Ever see "OTE" on a job offer and wonder what it means for your bank account? Let's clear it up. On-Target Earnings (OTE) is your total potential income if you hit 100% of your performance goals.

It’s not your guaranteed salary. Think of it as your base pay plus the variable commission you can earn by meeting your targets.

What Is OTE and How Does It Work

OTE is your total compensation package, made up of two parts: a guaranteed base salary and performance-based variable pay.

This structure is common in sales because it directly links performance to pay. For example, a $100,000 OTE package might be a $60,000 base salary and $40,000 in commission for hitting sales quotas. This 60/40 split is standard, but the ratio can change depending on the role and company.

The Core Components of OTE

Understanding these two parts is key to decoding any sales compensation plan.

- Base Salary: This is your guaranteed, predictable income that you receive every payday, regardless of performance. It provides financial stability.

- Variable Pay (Commission/Bonus): This is the "at-risk" portion of your pay, earned by hitting or exceeding your goals. This is where your performance pays off, and it can fluctuate based on your success.

Here’s a simple breakdown of how a $100,000 OTE might be structured.

OTE at a Glance: Base Salary vs Variable Pay

| Component | Description | Example (for a $100k OTE) |

|---|---|---|

| Base Salary | The guaranteed, fixed portion of your annual pay. | $60,000 |

| Variable Pay | The performance-based portion, earned by hitting 100% of your target. | $40,000 |

This table shows how the two parts combine to form your total On-Target Earnings.

The OTE figure on a job offer is the company's financial roadmap for a successful employee. It’s a clear signal of their performance expectations and the potential rewards.

Ultimately, OTE represents the earning potential the company believes is realistic for someone who performs well in the role. For a deeper dive into career topics, you can explore job-related insights on professional growth platforms.

See Salesmotion on a real account

Book a 15-minute demo and see how your team saves hours on account research.

The OTE Formula and Why the Pay Mix Matters

The OTE formula is simple: Base Salary + Variable Pay = On-Target Earnings. But the real story is the relationship between the two parts, known as the pay mix.

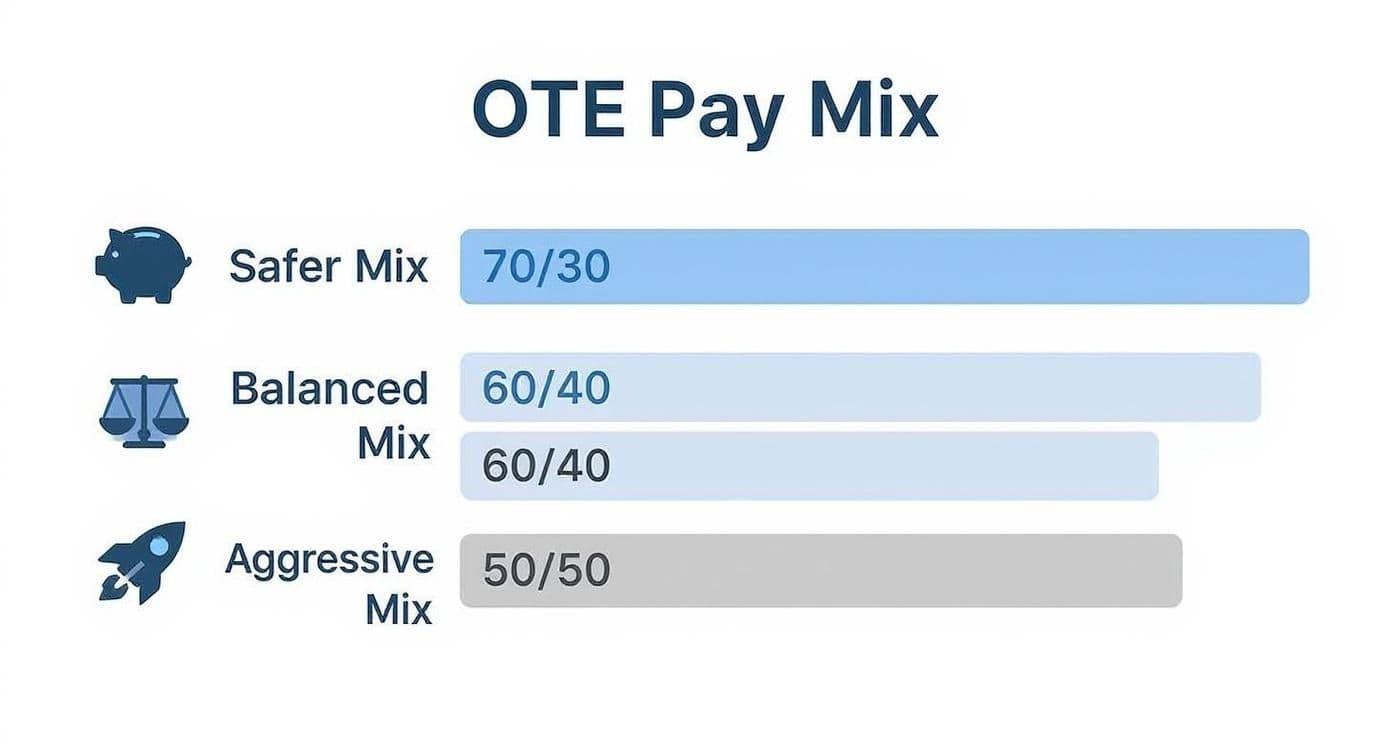

This mix is written as a ratio, like 50/50, 60/40, or 70/30. The first number is the base salary percentage, and the second is the variable pay. This ratio signals a lot about the role, the sales cycle, and the company's culture.

What Different Pay Mixes Tell You

The OTE split shows how much of your income is guaranteed versus "at-risk." Understanding this helps you decide if a role matches your risk tolerance and financial needs.

A mix with a larger base salary, like 70/30 or 80/20, usually signals a role with a longer, more complex sales process, such as enterprise sales. This structure offers more stability when a rep's influence is critical but not the only factor in closing a deal.

On the other hand, an aggressive 50/50 split is common for fast-paced, high-volume sales. This structure places a huge emphasis on performance. The risk is higher, but so is the potential reward for reps who consistently exceed their quota. It shows the company believes a salesperson has direct control over their success.

The pay mix is a window into a company's sales philosophy. A higher base suggests a focus on stability and process. A higher variable component points to a culture built on rewarding high performance.

Getting this structure right is a key part of a company’s sales strategy. To see how different models work in practice, check out these sales commission structure examples.

Here’s a quick breakdown of common pay mixes:

- 70/30 Mix (Safer): Common for Account Managers or Solutions Engineers where long-term relationships are key. Your income is more predictable.

- 60/40 Mix (Balanced): A standard split for many B2B sales roles. It offers a solid base with a strong incentive to hit your numbers.

- 50/50 Mix (Aggressive): Often seen in Account Executive roles in high-growth companies. It’s high-risk, high-reward.

“There's been a big focus on hyper personalization and relevance in our outbounding efforts. Salesmotion has been a key partner in hitting our significantly increased meeting targets. What stands out is how simple it is. Reps can log in and get valuable account insights within 30 seconds to a minute.”

Joe DeFrance

VP of Sales, Incredible Health

How to Calculate Your Actual Earnings With OTE

The OTE on an offer letter is a target, not a guarantee. Your actual earnings depend on your performance against your sales quota. Let's see how this works in different scenarios.

Imagine you’re offered a role with a $120,000 OTE, split into a $70,000 base salary and $50,000 in variable pay. If you hit exactly 100% of your quota, you earn the full $120,000.

But sales is rarely that predictable.

Calculating Earnings for Underperformance

Let's say you hit 75% of your quota. Your $70,000 base salary is guaranteed. Your variable pay, however, is tied to performance.

Here’s the math:

- Base Salary: $70,000 (guaranteed)

- Variable Pay Earned: 75% of $50,000 = $37,500

- Total Actual Earnings: $70,000 + $37,500 = $107,500

You still earn a solid income, but the $12,500 gap is a powerful motivator. This is the essence of OTE: balancing the security of a base salary with an incentive to meet your goals.

Unlocking Higher Earnings Through Overperformance

Now, what happens when you hit 125% of your quota? This is where your earnings potential really opens up, thanks to uncapped commissions and accelerators.

Uncapped commission means there's no ceiling on what you can earn. Accelerators are multipliers that increase your commission rate for every dollar you earn after hitting 100% of your target.

Even without an accelerator, the math is exciting. Hitting 125% of your target would look like this:

- Base Salary: $70,000

- Variable Pay Earned: 125% of $50,000 = $62,500

- Total Actual Earnings: $70,000 + $62,500 = $132,500

You’ve not only hit your OTE but surpassed it by $12,500.

This table shows how performance impacts your total pay with the $120,000 OTE example.

Sample OTE Calculation Scenarios

| Performance Level | Quota Attainment | Base Salary Earned | Variable Pay Earned | Total Earnings |

|---|---|---|---|---|

| Underperforming | 75% | $70,000 | $37,500 | $107,500 |

| On-Target | 100% | $70,000 | $50,000 | $120,000 |

| Overperforming | 125% | $70,000 | $62,500 | $132,500 |

As the table shows, your base salary provides a stable foundation, while your performance against quota determines your final income.

A higher base (like a 70/30 split) offers more security, while a more aggressive 50/50 split signals higher risk but also greater potential reward. Understanding these structures is key to learning how to measure sales productivity and connect it to financial outcomes.

How OTE Varies Across Different Sales Roles

OTE packages are not one-size-fits-all. A plan for a Sales Development Representative (SDR) is very different from one for an Account Executive (AE), because their roles in the sales process are different.

SDRs focus on top-of-funnel activities like generating qualified leads and booking meetings. They don’t close deals, so their OTE is structured for stability.

The Safer Mix for SDRs

SDRs typically have a safer pay mix with a higher base salary, such as 70/30 or 80/20. This structure provides a predictable income while motivating them to hit their activity and meeting targets. A higher base provides a solid financial foundation for a role focused on building a long-term pipeline.

The Aggressive Mix for AEs

Account Executives, however, are responsible for closing deals and generating revenue. Their direct impact on the bottom line is reflected in a more aggressive OTE structure.

AEs often see a 50/50 or 60/40 pay mix. While their base salary is still competitive, a large portion of their earning potential is tied to commission. This model incentivizes top performance, as their success in closing deals directly translates to a larger paycheck.

An OTE package tells a story about your role. A higher base indicates a focus on process and stability. A higher variable component means closed revenue is the primary measure of success.

Understanding how OTE changes by position is important. Specialized areas like high-ticket closing roles have unique compensation models, and it's useful to explore guides that detail sales operations roles and responsibilities.

“The Business Development team gets 80 to 90 percent of what they need in 15 minutes. That is a complete shift in how our reps work.”

Andrew Giordano

VP of Global Commercial Operations, Analytic Partners

Critical Questions to Ask About Your OTE

The OTE figure on your job offer is just the headline. To understand what you can realistically earn, you need to ask the right questions. This shows you're a serious candidate and helps you spot potential red flags before you accept an offer.

An impressive OTE might be achievable or just a sales pitch. The only way to find out is to ask specific questions about how the compensation plan works.

Key Areas to Investigate

Before you accept an offer, get clear answers to these critical questions. They will reveal the health of the sales team and the fairness of the compensation plan.

-

What percentage of the team is hitting quota? This is the most important question. If fewer than 60-70% of reps are hitting their targets, it’s a major red flag. It could mean quotas are unrealistic, the product is difficult to sell, or the team lacks support.

-

Are commissions capped or uncapped? An uncapped plan is a huge motivator. It means your earning potential is limitless, rewarding top performers who exceed their quota. A capped plan can limit your drive once you hit the ceiling.

-

How often does the compensation plan change? Constantly shifting quotas and commission structures create instability. You want a consistent plan that allows you to build momentum without worrying about changing goals.

-

What is the payout schedule for commissions? This is a practical but crucial detail. Are you paid the month after a deal closes, or do you have to wait until the customer pays? Knowing the timing is essential for managing your personal finances.

A high OTE on paper means nothing if historical data shows that targets are consistently out of reach. The team's past success rate is the best indicator of your own earning potential.

Asking these questions helps you build a complete picture of what you can expect to earn and provides insight into the company’s sales culture. Sales leaders also need this clarity, which is why they work to improve forecast accuracy to set challenging yet achievable targets.

Key Takeaways

- On-Target Earnings (OTE) is your total potential income if you hit 100% of your performance goals, combining a guaranteed base salary with performance-based variable pay.

- The pay mix ratio (such as 50/50, 60/40, or 70/30) signals a lot about the role, the sales cycle complexity, and the company's culture around risk and reward.

- SDRs typically have a safer pay mix like 70/30 or 80/20 for income stability, while Account Executives often see a more aggressive 50/50 or 60/40 split tied to closed revenue.

- Before accepting any offer, ask what percentage of the team is hitting quota, whether commissions are capped, and how often the compensation plan changes.

- Uncapped commissions and accelerators are how top-performing reps earn significantly above their stated OTE by exceeding their sales targets.

Common Questions About On-Target Earnings

Here are answers to a few more common questions about OTE.

Is OTE the Same as My Guaranteed Salary?

No. This is the most important distinction.

Your base salary is the only guaranteed part of your pay. OTE is a projection of what you could earn by hitting 100% of your targets. Your base is what you get for doing the job; the variable portion is what you earn for achieving your goals.

If you miss your quota, your total pay will be less than your OTE.

Your OTE is your earning potential, not a promise. The only guaranteed money is your base salary.

What Happens if I Exceed My Sales Quota?

Great compensation plans reward top performers. Many companies do this in two key ways.

First, uncapped commissions mean there is no ceiling on your earnings. The more you sell beyond your target, the more you make.

Second, accelerators are multipliers that increase your commission rate once you hit your quota. For example, your commission rate might jump from 10% to 15% for every deal closed after you reach 100% of your goal. This is how top reps earn significant incomes.

Are All Sales Jobs Based on OTE?

While the OTE model is standard for most revenue-generating roles, other structures exist.

- Commission-Only: A high-risk, high-reward model with no base salary. Your earnings are based entirely on your sales.

- High Base, Low Bonus: Often found in account management or customer success roles, where the focus is on client retention rather than new business.

However, for the vast majority of AEs and SDRs, the OTE structure provides the right balance of income stability and performance motivation.

Ready to stop guessing and start selling with precision? Salesmotion is an AI-powered account intelligence platform that delivers real-time, actionable insights on your target accounts. Our platform automates the tedious research, freeing up your team to focus on building pipeline and closing deals. Find out how companies like FranklinCovey are saving over 8 hours per rep each week.

Discover how to turn signals into sales at https://salesmotion.io.

Frequently Asked Questions

Is OTE the same as my guaranteed salary?

No. Your base salary is the only guaranteed portion of your compensation, paid regardless of performance. OTE represents the total amount you could earn if you hit exactly 100% of your sales targets, combining your base salary with the variable commission component. If you fall short of your quota, your actual earnings will be less than the stated OTE.

What is a typical OTE pay mix for sales roles?

The most common pay mix for B2B sales roles is a 60/40 split, where 60% is base salary and 40% is variable commission. SDRs and roles with longer, more complex sales cycles tend toward safer splits like 70/30 or 80/20 for more income stability. Account Executives in high-growth companies often see a more aggressive 50/50 split that places greater emphasis on closed-deal performance.

What does it mean when a company offers uncapped commissions?

Uncapped commissions mean there is no ceiling on what you can earn beyond your OTE. Once you hit 100% of your quota, you continue earning commission on every additional dollar of revenue you close. Many companies also add accelerators, which increase your commission rate above quota, meaning you earn a higher percentage on deals closed after hitting your target.

What percentage of the sales team should be hitting OTE?

A healthy, well-run sales organization typically has 60% to 70% of its reps hitting or exceeding their targets. If fewer than 60% of the team is reaching OTE, it could signal that quotas are unrealistic, the product is difficult to sell, or the team lacks adequate support and enablement. This is one of the most important questions to ask when evaluating a job offer.

How do accelerators work in a sales compensation plan?

Accelerators are multipliers that increase your commission rate for every dollar you earn after hitting 100% of your quota. For example, your standard commission rate might be 10%, but once you exceed your target, it could jump to 15% or even 20% for each subsequent deal. This structure is designed to heavily reward top performers and incentivize your best reps to keep pushing past their targets rather than coasting.