According to 6sense's Buyer Experience Report, 70% of the B2B buying journey happens anonymously — in what researchers call "the Dark Funnel." Buyers are researching solutions, comparing vendors, and forming shortlists long before they contact sales. Intent data providers exist to surface that hidden activity. But with annual costs ranging from $7,000 to $150,000+, choosing the wrong provider is an expensive mistake.

TL;DR: This guide reviews 12 intent data providers with honest pricing, platform capabilities, and use cases. Bombora and 6sense lead for enterprise ABM. G2 and TechTarget offer the strongest first-party signals. Salesmotion takes a different approach — tracking real-world trigger events instead of topic-based intent scores. HG Insights now includes TrustRadius after acquiring the review platform in June 2025. Jump to the comparison summary for a side-by-side view.

For a quick comparison of top providers, see our intent data provider ranking. If you are still deciding whether intent data is right for your team, read our buyer's checklist for evaluating intent data providers first.

This post goes deeper. Below you will find detailed platform snapshots, honest pricing breakdowns, and the specific strengths and weaknesses of 12 intent data providers. The goal is to give a VP of Sales or Revenue Ops leader the information needed to compare annual costs, understand what you are actually paying for, and avoid pricing surprises.

A note on timing: Forrester's 2025 research found that 92% of B2B buyers start with at least one vendor in mind, and 41% have already selected a preferred vendor before formal evaluation begins. This means intent data isn't just about finding new accounts — it's about being the vendor buyers already know and trust when the buying process kicks off.

Quick Comparison: Top Intent Data Providers (2026)

| Provider | Data Type | Starting Price | Best For |

|---|---|---|---|

| Salesmotion | Trigger events (news, SEC, hiring, funding) | Custom (demo required) | AEs and SDRs in complex verticals |

| Bombora | Cooperative publisher intent (18,000+ topics) | ~$25,000/year | Enterprise ABM programs |

| 6sense | Predictive intent + buying stage scoring | ~$35,000/year | Revenue teams needing buying-stage models |

| Demandbase | Global keyword intent + orchestration | ~$40,000/year | Enterprise ABM with multi-channel activation |

| G2 Buyer Intent | First-party review-site behavior | ~$10,000/year (add-on) | SaaS vendors with strong G2 presence |

| TrustRadius | Second-party review-site behavior | Custom (accessible) | Competitive takeout and retention plays |

| ZoomInfo | Streaming topic-based intent | ~$7,200/year (mid-market) | Sales teams wanting intent + contact data |

| TechTarget | First-party tech buyer research | Custom (enterprise) | IT/technology sellers |

| NetLine INTENTIVE | Person-level content engagement | Custom (program-based) | Multi-threaded outreach teams |

| Intentsify | Multi-source cross-verified intent | Custom (services + data) | Teams wanting managed activation |

| Madison Logic | Multi-signal ABM activation | Custom (enterprise) | Enterprise multi-channel ABM |

| HG Insights | Technography-aware intent | Custom (enterprise) | Tech sellers with data analytics teams |

For help identifying the right buyer intent keywords to track across these platforms, see our dedicated guide.

See real-time buying signals — not topic scores

Salesmotion tracks actual trigger events (news, earnings, hiring, funding) across your accounts. No black-box intent scores.

What Intent Data Providers Actually Cost

Before diving into individual reviews, here is a summary of annual costs across the 12 providers. These ranges reflect publicly available data, vendor disclosures, and verified customer reports as of early 2026.

| Provider | Annual Cost Range | Pricing Model | Contract |

|---|---|---|---|

| Salesmotion | Custom (demo required) | Platform subscription | Annual |

| Bombora | $25,000 - $80,000 | Data volume + topics | Annual |

| G2 Buyer Intent | $10,000 - $87,000+ | Add-on to vendor profile | Annual |

| TechTarget Priority Engine | Custom (enterprise) | Segments + seats | Annual |

| Demandbase | $40,000 - $120,000 | Platform tiers + modules | Annual (12-mo min) |

| 6sense | $35,000 - $150,000+ | Platform tiers | Annual |

| ZoomInfo Streaming Intent | $7,200 - $36,000 (mid-market) | Seats + add-ons | Annual |

| TrustRadius | Custom (accessible) | Subscription | Annual |

| NetLine INTENTIVE | Custom | Program-based | Custom |

| Intentsify | Custom (services + data) | Program + managed services | Custom |

| Madison Logic | Custom (enterprise) | Platform + media spend | Annual |

| HG Insights | Custom (enterprise) | Subscription + data scope | Annual |

Key pattern: Most providers require annual contracts with no month-to-month option. The total cost of ownership often exceeds the license fee once you factor in implementation, topic configuration, CRM integration setup, and ongoing optimization. Budget 15-25% above the quoted license price for these hidden costs.

“The account and contact signals are key for reaching out at important times, and the value-add messaging it creates unique to every contact helps save time and efficiency.”

Daniel Pitman

Mid-Market Account Executive, Black Swan Data

1. Salesmotion

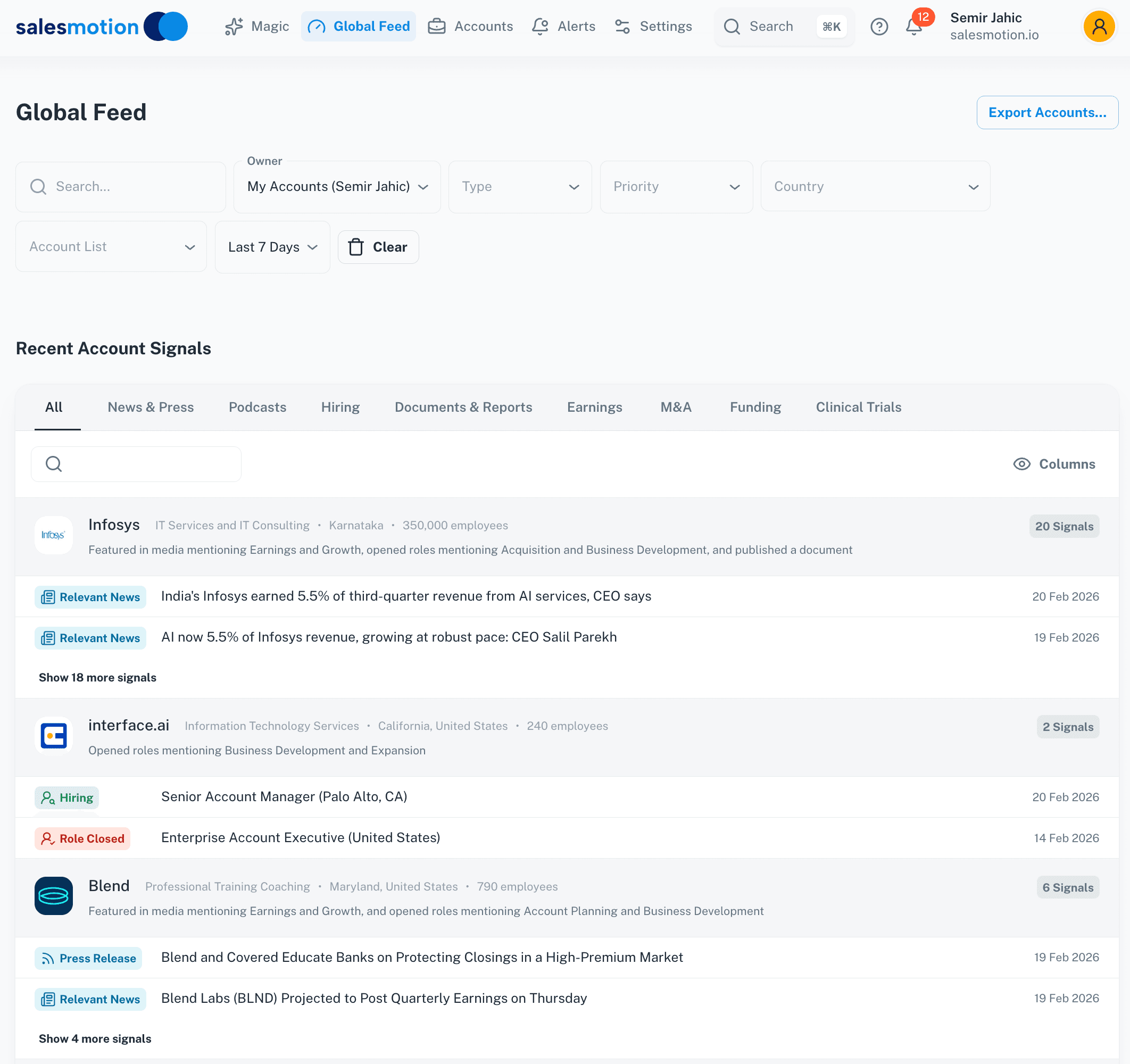

Salesmotion focuses on account intelligence rather than topic-level intent signals. It monitors over 1,000 public sources including news, SEC filings, hiring data, and investor activity to detect real-world trigger events. The platform turns these events into actionable insights with AI-generated account context, ready-to-use points of view, and specific outreach recommendations delivered directly into rep workflows.

Salesmotion's Global Feed surfaces real-time trigger events — earnings calls, executive hires, funding rounds, and news — across all monitored accounts.

Salesmotion's Global Feed surfaces real-time trigger events — earnings calls, executive hires, funding rounds, and news — across all monitored accounts.

Why Salesmotion Stands Out

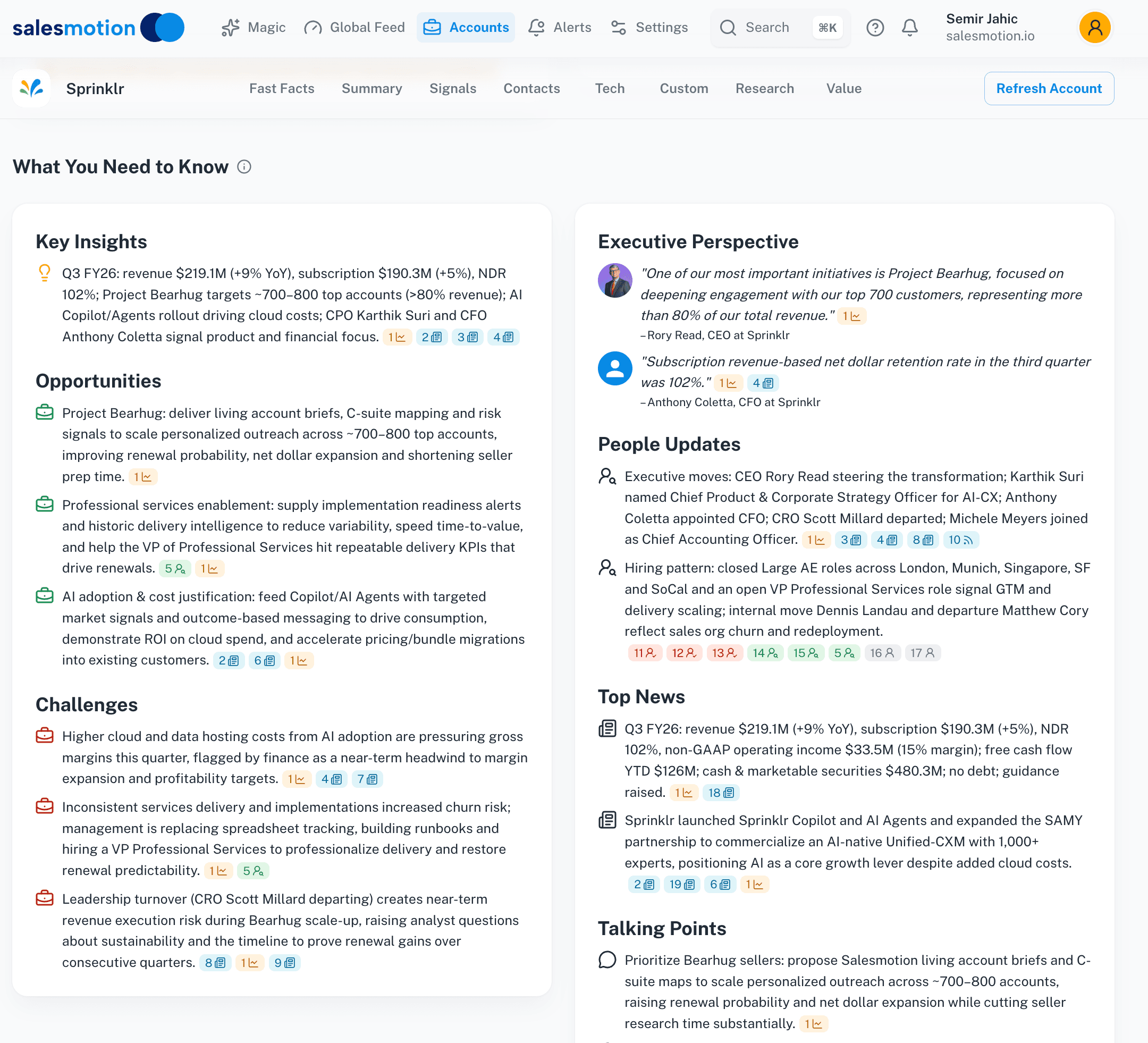

Salesmotion's strength is turning raw data into a strategic advantage. The platform provides full context behind every signal, complete with source links to ensure accuracy and reduce AI hallucination risk. This allows reps to prepare for meetings in minutes rather than hours, armed with compelling, evidence-backed messaging.

Case studies from companies like Incredible Health and Clari show measurable results including up to 50% more meetings booked and 60% faster meeting prep. The platform promises go-live within 48 hours and dedicated human support.

One-click account briefs: Salesmotion generates AI-powered summaries with key initiatives, strategic context, and actionable talking points — all source-backed.

One-click account briefs: Salesmotion generates AI-powered summaries with key initiatives, strategic context, and actionable talking points — all source-backed.

Platform Snapshot: Salesmotion

| Feature | Details |

|---|---|

| Best For | AEs, SDRs, and RevOps teams in complex verticals like enterprise SaaS, life sciences, and financial services. |

| Key Offering | AI-driven signal detection, automated account briefs, MEDDICC-aligned messaging, and stakeholder mapping. |

| Data Source | 1,000+ public sources including news, press releases, SEC filings, hiring trends, and investor activity. |

| Pricing | Custom. Demo required. Fast time-to-value with streamlined setup. |

| Primary Strengths | Source-backed insights reduce hallucination risk. Integrates directly into CRM, Slack, and email workflows. |

| Potential Limitations | Enterprise-level investment. Best performance requires initial setup of signal filters and playbooks. |

| Website | salesmotion.io |

What It Costs

Salesmotion pricing is demo-based and tailored to team size and use case. The platform targets enterprise and mid-market revenue teams. Expect an investment comparable to other account intelligence platforms, with the advantage of fast go-live (48 hours) that reduces implementation costs. To learn more about the approach, see Salesmotion's methodology for B2B intent data.

2. Bombora

Bombora is a pioneer in B2B intent data, known for its consent-based Data Co-op. This co-op gathers behavioral data from a network of 5,000+ B2B publishers, analysts, and vendors. Their Company Surge metric identifies when a business is consuming far more content on a specific topic than usual, signaling active buying intent.

Bombora's Company Surge metric flags accounts researching topics above their historical baseline.

Bombora's Company Surge metric flags accounts researching topics above their historical baseline.

The quality and privacy-conscious nature of Bombora's data make it a category leader. Instead of relying on bidstream data, its direct publisher relationships provide higher-quality signals. This makes it a strong choice for teams running sophisticated ABM campaigns.

2025 update: Bombora introduced Curated Ecosystem Audiences, pre-built audience segments based on technology ecosystems (e.g., Salesforce, Microsoft, AWS) that combine intent signals with technographic data. This reduces the manual topic configuration that has traditionally been Bombora's biggest adoption barrier.

You can explore more about Bombora's approach to intent data.

Platform Snapshot: Bombora

| Feature | Details |

|---|---|

| Best For | Enterprise and mid-market companies running mature ABM programs that need high-quality third-party intent signals. |

| Key Offering | Company Surge: Identifies accounts showing increased research on over 18,000 B2B topics. |

| Data Source | Proprietary, consent-based Data Cooperative of B2B publishers, providing exclusive behavioral data. |

| Pricing | $25,000 - $80,000/year based on topic volume, account volume, and integration needs. Annual contracts required. |

| Primary Strengths | High-fidelity signals from a direct publisher network. Extensive ecosystem integrations (Salesforce, HubSpot, 6sense, Demandbase). |

| Potential Limitations | Significant investment for smaller teams. Requires strategic topic selection and operationalization by RevOps. |

| Website | bombora.com |

What It Costs

Bombora typically charges $25,000 to $80,000 annually. The primary cost drivers are the number of topics tracked, the size of your target account list, and which integrations you activate. Many teams start with a focused topic set (10-20 topics) and expand as they validate signal quality. Note that Bombora data is also bundled into 6sense, Demandbase, and ZoomInfo at reduced rates, so check whether you already have Bombora access through an existing platform before purchasing separately.

“Automatic account profile detail I can use to manage my territory. Using Salesmotion AI to generate value statements per persona, account, etc. Using Salesmotion to give me a starting point based on new hires, or news alerts is critical.”

Adam Wainwright

Head of Revenue, Cacheflow

3. G2 Buyer Intent

G2 offers first-party intent data from buyer activity on its software marketplace. When companies visit your G2 profile, compare you against competitors, or research your pricing, G2 captures those signals. This gives teams high-quality, bottom-of-funnel signals from an audience that is clearly in the market.

G2 Buyer Intent surfaces companies actively researching and comparing software on its review platform.

G2 Buyer Intent surfaces companies actively researching and comparing software on its review platform.

The immediacy and relevance of G2's signals make them some of the most actionable in the market. These are not signs of passive research but represent active evaluation from verified business users. Since the data is captured on G2's own platform, it is not dependent on third-party cookies. Learn more about using these triggers in our guide to signal-based selling.

Platform Snapshot: G2 Buyer Intent

| Feature | Details |

|---|---|

| Best For | B2B SaaS companies looking for high-intent, bottom-of-funnel signals to accelerate sales cycles. |

| Key Offering | Real-time alerts on which companies view your G2 profile, category, competitor pages, and pricing information. |

| Data Source | First-party behavioral data from millions of verified software buyers on G2.com. |

| Pricing | Add-on to G2 vendor plans. Intent data features range from $10,000 to $87,000+ annually depending on the bundle. |

| Primary Strengths | Data comes from users actively evaluating software. First-party data not reliant on third-party cookies. |

| Potential Limitations | Requires a paid G2 vendor subscription. Signals are limited to activity on the G2 platform only. |

| Website | sell.g2.com/data |

What It Costs

G2 Buyer Intent is an add-on to G2's vendor subscription. A base G2 Core subscription lists at approximately $15,000 per year. Adding Buyer Intent, Review Growth, and other modules can push total costs to $87,000+ annually. However, G2 is known to accept 40-45% discounts on bundled renewal and expansion deals. Start by negotiating the intent data add-on separately from your review profile subscription. If your product category has strong G2 traffic, the signal quality justifies the cost. If your buyers do not research on G2, the signals will be too sparse to act on.

4. TechTarget Priority Engine

TechTarget's Priority Engine platform offers first-party intent data sourced from its network of over 150 technology-specific websites. This gives teams direct access to active research of tech buyers at both the account and individual prospect level. Instead of broad topical signals, Priority Engine identifies specific people at target accounts consuming content related to precise IT solutions.

TechTarget's Priority Engine delivers prospect-level intent signals from its owned network of technology research sites.

TechTarget's Priority Engine delivers prospect-level intent signals from its owned network of technology research sites.

TechTarget's laser focus on the technology sector makes it one of the most effective providers for tech-focused teams. The platform excels at providing granular, prospect-level signals that sales teams can act on immediately. Its sales activation tools let reps see which individuals are researching their product category and export those contacts directly into sales sequences.

Platform Snapshot: TechTarget Priority Engine

| Feature | Details |

|---|---|

| Best For | B2B technology companies selling to IT departments and tech decision-makers who need person-level buying signals. |

| Key Offering | Account-level and prospect-level intent signals from its first-party network of tech sites. |

| Data Source | First-party behavioral data from TechTarget's owned network of technology research websites. |

| Pricing | Enterprise subscription. Pricing depends on number of technology segments tracked and user seats. |

| Primary Strengths | Hyper-specific first-party data on tech buyers. Strong sales activation and export tools. Named a Forrester Wave Leader (Q1 2025). |

| Potential Limitations | Primarily limited to the technology market. Less effective for non-IT or general B2B use cases. |

| Website | techtarget.com/products/priority-engine |

What It Costs

TechTarget does not publish pricing publicly. Expect enterprise-level subscription pricing based on the number of technology segments you track and the number of user seats. TechTarget's unique advantage is prospect-level data (named individuals, not just accounts), which is rare among intent providers. If you sell to IT decision-makers, the ROI case is strong because you get both the intent signal and the contact to act on it. If your buyers are outside of technology roles, this platform will not serve your needs.

5. Demandbase

Demandbase offers a comprehensive go-to-market platform, Demandbase One, with intent data as a core component. The platform provides global B2B intent signals from trillions of monthly online events, letting teams identify accounts actively researching relevant keywords and topics. It also natively integrates Bombora data alongside its own proprietary signals.

2025-2026 update: Demandbase launched Agentbase in March 2025, an agentic AI layer that autonomously identifies in-market accounts, suggests engagement strategies, and orchestrates campaigns — moving beyond passive intent signals toward autonomous action on those signals. This positions Demandbase at the intersection of intent data and AI agents.

Demandbase One unifies intent data with advertising, website, and CRM signals for enterprise ABM orchestration.

Demandbase One unifies intent data with advertising, website, and CRM signals for enterprise ABM orchestration.

What distinguishes Demandbase is its flexible data delivery and powerful orchestration capabilities. Intent data is natively integrated within its platform for seamless ABM campaign execution, but it can also be delivered as a standalone service to cloud warehouses like BigQuery or Redshift. For a head-to-head comparison, see Salesmotion vs Demandbase.

Platform Snapshot: Demandbase

| Feature | Details |

|---|---|

| Best For | Global enterprises needing flexible intent data delivery for both native platform use and data warehouse analytics. |

| Key Offering | Account Intent: tracks trillions of monthly B2B behavioral signals to identify in-market accounts based on keyword research. |

| Data Source | A network of bidstream, publisher, and proprietary data sources plus Bombora co-op data, providing extensive global keyword coverage. |

| Pricing | $40,000 - $120,000/year. Quote-based licensing with access to advanced features tied to higher-tier packages. |

| Primary Strengths | Flexible delivery (native platform, APIs, warehouse exports). Massive signal volume. Strong ABM orchestration. |

| Potential Limitations | Enterprise pricing and complexity. Full value requires the broader GTM platform, not just intent data alone. |

| Website | demandbase.com/products/account-intelligence/intent |

What It Costs

Demandbase typically charges $40,000 to $120,000 annually depending on which modules you select. Intent data is one component of the broader Demandbase One platform. Minimum 12-month contracts are standard. The intent data is most cost-effective when you also use Demandbase's advertising, personalization, or orchestration capabilities. If you only need intent data, a dedicated provider like Bombora delivers comparable signals at a lower price point. Budget for dedicated RevOps resources to configure and maintain the platform. Implementation typically takes 4-8 weeks for full activation.

6. 6sense

6sense has grown from a predictive analytics tool into a comprehensive Revenue AI platform where intent data is central. The platform uncovers anonymous buying signals across the web and combines them with its own keyword-level intent data to find in-market accounts. It excels at predicting buying stage, allowing for highly relevant marketing and sales actions.

6sense combines multiple intent sources with predictive analytics to model account buying stages.

6sense combines multiple intent sources with predictive analytics to model account buying stages.

6sense natively ingests third-party intent from partners like Bombora and G2, consolidating multiple signal types into a single buying stage score. For teams with mature analytics functions, 6sense offers Data Packs that deliver raw web and keyword intent data directly to a data warehouse (SFTP, S3, Snowflake) for custom modeling. For a head-to-head comparison, see Salesmotion vs 6sense.

Platform Snapshot: 6sense

| Feature | Details |

|---|---|

| Best For | Mid-market to enterprise organizations seeking a unified platform to identify intent and orchestrate multi-channel campaigns based on buying stage. |

| Key Offering | Revenue AI Platform: combines multiple intent sources with predictive scoring to reveal in-market accounts and their buying stage. |

| Data Source | Proprietary network capturing web and keyword-level intent, with native ingestion of partner data from Bombora and G2. |

| Pricing | $35,000 - $150,000+/year. Four tiers: Free (50 credits/month), Team, Growth, and Enterprise. |

| Primary Strengths | Mature buying stage scoring and native campaign activation. Flexible Data Packs for advanced analytics teams. Named a Forrester Wave Leader (Q1 2025). |

| Potential Limitations | Significant platform investment required. Data access increasingly tied to platform usage. Black box scoring methodology. |

| Website | 6sense.com/platform/intent-data |

What It Costs

6sense pricing starts at approximately $35,000 annually for smaller teams and scales to $150,000+ for enterprise deployments. The platform has four tiers (Free, Team, Growth, Enterprise), but meaningful intent data access begins at the Growth tier. The Free tier provides 50 credits per month, which is useful for evaluation but not for production use. Hidden cost factors include the RevOps resources required to configure predictive models, maintain topic taxonomies, and build activation workflows. Plan for a 6-12 week implementation timeline. For a detailed pricing analysis, see our 6sense pricing breakdown.

7. ZoomInfo Streaming Intent

ZoomInfo is a major player in GTM intelligence, and its Streaming Intent product is a core part of its SalesOS platform. It identifies accounts showing real-time interest in specific business topics. The main strength is its tight integration with ZoomInfo's broader data cloud, which includes extensive contact information, technographics, and company attributes.

2025 update: ZoomInfo launched Copilot Workspace in October 2025, an AI-powered interface that lets reps ask natural-language questions about intent signals, account activity, and contact data — moving from dashboard-based workflows to conversational AI interaction. This makes intent data more accessible to reps who don't want to configure complex filters.

ZoomInfo embeds intent signals directly into its contact database and sales activation workflows.

ZoomInfo embeds intent signals directly into its contact database and sales activation workflows.

What makes ZoomInfo one of the most widely used providers is its focus on sales activation. Instead of just delivering a list of surging accounts, it embeds signals directly into sales workflows, making it easy for AEs and BDRs to act immediately.

Platform Snapshot: ZoomInfo Streaming Intent

| Feature | Details |

|---|---|

| Best For | Sales teams focused on high-velocity outreach and direct activation of intent signals integrated with a comprehensive contact database. |

| Key Offering | Streaming Intent: real-time, topic-based intent alerts delivered within SalesOS to trigger immediate sales actions. |

| Data Source | Proprietary network of web publishers, bidstream data, and third-party sources, combined with its extensive company data cloud. |

| Pricing | $7,200 - $36,000/year for mid-market. Enterprise tier: $15,000+/month. Multi-seat minimums and annual contracts required. |

| Primary Strengths | Deeply integrated into sales workflows. Combines intent with a massive contact and company database. Wide ecosystem adoption. |

| Potential Limitations | Add-on pricing escalates quickly. Packaging can be complex and less transparent than competitors. Intent data quality depends on bidstream sources. |

| Website | zoominfo.com |

What It Costs

ZoomInfo's mid-market pricing runs $600 to $3,000 per month ($7,200 to $36,000 annually). At the enterprise tier, costs reach $15,000+ per month. Intent data is typically an add-on to the base SalesOS subscription, not included in the standard contact database pricing. Multi-seat minimums apply. Watch for add-on costs that can escalate the total contract quickly: intent data, enrichment credits, workflow automation, and additional seat licenses are each priced separately. The advantage is that if you already use ZoomInfo for contacts, adding intent is an incremental cost rather than a separate platform purchase.

8. TrustRadius Downstream Intent Data (Now Part of HG Insights)

TrustRadius offers a unique form of intent data called downstream intent, derived from buyer behavior on its B2B software review site. Instead of tracking broad, top-of-funnel research, TrustRadius captures high-value signals from accounts actively comparing products, reading reviews, and evaluating specific categories.

Update: TrustRadius was acquired by HG Insights in June 2025. The combined platform now merges TrustRadius buyer intent with HG's technographic data, offering both review-site signals and technology stack context in a single solution. Existing TrustRadius customers should evaluate the combined offering.

What makes TrustRadius distinct is its focus on second-party data from its own platform. The signals reveal which accounts are researching your specific product, your competitors, or your entire category. This is invaluable for competitive takeout campaigns and identifying churn risks. The data is company-level only, so it is best activated through ABM platforms and paid media channels like LinkedIn Matched Audiences. See also our guide to the best account research software.

Platform Snapshot: TrustRadius Downstream Intent

| Feature | Details |

|---|---|

| Best For | B2B software companies looking for high-potency, bottom-funnel intent signals to fuel competitive takeout, retention, and ABM campaigns. |

| Key Offering | Downstream Intent: company-level signals on accounts researching your product, competitors, or category on the TrustRadius site. |

| Data Source | Second-party behavioral data captured directly from visitors on the TrustRadius B2B review platform. |

| Pricing | Custom subscription pricing. Depends on scope: number of competitors and categories tracked. Generally more accessible than enterprise ABM platforms. |

| Primary Strengths | Bottom-funnel data indicates strong purchase intent. Excellent for competitive and retention plays. Not dependent on third-party cookies. |

| Potential Limitations | Company-level only (no individual contacts). Coverage primarily focused on software categories. Smaller audience than G2. |

| Website | solutions.trustradius.com/products/downstream-intent-data |

What It Costs

TrustRadius pricing is custom but generally more accessible than the enterprise ABM platforms. Expect subscription pricing based on the number of competitors, categories, and products you want to track. The value proposition is strongest for SaaS companies where buyers actively use TrustRadius for evaluation research. If your category has limited TrustRadius traffic, the signal volume will not justify the investment. Negotiate a short proof-of-concept period before committing to an annual contract.

9. NetLine INTENTIVE

NetLine's INTENTIVE platform takes a unique approach by focusing on first-party, permissioned, buyer-level intent signals. Unlike providers that only deliver account-level data, INTENTIVE identifies specific people within target accounts who are actively engaging with content. It blends online content registrations from its network with offline event activity to provide a view of an individual's buying journey.

NetLine INTENTIVE identifies specific individuals engaging with content across its first-party network.

NetLine INTENTIVE identifies specific individuals engaging with content across its first-party network.

This person-level transparency is a significant advantage for sales teams aiming to engage multiple stakeholders within a buying committee. By knowing exactly who is consuming content related to your solutions, you can bypass guesswork and tailor engagement precisely.

Platform Snapshot: NetLine INTENTIVE

| Feature | Details |

|---|---|

| Best For | B2B teams that need person-level contact data to enable precision outreach and multi-threaded sales plays. |

| Key Offering | Buyer-Level Intent: contact-level data on individuals engaging with over 11,000 topics and 285+ activities. |

| Data Source | First-party, permission-based data from NetLine's content syndication network and Informa's offline event portfolio. |

| Pricing | Custom. Program-based pricing requires engaging with their sales team. Not self-service. |

| Primary Strengths | Person-level transparency identifies specific contacts, not just accounts. First-party, permissioned data. |

| Potential Limitations | Data is strongest for audiences engaged with NetLine/Informa assets. Sales-gated access. |

| Website | netline.com/platform/intentive.html |

What It Costs

NetLine uses custom, program-based pricing that requires a sales conversation. The cost depends on the scale of your content syndication and event portfolio engagement. NetLine's unique value is person-level attribution (you get the actual person researching, not just the company), which is rare and valuable for multi-threaded selling. If your GTM strategy relies heavily on content marketing and event participation, NetLine deserves serious evaluation.

10. Intentsify

Intentsify positions itself as an intelligence activation platform, not just a data source. It gathers intent signals from multiple providers (including Bombora) and cross-verifies them to create a more reliable view of account activity. This multi-source approach is designed to reduce the false positives that come from relying on a single dataset.

2026 update: Intentsify acquired Salutary Data in January 2026, strengthening its technographic data capabilities and expanding its ability to identify technology-driven buying signals alongside behavioral intent. The acquisition adds technology install data to Intentsify's existing multi-source intent aggregation.

Intentsify aggregates and cross-verifies intent signals from multiple sources for higher reliability.

Intentsify aggregates and cross-verifies intent signals from multiple sources for higher reliability.

What makes Intentsify unique is its emphasis on done-for-you activation. Beyond supplying data, they offer managed services to execute campaigns based on the intelligence, including targeted advertising and content syndication. This makes it a strong choice for marketing teams lacking internal resources to build and manage complex activation programs. Named a Forrester Wave Leader (Q1 2025).

Platform Snapshot: Intentsify

| Feature | Details |

|---|---|

| Best For | Marketing teams that want a managed, full-service solution for both intent data aggregation and campaign activation. |

| Key Offering | Intelligence Activation Platform: combines multi-source intent data with managed activation services like ABM ads and lead generation. |

| Data Source | Third-party intent data sources (including Bombora), bidstream data, and proprietary signals, cross-verified for accuracy. |

| Pricing | Program-based pricing requiring a custom quote. Typically involves a services engagement. Not a self-serve SaaS model. |

| Primary Strengths | Managed activation offloads campaign execution. Multi-source verification reduces single-source data bias. |

| Potential Limitations | Not ideal for teams wanting direct control over a self-serve tool. Requires commitment to the service-based model. |

| Website | intentsify.io |

What It Costs

Intentsify uses program-based pricing that bundles data with managed services. This means you are paying for both the intent intelligence and the campaign execution (ABM advertising, content syndication, lead generation). The total cost depends on program scope and scale. This model works well for marketing teams that lack the internal resources to operationalize intent data themselves. If you have a mature marketing ops team that prefers self-serve tools, the services component may not align with your operating model.

11. Madison Logic

Madison Logic is an end-to-end ABM platform where intent data fuels multi-channel activation. It combines proprietary and third-party intent signals within its ML Intent Dashboard, allowing you to see which accounts and buying groups are showing active interest. The platform scores and prioritizes these accounts for targeted campaigns.

Madison Logic bridges intent signals directly to multi-channel ABM campaign execution.

Madison Logic bridges intent signals directly to multi-channel ABM campaign execution.

What makes Madison Logic unique is its direct bridge from signal to action. The platform orchestrates campaigns across Connected TV, digital audio, display ads, LinkedIn, and content syndication. This integrated approach is ideal for enterprise marketing teams who want to streamline ABM execution without stitching together multiple tools.

Platform Snapshot: Madison Logic

| Feature | Details |

|---|---|

| Best For | Enterprise B2B teams looking for a unified platform combining intent data with native multi-channel ABM campaign activation. |

| Key Offering | ML Intent Dashboard: aggregates and scores intent signals to prioritize accounts and buying groups for targeted outreach. |

| Data Source | Multi-signal dataset combining proprietary behavioral data with third-party sources for comprehensive coverage. |

| Pricing | Enterprise quote-based pricing. A demo is required. Pricing includes both platform access and media spend components. |

| Primary Strengths | Directly connects intent signals to paid media execution across diverse channels. Strong analyst recognition for unified ABM workflow. |

| Potential Limitations | Not the best fit for teams only needing a raw intent data feed. Requires managed multi-channel budgets. |

| Website | madisonlogic.com |

What It Costs

Madison Logic pricing is enterprise and quote-based. The total investment includes both the platform subscription and media spend for campaign activation. This is not a data-only purchase. If you need intent data to fuel your own outreach sequences, a standalone provider is more cost-effective. Madison Logic's value is in the orchestrated execution: it turns intent signals into live campaigns across multiple channels without requiring your team to manage each channel independently.

12. HG Insights Contextual Intent (Now Includes TrustRadius)

HG Insights takes a specialized approach by layering intent signals over its robust technographic data. Their Contextual Intent offering identifies accounts that are not only researching relevant topics but also have a compatible or competitive technology stack. This provides a powerful filter, dramatically reducing noise.

Major 2025 update: In June 2025, HG Insights acquired TrustRadius, combining HG's technographic intelligence with TrustRadius's buyer intent data from verified software reviews. This creates what the companies call "the most comprehensive AI-powered revenue growth intelligence (RGI) solutions on the market." Demand generation and sales teams now get contextualized insights and in-market leads from a single platform that merges technology stack data with active buyer review behavior.

HG Insights now combines technographic data with TrustRadius review-site buyer intent after the June 2025 acquisition.

HG Insights now combines technographic data with TrustRadius review-site buyer intent after the June 2025 acquisition.

Instead of just knowing an account is interested in "cloud security," you can know they are interested, are a current AWS customer, and have recently been comparing security vendors on TrustRadius — making outreach hyper-relevant. The direct data delivery via Snowflake Data Marketplace makes it a strong choice for companies with mature data analytics teams.

Platform Snapshot: HG Insights Contextual Intent

| Feature | Details |

|---|---|

| Best For | Technology companies that need to qualify buying intent based on a prospect's existing technology stack and active review-site behavior. |

| Key Offering | Contextual Intent: technography-aware intent scoring that links signals to an account's specific IT environment, now enriched with TrustRadius buyer intent data. |

| Data Source | Proprietary global technographic intelligence combined with TrustRadius first-party buyer review data and third-party behavioral signals. |

| Pricing | Enterprise subscription. Often delivered via Snowflake Data Marketplace. Pricing depends on data scope and delivery method. |

| Primary Strengths | Filters out irrelevant intent signals using technology stack context. TrustRadius acquisition adds bottom-funnel buyer intent. Analytics-ready Snowflake integration. |

| Potential Limitations | Primarily built for technology vendors. May require data team involvement for full utilization. The TrustRadius integration is still being unified post-acquisition. |

| Website | hginsights.com |

What It Costs

HG Insights uses enterprise subscription pricing that depends on data scope, the number of technology segments tracked, and delivery method. The TrustRadius acquisition may affect packaging and pricing as the combined platform matures. The Snowflake Data Marketplace delivery is ideal for companies that want to blend intent with other business intelligence in their data warehouse. If your sales team does not have a mature analytics function or your ideal customer profile is not defined by technology stack, this provider's niche focus will not serve your needs.

Provider Comparison Summary

| Solution | Core offering | Key signals | Best for | Unique strengths | Annual cost |

|---|---|---|---|---|---|

| Salesmotion | AI account intelligence | News, earnings, SEC, funding, hiring, press | AEs, SDRs, RevOps in complex verticals | Source-backed POVs, fast setup, workflow integrations | Custom |

| Bombora | Publisher co-op intent | Topic signals (18k+ topics) | Marketing/ABM teams at scale | Privacy-forward publisher data, broad integrations | $25K-$80K |

| G2 | Review-site behavioral intent | Product, category, competitor, pricing page views | Software vendors | Down-funnel verified signals, first-party data | $10K-$87K+ |

| TechTarget | Tech buyer research intent | Prospect and account research signals | IT/technology sellers | Prospect-level signals, sales activation | Enterprise |

| Demandbase | Global intent + orchestration | Keyword coverage, trend scores | ABM teams, analytics platforms | Flexible delivery (APIs, warehouse), data scale | $40K-$120K |

| 6sense | Revenue AI + orchestration | Web and keyword intent, Bombora/G2 ingestion | Teams needing buying-stage scoring | Predictive models, multi-source ingestion | $35K-$150K+ |

| ZoomInfo | Streaming intent + data cloud | Topic-based streaming alerts | Sales activation, outbound teams | Wide adoption, enrichment + intent combined | $7K-$36K+ |

| TrustRadius (now HG Insights) | Review-site downstream intent | Product/competitor/category behaviors | Bottom-funnel and competitive plays | Bottom-funnel clarity, now combined with technographics | Custom |

| NetLine | Buyer-level permissioned intent | Content registrations, event activity | Multi-threaded outreach teams | Person-level attribution | Custom |

| Intentsify | Multi-source + managed activation | Cross-verified intent, buying-group signals | Teams wanting managed activation | Managed services reduce operational load | Custom |

| Madison Logic | ABM activation + intent | Multi-signal, buying group scoring | Enterprise ABM, multi-channel campaigns | Direct paid media activation tied to intent | Enterprise |

| HG Insights (+ TrustRadius) | Technography-aware intent + review data | Tech-contextualized intent + buyer reviews | Tech sellers, analytics teams | Filters intent by tech stack, buyer review signals | Enterprise |

What the Analysts Are Saying About Intent Data in 2026

The intent data market is at an inflection point. Several analyst reports published in 2025–2026 shape how buyers should evaluate providers:

-

Forrester Wave: Intent Data Providers, Q1 2025 — Named TechTarget, 6sense, and Intentsify as Leaders. The report emphasized the shift from raw signal delivery to activation-ready intelligence, noting that buyers increasingly want providers who can operationalize intent signals, not just surface them.

-

Forrester's 2026 B2B Predictions — Projected that B2B companies will lose more than $10 billion from ungoverned use of generative AI, including AI applied to intent data workflows. The report warns that one in five B2B sellers will be compelled to respond to AI-powered buyer agents.

-

6sense Buyer Experience Report (2025) — Found that 70% of the buying journey happens anonymously in the "Dark Funnel," and 95% of the time, the winning vendor is already on the buyer's Day One shortlist. This reinforces why early-stage signal detection matters more than late-stage intent scores.

-

Forrester: Buyers Choose Before Buying — A 2025 Forrester study found that 92% of buyers start with at least one vendor in mind, and 41% have already selected a preferred vendor before formal evaluation. Among C-suite buyers, 47% express early vendor loyalty vs. only 34% of individual contributors.

-

HG Insights Acquires TrustRadius (June 2025) — HG Insights acquired TrustRadius to combine technographic intelligence with buyer review data, signaling further consolidation in the intent data market.

These trends point to a market where raw intent scores are table stakes. The real competitive advantage comes from combining intent signals with verified account context — leadership changes, earnings priorities, funding events, and competitive signals — to reach buyers during that anonymous research phase.

Key Takeaways

- Intent data providers range from $7,000 to $150,000+ annually. The total cost of ownership exceeds the license fee once you factor in implementation, topic configuration, and RevOps resources. Budget 15-25% above the quoted price.

- Data sourcing methodology matters more than signal volume. Cooperative publisher data (Bombora) and first-party platform data (G2, TrustRadius, TechTarget) are more reliable than bidstream-based signals, which carry higher false positive rates and regulatory risk.

- Check whether you already have intent data bundled into an existing platform. Bombora data is embedded in 6sense, Demandbase, and ZoomInfo, so you may be paying twice for the same signals.

- Person-level intent (TechTarget, NetLine) is significantly more actionable than account-level intent for sales teams, but comes at a higher price point and with narrower coverage.

- The best results come from combining intent data with verified account signals like leadership changes, earnings priorities, and hiring patterns rather than relying on intent alone. For a framework on combining these signals, see what intent data is and how to use it.

- Run a two to four week proof of concept with your real target accounts before signing an annual contract. For an evaluation checklist that helps you structure this process, read our intent data buyer's guide.

Frequently Asked Questions

How do I compare intent data provider pricing when most use custom quotes?

Request proposals from three to four providers simultaneously and ask each for a standardized scope: same number of topics, same target account list size, same integration requirements. This creates an apples-to-apples comparison. Ask specifically about implementation costs, overage charges, and what happens to pricing at renewal. Most vendors offer 20-40% discounts from their initial quote, particularly at quarter-end or year-end.

Can we use multiple intent data providers at the same time?

Yes, and many enterprise teams combine a broad third-party source like Bombora with a niche first-party platform like G2 or TrustRadius. The key is having a clear data strategy so your team is not overwhelmed by duplicate or conflicting alerts. Cross-referencing signals from multiple providers improves confidence that an account is genuinely in-market. However, check for overlap first because providers like 6sense and Demandbase already bundle Bombora data into their platforms.

What hidden costs should I watch for with intent data contracts?

Common hidden costs include: implementation and onboarding fees (often $5,000-$15,000), CRM integration setup and maintenance, overage charges when you exceed topic or account limits, additional seat licenses for new team members, and data warehouse delivery fees for raw data exports. Also factor in the internal cost of a RevOps resource to configure topics, build workflows, and maintain the integration. Most teams underestimate this by 30-50%.

How quickly can we expect to see pipeline impact from intent data?

Most teams see actionable signals within the first two weeks. Meaningful pipeline impact typically takes 60 to 90 days as your team learns to interpret signals, refines workflows, and builds enough data to measure conversion lift. AI-driven platforms tend to deliver faster time-to-value because they push ready-to-use insights rather than raw data that requires manual analysis. For more on implementation timelines, see our ranked comparison of intent data providers.

Do intent data providers work for companies outside the technology industry?

Yes. While many providers started with a technology focus, the underlying signals apply across industries. Providers like Bombora, Demandbase, and Salesmotion serve companies in financial services, healthcare, manufacturing, and other verticals. Evaluate whether a provider's data sources align with where your specific buyers do their research. Platform-specific providers like G2 and TrustRadius are most relevant for software categories, while cooperative-based providers offer broader industry coverage.