Let's cut to the chase. Net Revenue Retention (NRR) is a vital health metric for any subscription business. It answers a simple but powerful question: If we didn't sign a single new customer this month, would our revenue from existing customers grow or shrink?

A high NRR means your customers aren't just staying, they're spending more over time. It's the ultimate sign of a healthy, valuable product.

Why Net Revenue Retention Matters

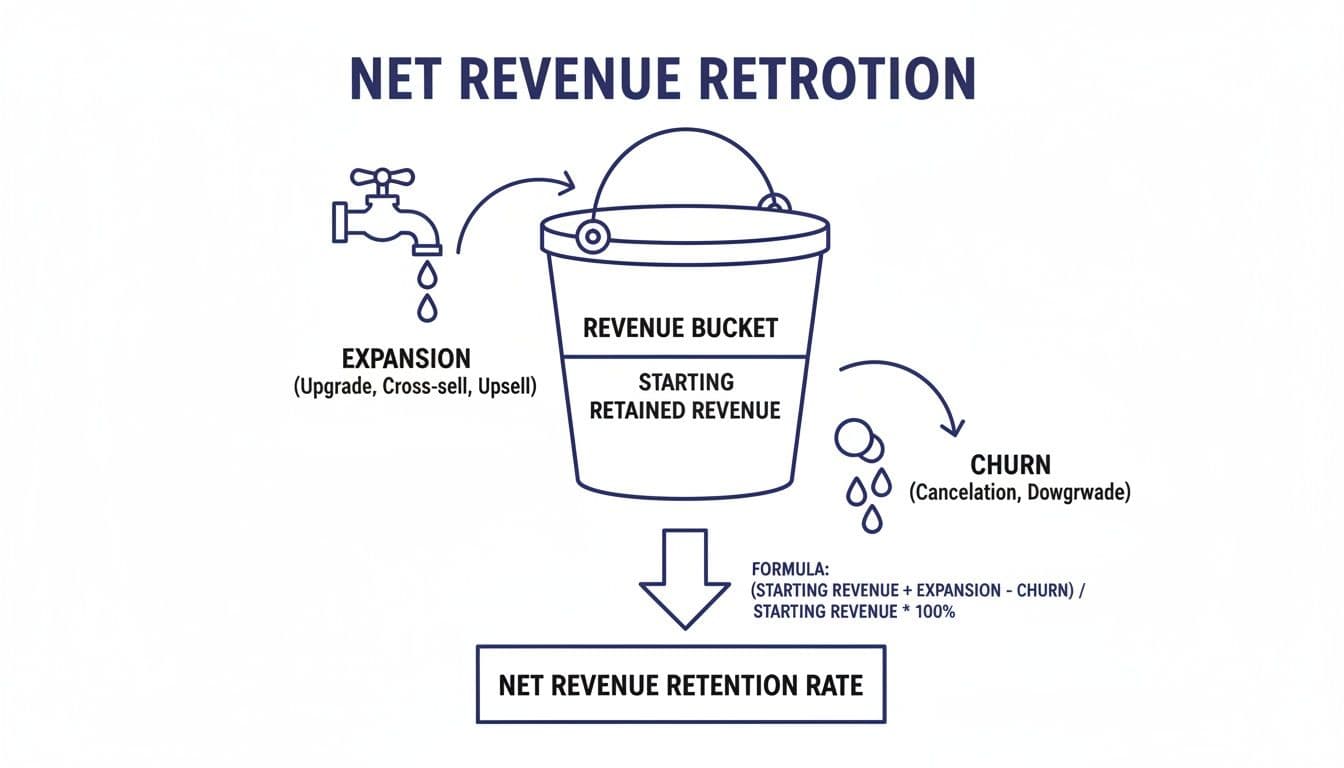

Think of your monthly recurring revenue (MRR) as a bucket of water. Every month, some water leaks out through churn (cancellations) and contraction (downgrades).

To keep the bucket full, you have to add more water. While new customers are one way to do that, NRR focuses on the water you already have.

A strong NRR shows you’re not just plugging leaks, but also adding more water from an expansion revenue tap—money from existing customers who upgrade, buy more, or increase usage.

When expansion revenue is greater than the revenue you lose, your NRR will be over 100%. That’s when your business starts growing on its own, without relying solely on new customer acquisition.

The Leaky Bucket Analogy

The "leaky bucket" concept is key to understanding sustainable growth. A business focused only on acquiring new customers is in a constant, expensive race to fill a draining bucket.

A business with high NRR, on the other hand, has a bucket that refills itself.

This diagram shows how it works. Expansion revenue tops up your revenue bucket, while churn and contraction create leaks.

The takeaway is simple: for your existing customer base to become a growth engine, your expansion revenue has to outpace the revenue you lose.

The Power of Compounding Revenue

This is where NRR's real power becomes clear. Unlike metrics that only measure customer loss, NRR includes customer growth, showing if your customer base is an appreciating asset.

Net Revenue Retention offers a more complete story than gross retention by accounting for customer growth. It frames retention not just as a defensive metric, but as a powerful lever for capital-efficient growth that resonates with CROs and revenue leaders.

The relationship between NRR and growth is exponential. Research from SaaS Capital shows that firms with an NRR above 110% grow their revenue 2.5 times faster than their low-NRR peers.

This compounding effect means high-NRR companies spend less on acquisition and build a more predictable, scalable revenue foundation. That’s why a solid NRR is a powerful signal to investors that a company is on the right track. For more on building a sustainable engine, check out our guide on RevOps best practices.

See Salesmotion on a real account

Book a 15-minute demo and see how your team saves hours on account research.

How to Calculate Net Revenue Retention With Real-World Examples

We’ve covered the "what" and "why." Now let's run the numbers.

Calculating NRR isn't just a math exercise; it's how you tell the story of your customer base. Are they growing with you or slipping away? The formula is simple and bundles all the ups, downs, and departures into one clean percentage.

You need four pieces of data for a specific period, like a month or quarter:

- Starting Recurring Revenue: The total recurring revenue from existing customers at the start of the period.

- Expansion Revenue: New revenue from existing customers (upsells, cross-sells, add-ons).

- Contraction Revenue: Lost revenue from customers downgrading plans or reducing usage.

- Churned Revenue: Revenue lost when customers cancel their subscriptions.

Once you have those figures, use this formula:

NRR = [(Starting RR + Expansion RR) – (Contraction RR + Churned RR)] / Starting RR

Let's walk through two scenarios.

Example 1: The Healthy SaaS Company

Imagine "InnovateTech," a B2B software company, calculating its NRR for Q2.

InnovateTech started the quarter with $2,000,000 in Annual Recurring Revenue (ARR).

Their teams had a great quarter, upselling key accounts and adding $300,000 in expansion ARR.

Of course, a few customers downgraded, leading to $50,000 in contraction ARR. A couple of smaller clients didn't renew, costing them $100,000 in churned ARR.

Let's plug it in:

- NRR = [($2,000,000 + $300,000) – ($50,000 + $100,000)] / $2,000,000

- NRR = [$2,300,000 – $150,000] / $2,000,000

- NRR = $2,150,000 / $2,000,000

- NRR = 1.075, or 107.5%

An NRR of 107.5% is a fantastic signal. It means InnovateTech grew its existing revenue base by 7.5%, even after losing some business. Their expansion efforts overfilled the bucket, turning their customer base into a growth engine.

Example 2: The Leaky Bucket Problem

Now for a different story. Let's look at "ConnectSphere," a project management tool for small businesses.

They started the quarter with $500,000 in Monthly Recurring Revenue (MRR).

The team managed a few upsells, adding $25,000 in expansion MRR.

But a recent price hike caused several customers to downgrade, leading to $40,000 in contraction MRR. A new competitor also poached a significant number of users, resulting in $60,000 in churned MRR.

Here's their NRR:

- NRR = [($500,000 + $25,000) – ($40,000 + $60,000)] / $500,000

- NRR = [$525,000 – $100,000] / $500,000

- NRR = $425,000 / $500,000

- NRR = 0.85, or 85%

An NRR of 85% is a red flag. ConnectSphere is losing 15% of its existing revenue each quarter. They're now in an expensive race to acquire new customers just to stay afloat. This metric highlights an urgent need to fix customer satisfaction and retention. Understanding these revenue dynamics is as fundamental as knowing your sales pipeline velocity.

“Salesmotion empowers me to cultivate a great buyer experience. I'm able to challenge prospects' thinking and be a trusted consultative seller. A major part of this is Salesmotion insights.”

Austin Friesen

Account Executive, FY25 #1 President's Club, Clari

What Is a Good Net Revenue Retention Rate?

So, you’ve calculated your NRR. Now, is it any good?

The answer: it depends. There’s no single magic number. A “good” NRR is shaped by your business model and, most importantly, who you sell to.

Context is everything. A business selling large annual contracts to enterprises will have a different NRR target than one selling cheap monthly subscriptions to small businesses.

Why NRR Benchmarks Vary

Selling a $100,000 annual contract to a Fortune 500 company involves deep relationships and high switching costs. These customers are less likely to churn and have huge potential for expansion.

Compare that to a $50/month tool for startups. The customer base is more fluid, and churn is a natural part of the business. While you can expand these accounts, the dollar amounts are smaller. It's a different game.

Here’s a rough guide based on your target market:

- Enterprise (High ACV): Top companies often hit 125% NRR or higher. Their strategy is to land large accounts and grow their value over years.

- Mid-Market (Medium ACV): A strong NRR is typically 110% - 120%. These businesses balance new customer acquisition with solid expansion.

- Small Business (Low ACV): Anything over 100% is healthy. Given the churn in this segment, simply retaining your revenue from a cohort is a win.

The bottom line: your Annual Contract Value (ACV) and customer segment are the biggest factors defining a "good" net revenue retention rate. Elite performance is about beating the benchmark for your specific market.

Striving for Elite Performance

While benchmarks provide a starting point, ambitious leaders aim for top-quartile performance. Public SaaS companies often report a median NRR around 110-115%, but the best-in-class consistently surpass 130%.

Reaching that level signals a powerful, self-sustaining growth engine. This isn't a vanity metric—it directly fuels growth. Analysis shows that SaaS companies with superior NRR grow 2.5 times faster. One AI platform’s 143% NRR and 65% revenue growth is a perfect example of winning by going deeper with existing customers. You can explore more about how NRR fuels sustainable growth and its importance for SaaS businesses.

This doesn’t happen by accident. It's the result of focusing on the entire customer journey. Companies hitting these numbers have mastered turning account intelligence into action. They know when a customer is ready for an upsell, when they're at risk of churning, and how to prove their value at every touchpoint.

Three Strategic Levers to Improve Your NRR

Knowing your NRR is one thing. Improving it is where the work begins. It’s not about luck; it’s about pulling the right levers.

Think of NRR as the result of three strategic pillars your teams can focus on daily.

1. Reduce Revenue Churn

First, stop the bleeding. Before you can think about expansion, you must minimize the revenue walking out the door. Proactive churn management is the bedrock of a healthy net revenue retention rate.

This requires a shift from a reactive "save" mentality to proactive health monitoring. You can't wait for a customer to say they're unhappy; by then, it's often too late.

Your customer success and account management teams need to spot early warning signs, such as:

- Decreased Product Usage: A sudden drop in logins or feature engagement is a major red flag.

- Support Ticket Spikes: A surge in complaints often signals growing frustration.

- Key Champion Departures: When your internal advocate leaves, your relationship is at risk.

Formalize this with a robust client retention program that turns these signals into action. A dip in usage should trigger a check-in. A champion leaving should trigger a re-engagement plan. This is how you get ahead of problems.

2. Drive Expansion Revenue

Once churn is under control, the next lever is to grow the accounts you already have. This is what pushes your NRR well above 100%.

Expansion revenue from upsells and cross-sells transforms your existing customers into your best growth engine.

The key is timing and relevance. A generic "upgrade now!" email is noise. Success comes from pinpointing the exact moment a customer is ready for more.

These moments are often triggered by positive changes in their business. Your team should be alert for signals like:

- New Funding or M&A Activity: This means new budgets and strategic projects.

- Hiring Sprees in Specific Departments: If a customer is hiring salespeople, they'll need more seats for your CRM.

- New Product Launches: They might need additional features to support the launch.

Catching these triggers allows your team to craft relevant outreach. Instead of a generic pitch, they can say, "I saw your company just secured its Series B to expand into Europe. Let's talk about how our international package can support that." This is a strategic conversation, not a sales pitch.

For more ideas, explore our guide to modern account management strategies.

3. Prevent Revenue Contraction

The third lever is often overlooked but critical. Revenue contraction happens when customers downgrade plans or reduce seats. It’s not as final as churn, but it’s a drag on NRR and can signal a customer is on their way out.

Preventing contraction comes down to one principle: continuously demonstrating value. If a customer can't see the ROI from your full feature set, they'll look for ways to cut costs.

The best defense against contraction is a strong offense. Don't wait for the renewal conversation to justify your price. Consistently prove your product’s worth throughout the customer lifecycle.

This involves a few key habits:

- Regular Business Reviews: Schedule quarterly check-ins to review usage data, highlight wins, and align on goals.

- Proactive Feature Education: If a customer isn't using a premium feature they pay for, offer training to show them what they're missing.

- Sharing Success Stories: Show them how similar companies are using your platform to solve their problems.

When you make value an ongoing process, you make it harder for a customer to justify a downgrade.

“This is my singular place that very simply summarizes a company's top initiatives, strategies and connects them to my solution. Something I would spend hours researching manually, now it's automated.”

Derek Rosen

Director, Strategic Accounts, Guild Education

Turning Account Intelligence into Higher Net Revenue Retention

The levers for improving net revenue retention are clear: cut churn, stop contraction, and drive expansion. But turning these ideas into action is where most companies struggle.

Hope is not a strategy. Real improvement comes from building a systematic, data-driven process.

This is where account intelligence gives you an advantage. Instead of reacting to problems or guessing at opportunities, you can use real-time signals from your customers to take decisive action. By keeping a pulse on your key accounts, you give your teams the context they need to make every interaction count.

Getting Ahead of Risk with Negative Signals

The biggest threats to your NRR are the ones you don't see coming: a key sponsor leaves, the company has a bad quarter, a competitor gets acquired. These events happen long before a cancellation email arrives.

Without a system to catch these early warnings, your team is always on the defensive. Account intelligence flips the script.

By monitoring negative signals in real-time, you can move from a reactive "save" motion to a proactive risk management strategy. This allows your teams to intervene before a small problem becomes a churned account.

Imagine getting an alert the moment your champion updates their LinkedIn profile. Your account manager can immediately start building a relationship with their replacement, rather than finding out during a renewal call three months later.

Capitalizing on Opportunity with Positive Signals

Just as important as spotting risk is knowing when to act on opportunity. The best moments for expansion are rarely random; they’re triggered by positive changes within a customer's business.

A customer raising a new funding round is a flashing sign of new budgets and growth plans. A hiring surge in a specific department indicates a need for more licenses. A new product launch creates an opening to discuss a premium feature.

Positive signals transform generic upsell pitches into timely, relevant conversations.

- New Funding Rounds: A perfect time to discuss how your platform helps them scale with their new capital.

- Departmental Hiring Surges: If they’re hiring 50 new salespeople, they need more seats. It’s a simple reason to connect.

- Product Launches or Geographic Expansion: An opportunity to introduce add-ons or higher-tier plans that support their new strategy.

Armed with these triggers, your reps can craft a message that hits on the customer’s immediate priorities. It's the difference between a cold pitch and a strategic discussion. You can explore account intelligence tools compared to see which platforms are best at surfacing these critical signals.

Making Every Interaction Relevant

Ultimately, boosting your net revenue retention comes down to relevance at scale. The teams that win are the ones who understand their customers most deeply. They don't just sell a product; they solve specific, timely problems.

Account intelligence provides the raw material for that relevance. It gives your reps the "so what" behind every signal, helping them connect an external event to a customer's potential need.

This allows them to focus their efforts where it matters most. Instead of treating every account the same, they can zero in on customers showing clear signs of risk or opportunity. They spend less time on manual research and more time having strategic conversations that lead to higher retention and expansion.

Common Questions About Net Revenue Retention

Here are answers to a few common questions about net revenue retention.

What Is the Difference Between Net and Gross Revenue Retention?

This is the most common point of confusion. The difference is expansion revenue.

Gross Revenue Retention (GRR) is a defensive metric. It measures how well you hold onto existing revenue, ignoring any upsells or cross-sells. It's all about preventing churn and contraction.

The formula is: (Starting RR – Contraction RR – Churn RR) / Starting RR

A strong GRR (e.g., 90% or higher) shows your product is sticky. It answers, "How much of our original revenue did we keep?"

Net Revenue Retention (NRR) tells the whole story. It takes everything GRR measures and adds expansion revenue. It answers, "Did our existing customer base grow or shrink in value?"

Key takeaway: GRR measures loyalty, but NRR measures momentum. A healthy business needs both, but NRR is the true north star for capital-efficient growth.

How Often Should We Calculate NRR?

The best cadence depends on your business model. A tiered approach works well for most SaaS companies.

- Monthly: For tactical teams. A monthly calculation provides an early warning system for customer success and account managers.

- Quarterly: The standard for strategic reporting to leadership and the board. It smooths out monthly blips and provides a stable number for forecasting.

- Annually: Your big-picture health score. It's the headline number for investors, showing the resilience of your customer base over a full business cycle.

Best practice? Track all three. Use the monthly view for quick action, quarterly for strategy, and annual for validation.

Can Early-Stage Startups Focus on NRR?

Good question. With only a handful of customers, one churn can make your NRR swing wildly, which can be discouraging.

But ignoring net revenue retention entirely is a mistake.

While the metric itself might be too volatile to report at first, the behaviors that drive NRR are critical from day one. An early-stage startup should be obsessed with:

- Preventing early churn: Your first customers must be successful.

- Finding expansion paths: Understand what would make those first customers pay more.

- Building real relationships: The groundwork for long-term loyalty starts with your first customer.

So, while you might hold off on reporting NRR until you have a more stable customer count, the principles behind it should be baked into your company’s DNA from the start.

By turning signals into action, Salesmotion helps your B2B revenue teams get ahead of churn and spot expansion opportunities when they happen. Our AI-powered account intelligence platform monitors what's happening across your accounts and delivers the actionable "so what" your reps need to drive net revenue retention. See how it works.