unstructured data and turn it into clear, actionable insights that tell you exactly when to reach out and why.

This is what makes sales intelligence a strategic necessity. It doesn't just hand reps a list of companies; it tells them which company to focus on right now and gives them the perfect conversation starter.

For example, a platform might flag these triggers:

- A target account just closed a new funding round. Translation: They have capital to invest in new solutions.

- A key executive from a competitor just joined your prospect's team. This is a golden opportunity to introduce a new perspective.

- A company posted a wave of job openings for a new department. This signals a new strategic initiative where your product could be the foundation.

These aren't just interesting facts; they're high-value entry points for a relevant conversation.

Staying Ahead in Complex Deal Cycles

Let's face it, modern B2B deals are messy. They involve multiple stakeholders, long evaluation cycles, and stiff competition. A generic, one-size-fits-all pitch is a one-way ticket to the deleted folder.

Sales intelligence gives your team the context needed to navigate this complexity. By understanding an account's current challenges, priorities, and internal shifts, reps can tailor their messaging to resonate with each person involved. They enter conversations with real insight, showing they've done their homework and understand the prospect's world.

Top-performing revenue teams don't see sales intelligence as just another tool. They treat it as a core capability. It’s the engine that powers a proactive, relevant, and effective sales motion, keeping them one step ahead of the competition.

See Salesmotion on a real account

Book a 15-minute demo and see how your team saves hours on account research.

Decoding the Signals That Drive Sales

Effective sales intelligence is about listening to the market and knowing which whispers signal a major opportunity. Imagine your entire market is a quiet landscape. Suddenly, a flare goes up—a company announces a huge funding round. That flare is a buying signal, and the point of sales intelligence is to spot it instantly.

These platforms constantly sift through data—news articles, press releases, social media, regulatory filings—using smart algorithms to pick out specific trigger events. This process cuts through the noise and turns chaotic market activity into a clear, prioritized to-do list for your sales team.

The goal is to shift from reactive selling to a proactive, signal-based approach. Stop guessing who might be ready to buy and start engaging accounts that are showing you they have a need.

The Anatomy of a Buying Signal

So, what are these signals? Think of them as observable events that suggest a company is about to start shopping for a product like yours. They provide the crucial "why now?" that turns a cold email into a warm, relevant conversation.

Most of these signals fall into a few key categories, which sales intelligence platforms track relentlessly.

Here’s a quick breakdown of the most common signal types.

Common Sales Signals and Example Triggers

| Signal Type | Description | Example Trigger |

|---|---|---|

| Financial Signals | Clues related to a company's capital, spending power, and growth. These often indicate a budget is available. | A company announces a $50M Series C funding round, signaling a major investment in scaling up. |

| Hiring & People Signals | A company's hiring patterns reflect its strategic priorities. Key hires or large-scale recruiting points to new initiatives. | A target account posts 15 new job openings for their sales department, indicating a GTM expansion. |

| Product & Strategy Signals | Actions a company takes in the market, like launching new products or expanding, which create demand for supporting tools. | A SaaS company announces its expansion into the European market, creating a need for new compliance and operational software. |

| Technology Signals | Changes in a company's tech stack that signal integration opportunities, often revealed through job postings or tech trackers. | A job description for a new DevOps engineer requires experience with AWS and Kubernetes, revealing their core infrastructure. |

These signals are the foundation of modern sales. By tracking them, you get a head start on the competition and show up at the right moment.

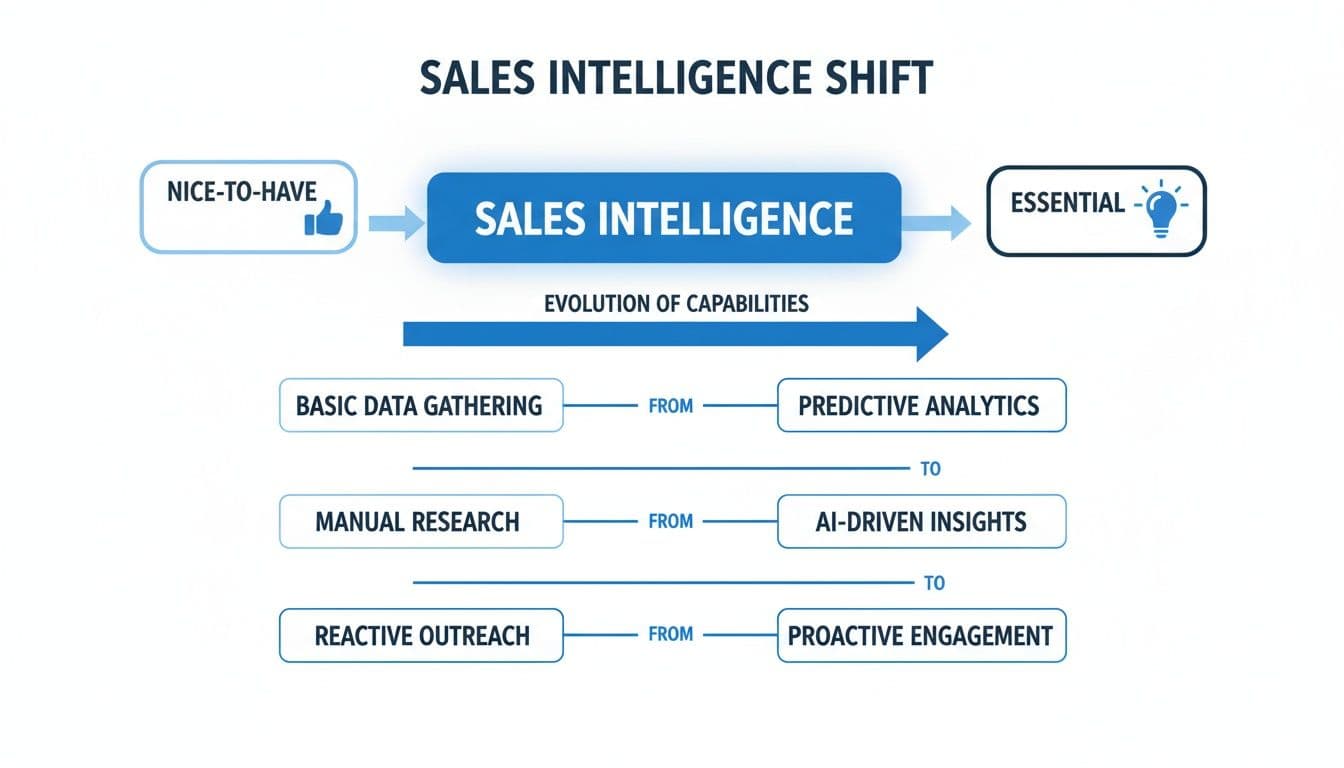

This infographic shows how much the game has changed.

What was once a "nice-to-have" for enriching data is now a must-have capability for any serious revenue team.

From Signal to Actionable Insight

Knowing a signal happened isn't enough. The real power comes from turning that data into a smart sales play. A great sales intelligence platform doesn’t just tell you what happened; it provides the context to understand why it matters.

This is happening because of a fundamental shift in B2B buying. Inside sales is exploding, with B2B direct sales expected to make up 48.14% of revenue by 2025. These teams are scaling at an incredible 18.62% CAGR, thanks to tools that help them manage complex deals from anywhere. The market share for sales intelligence software, now at 89%, proves that teams need these tools integrated into their daily workflow.

The core job of sales intelligence is to connect a market event to a business pain. When a signal appears, the platform should arm the seller with the "so what," letting them craft a message that resonates instantly.

For example, a new VP of Engineering is hired (the signal). The platform should then prompt the rep with a talk track about how new leaders often re-evaluate their tech stack to make an early impact (the "so what"). You can dig deeper into combining data types in our guide on how B2B intent data complements signal-based selling.

By sorting and prioritizing these triggers, sales leaders can build playbooks for their teams. This ensures a consistent and effective response every time a key opportunity appears, turning sales from an art based on intuition into a science driven by data.

“We're no longer fishing. We know who the right customers are, and we can qualify them quickly. Salesmotion has had a direct impact on pipeline quality.”

Andrew Giordano

VP of Global Commercial Operations, Analytic Partners

The Tangible Benefits for B2B Revenue Teams

When investing in new tech, it always comes down to one question: what’s the real return? With sales intelligence, the impact is measurable, tangible, and shows up in your team's most important metrics.

It's all about replacing low-yield, manual activities with high-impact, data-driven actions. The core benefit is simple: it drastically reduces the manual research that drains a seller’s day.

Instead of spending hours digging for context, your reps get the "why you, why now" delivered directly to them. This single shift lets them spend less time on administrative work and more time building relationships and closing deals. Ultimately, a strong sales intelligence definition is incomplete without understanding its direct impact on revenue.

Supercharge Sales Efficiency

The most immediate win is giving your team back their most valuable asset: time. Studies suggest most reps spend only about 23% of their day actually selling. The rest is consumed by manual research, data entry, and trying to find a good reason to reach out.

Sales intelligence platforms automate that grunt work. They monitor your target accounts 24/7 and serve up the perfect opening.

A key benefit of sales intelligence is transforming reps from researchers into strategic advisors. When the platform provides the context, the seller can focus on crafting the perfect message and guiding the conversation.

This automation translates directly to more selling activity. Reps can prep for meetings in minutes, not hours, and engage more high-potential accounts every day. The result is a more productive, motivated sales team focused on what they do best.

Boost Pipeline and Win Rates

A more efficient team naturally builds a bigger, healthier pipeline. By focusing on accounts showing clear buying signals, reps pour their energy where it’s most likely to pay off.

This isn't about cramming more leads into the funnel; it's about adding the right leads.

Teams using signal-based outreach see a clear jump in key metrics:

- Higher Response Rates: When outreach is timely and relevant, prospects are far more likely to engage. A message referencing a recent funding round is infinitely more powerful than a generic cold email.

- Shorter Sales Cycles: Engaging at the right moment often means the prospect is already aware of their problem and has a budget ready. This alignment can shave weeks or even months off the deal cycle.

- Increased Win Rates: Reps armed with deep account knowledge can navigate complex deals more effectively. They understand the prospect’s pain points, tailor their solution, and build stronger relationships. For more on this, check out our guide on unlocking revenue with sales intelligence data.

Drive Predictable Revenue Growth

For revenue leaders, predictability is the ultimate goal. Sales intelligence moves your organization from a model based on luck and timing to one built on a consistent, repeatable process.

You can build entire sales plays around specific triggers, measure their effectiveness, and scale what works across the team.

This data-driven approach allows for more accurate sales forecasting. By analyzing which signals most often convert into pipeline, you can better predict future revenue and allocate resources with confidence. This strategic oversight is why revenue leaders see sales intelligence as a high-impact investment in sustainable growth.

Putting Sales Intelligence into Action

Knowing the theory is one thing, but seeing sales intelligence drive results is what matters. How does a signal about a new funding round turn into a closed deal? It comes down to using that data in specific, repeatable sales plays.

The value of modern sales intelligence isn't just the data itself; it’s the strategic moves it unlocks. Every industry has unique triggers that signal an opportunity. The key is to map these triggers directly to a sales motion your team can execute repeatedly. This is where theory turns into revenue.

This section is a playbook for turning common industry signals into concrete sales actions.

Scenario 1: B2B SaaS and IT Services

In the fast-paced world of technology, timing is everything. A company’s strategic shifts, leadership changes, and product launches are all powerful buying signals. A generic sales pitch will fall flat, but a message tied to a specific, timely event gets attention.

The Trigger: A mid-sized enterprise software company hires a new Chief Information Security Officer (CISO). This CISO previously worked at a company known for its aggressive cloud-first strategy.

The Sales Play:

- Alert the Account Executive (AE): The sales intelligence platform flags the executive move and provides context on the new CISO’s background.

- Craft Hyper-Relevant Outreach: The AE’s messaging focuses on the challenges of securing a multi-cloud environment—a pain point the new CISO likely prioritized in their last role. The subject line could be, "Thoughts on securing your cloud migration."

- Inform the Value Proposition: The outreach highlights case studies of similar companies that successfully secured their cloud assets during a strategic overhaul.

This approach transforms a cold outreach into a peer-level conversation about a known business priority. The signal provided the "why now," giving the AE a credible reason to start a conversation.

The goal isn't just to know that a leadership change happened. It's to understand the strategic implications of who was hired and use that insight to frame your solution as an answer to their immediate priorities.

Scenario 2: Life Sciences and Healthcare

The life sciences sector runs on different triggers, such as regulatory milestones, clinical trial results, and research funding. For teams selling into biotech, pharma, or medical device companies, these signals are gold.

The Trigger: A biotech startup announces it has successfully completed Phase II clinical trials and secured a new funding round to prepare for commercialization.

The Sales Play:

- Immediate Signal Triage: The platform alerts the sales team that the company is shifting from an R&D focus to a commercial one.

- Targeted Multi-Threading: The sales team immediately identifies the new critical stakeholders, like the Head of Market Access or a soon-to-be-hired Chief Commercial Officer.

- Tailored Messaging: Outreach focuses on the challenges of scaling for a drug launch, like building a patient services hub or ensuring supply chain integrity.

Without this trigger, a sales team might wait months before realizing the company’s needs have changed. With sales intelligence, they are the first in the door offering a solution for the company’s next big challenge. If you want to dig deeper into the platforms that enable these workflows, you can learn more about the best B2B sales intelligence tools available today.

Scenario 3: Manufacturing and Industrials

For traditional industries like manufacturing, signals are often tied to physical operations and major capital investments. A new factory, a supply chain overhaul, or a push for sustainability can create massive openings.

The Trigger: An automotive parts manufacturer announces a $150 million investment to expand its main production facility and retool its assembly line for electric vehicle components.

The Sales Play:

- Identify Core Needs: The sales intelligence platform connects the expansion news to common needs, like industrial automation software, predictive maintenance tools, or specialized logistics services.

- Map the Buying Committee: The AE identifies key decision-makers involved in the expansion, from the VP of Operations to the Plant Manager and Head of Procurement.

- Deliver a Value-Driven Pitch: The sales outreach directly references the plant expansion and focuses on hard ROI, such as "reducing downtime by 15% during retooling" or "improving production throughput for your new EV lines."

In each scenario, sales intelligence provides the critical context that separates top performers from everyone else. It allows teams to be proactive, relevant, and consistently one step ahead.

“We have very limited bandwidth, but Salesmotion was up and running in days. The template made it easy to load our accounts and embedding it in Salesforce was simple. It was one of the easiest rollouts we've done.”

Andrew Giordano

VP of Global Commercial Operations, Analytic Partners

Getting Your Team Started the Right Way

Adopting a sales intelligence platform is a major step, but the tech alone isn't enough. A successful rollout requires a plan to build new habits across your team.

A great implementation isn’t just about syncing with your CRM; it’s about integrating a smarter way of selling into your team’s daily rhythm. The goal is to make signal-based selling feel less like a new task and more like the most effective way to hit their numbers. This starts with a clear, phased approach.

Laying the Groundwork with Integration

First, ensure the platform integrates seamlessly with your existing systems, especially your CRM. This is about embedding intelligence directly into the tools your reps already use every day. A smooth integration prevents the tool from becoming "just another login" that everyone ignores.

The connection must be a two-way street. Signals and insights should flow into your CRM, and your CRM data should tell the platform which accounts to monitor. This creates a unified system where reps can spot triggers and take action without leaving their main workspace.

Launching a Pilot Program

Instead of a company-wide "big bang" launch, start with a focused pilot program. Pick a small, motivated group of your best reps—the early adopters who are eager to try new things. This approach has several advantages.

- Quick Wins and Feedback: The pilot group can generate early success stories and provide priceless feedback on what's working, helping you iron out kinks before going wide.

- Champions for Change: These first users become internal champions. Their authentic "this works" stories are more convincing than any top-down mandate.

- Refined Playbooks: Use the pilot phase to test and solidify sales plays based on different signals. By the time you roll it out to everyone, you'll have proven templates ready.

Training for Adoption, Not Just for Usage

Good training must focus on the "why," not just the "how." Reps don't need another lecture on clicking buttons; they need to understand how this tool will help them build more pipeline and close bigger deals.

The best onboarding programs are built around real-world workflows. Show reps exactly how to use a funding signal to craft a compelling email or how to prep for a meeting in minutes using an automated account brief.

Frame the training around solving their biggest daily headaches, like manual research and ineffective outreach. When they see the platform as a solution to their problems, adoption becomes a no-brainer. You can discover more about the features that drive adoption in our deep dive on choosing a sales intelligence platform.

Measuring What Truly Matters

To prove ROI and improve continuously, you need to track the right metrics. Forget simple usage stats and focus on the key performance indicators (KPIs) that connect directly to revenue.

Your measurement framework should include:

- Leading Indicators (Activity): Track signal engagement rates (how many signals are acted upon) and the number of signal-based sequences launched. This shows if the team is using the new workflow.

- Lagging Indicators (Results): Monitor the pipeline contribution from signal-driven outreach and compare the win rates of deals influenced by intelligence versus those that weren't.

This balanced approach provides the full picture of both adoption and impact. It gives you the hard data needed to justify the investment and double down on what’s working.

Key Takeaways

- Sales intelligence transforms raw market data into actionable insights that tell reps who to contact, when to reach out, and what to say.

- The core components -- firmographic data, technographic data, and buying signals -- work together to provide a 360-degree view of target accounts.

- Buying signals like funding rounds, executive hires, and strategic expansions provide the critical "why now" that turns cold outreach into warm, relevant conversations.

- Sales intelligence platforms drastically reduce the manual research tax, giving reps back time to focus on building relationships and closing deals.

- A successful rollout starts with a focused pilot program, training centered on real-world workflows, and metrics that connect signal engagement to pipeline and revenue.

- The market for sales intelligence is projected to grow from $4.85 billion to $12.45 billion by 2034, signaling that data-driven selling is now a strategic necessity, not an option.

Frequently Asked Questions

Here are some quick answers to common questions about sales intelligence.

Is Sales Intelligence Just Another Name for a CRM?

No, they're different tools that work together. A CRM (Customer Relationship Management) platform is your system of record for managing interactions with existing customers and known prospects.

Sales intelligence platforms are discovery engines. They scan the market for new opportunities and provide the "why now" context to engage them, feeding high-potential leads into your CRM.

How Is This Different from Intent Data?

They are related but distinct. Intent data tracks anonymous online behavior, like when someone at a company downloads a whitepaper or researches a specific topic. It tells you what they're interested in.

Sales intelligence focuses on concrete trigger events—a new funding round, an executive hire, or a product launch. It tells you why they might be ready to buy right now. The best sales teams use both to get a complete picture.

How Do You Measure the ROI?

Focus on metrics tied directly to revenue. Track leading indicators (like the number of sales plays launched from signals) and lagging indicators (like the pipeline and closed deals that result).

A powerful way to see the impact is to compare the win rates of deals influenced by sales intelligence versus those that weren't. The numbers usually speak for themselves.

Ready to turn market signals into your next big deal? Salesmotion provides the actionable intelligence your team needs to win. See how it works at https://salesmotion.io.