Let's be direct: the old way of account planning in sales is a chore because it's usually a waste of time. We've all been there—spending days building a static plan only to watch it gather dust in a shared drive.

Your key accounts are constantly changing. The "set it and forget it" approach is dead.

Why Traditional Account Planning Is Broken

The classic model of account planning—the once-a-year, check-the-box exercise—is fundamentally flawed. It treats accounts like static snapshots in a real-time world.

Key contacts leave, new executives arrive, strategies pivot, and market pressures shift priorities overnight. Frameworks like SWOT and PESTLE analysis can help you anticipate these shifts. A plan built in January is often irrelevant by March.

This old-school method relies on tedious, manual research. Reps spend hours digging through dense financial reports, old news articles, and LinkedIn profiles. One AWS sales manager reported spending up to 40 hours per customer before they modernized their approach.

The result? A snapshot in time, not a living strategy.

The Gap Between Intent and Execution

Most sales leaders know a strategic approach is critical. For 61% of global B2B companies, strategic account management is a key lever for growth. The problem isn't the goal; it's the execution.

A recent study found that 71% of companies saw sales improve by less than 26% after launching these programs. This shows a huge gap between intent and impact. Too many teams leave value on the table because their planning is weak or inconsistent.

This gap exists because a static plan fails to give a salesperson what they need most: a compelling reason to engage right now. Last quarter's data doesn't help you write a relevant email today.

The core failure of traditional account planning is treating it as an event, not a continuous process. Top performers see it as an always-on system fueled by a constant flow of intelligence.

Let's break down the old way versus the new.

Traditional vs Modern Account Planning

This table shows how different the two philosophies are. It’s a shift from a reactive, document-heavy exercise to a proactive, insight-driven system.

| Attribute | Traditional Planning (The Old Way) | Modern Planning (The Winning Way) |

|---|---|---|

| Cadence | Annual or semi-annual "event" | Continuous, always-on process |

| Primary Input | Manual research, historical data | Real-time signals, intent data, triggers |

| Output | Static PowerPoint or Word document | Dynamic, actionable insights in the CRM |

| Focus | Internal review, "checking the box" | Proactive engagement, timely outreach |

| Rep Experience | A dreaded, time-consuming chore | A value-add that helps win deals |

| Tech Reliance | Spreadsheets, documents, CRM fields | Integrated intelligence & automation tools |

| Impact | Quickly becomes outdated, low ROI | Drives relevant conversations, high ROI |

The modern approach isn't just a better version of the old one; it's a completely different game.

Moving from Static to Signal-Driven

The alternative is a modern, signal-driven approach. Instead of periodic deep dives, you build a system for continuous intelligence. This transforms account planning from a dreaded task into a powerful revenue engine.

It’s about spotting opportunities as they happen. For example:

- A target account hires a new CIO from a company that was your customer.

- An earnings call reveals a new strategic focus on operational efficiency.

- A key decision-maker posts on LinkedIn about a challenge you solve. (See our guide on how to find decision makers for more tactics.)

These signals give you a timely, relevant reason to connect. This modern approach isn't just about better planning; it's about building a system that delivers actionable insights into a seller's daily workflow. This often requires more than just your existing tools, which is why it's important to understand why your sales tech stack isn't enough to support a dynamic strategy.

See Salesmotion on a real account

Book a 15-minute demo and see how your team saves hours on account research.

How to Select and Prioritize Your Target Accounts

In sales, your time is your most valuable asset. Spending it on accounts with little potential is a fast track to missing your quota. Effective account planning starts with a simple truth: not all accounts are created equal.

The key is to move beyond basic firmographics like industry and company size. You need to focus on the signals that indicate true revenue potential.

This is why a structured tiering system is a game-changer. By dividing your territory into distinct tiers, you align your effort with the size of the opportunity. Think of it as portfolio management for your time—you invest your most significant resources in your highest-return prospects.

Building Your Account Tiering Framework

A simple Tier 1, 2, and 3 system is all you need to start. The goal isn't a rigid, complex matrix, but a flexible framework that sharpens your focus.

Let’s break down what each tier means and the criteria you should use.

Tier 1 Accounts: The Crown Jewels

These are your top 10-15% of accounts. They are the best fit for what you sell and hold the highest potential for large, long-term deals. Your time here should be deep, strategic, and proactive.

- Ideal Customer Profile (ICP) Fit: A textbook match for your ICP—industry, size, tech stack, and more.

- Market Opportunity: The potential deal size is large enough to make or break your quarter.

- Strategic Alignment: Their public goals, from earnings calls or investor days, align perfectly with the value you deliver.

- Existing Relationships: You may already have a champion in the organization or a small foothold to build from.

Tier 2 Accounts: The High-Potential Contenders

Making up the next 20-30% of your territory, these accounts are strong but may lack one or two Tier 1 elements. They have serious potential but require careful qualification before you invest significant time and resources.

- Strong ICP Fit: They check most boxes but not all. Perhaps they're in a secondary vertical or are slightly smaller than your typical enterprise target.

- Moderate Opportunity: The deal size is still meaningful, even if it’s not a Tier 1 account.

- Emerging Signals: They might show early buying signals, like posting a relevant job or a key executive mentioning a challenge you can solve.

Tier 3 Accounts: The Opportunistic Plays

This is the remaining 50-60% of accounts. Engagement here needs to be efficient and largely automated. The goal is to monitor them for signals that could move them to a higher tier while maintaining a light, consistent touch.

- Partial ICP Fit: They fit some of your criteria but have clear gaps that make them a lower priority.

- Low Immediate Potential: There’s no obvious, pressing need or active buying signal right now.

- Long-Term Nurturing: These accounts are perfect for automated marketing sequences and periodic check-ins.

Putting Tiering Into Practice

Let's make this practical. Imagine a sales rep for a complex SaaS platform for life sciences companies. Here’s how they might tier their accounts:

- Tier 1: A large pharmaceutical company that just announced a major R&D initiative in an area where her software excels. They are a perfect ICP fit, and the potential contract value is enormous.

- Tier 2: A mid-sized biotech firm that recently secured a new round of funding. They fit the ICP, but the immediate need isn't clear yet. It's a high-potential account worth investigating.

- Tier 3: A small contract research organization (CRO) in the right industry but without the scale for a large deployment. The rep will add them to a long-term nurture campaign and check back in a few quarters.

The power of tiering isn't just the initial sort; it's how it dictates your actions. For Tier 1, you build a comprehensive plan. For Tier 2, you validate. For Tier 3, you monitor.

This model gives you a clear, data-backed reason for where you spend your time. Instead of reacting to your inbox, you proactively focus your energy where it counts.

This process isn't static. For more on keeping your strategy sharp, you can learn about the best practices for tiering accounts in sales. And for specialized industries like finance, leveraging a dynamic bank prospect database can provide a significant intelligence advantage.

“We're no longer fishing. We know who the right customers are, and we can qualify them quickly. Salesmotion has had a direct impact on pipeline quality.”

Andrew Giordano

VP of Global Commercial Operations, Analytic Partners

Mapping Stakeholders to Uncover Key Initiatives

Winning a complex deal isn't about selling to a company; it's about navigating a web of human relationships. An org chart is a starting point, but real account planning in sales means understanding who holds the power, who influences decisions, and who might block you.

This is stakeholder mapping. It’s a deep dive into the political landscape of your target account, moving past job titles to uncover the core motivations of key players. Without this map, you’re flying blind.

Moving Beyond the Org Chart

A static org chart is dangerously incomplete. It shows formal structure but tells you nothing about influence. The real work is identifying the roles people play on a buying committee, which often have little to do with their official titles.

In most large deals, you'll encounter a few key personas:

- The Champion: Your internal advocate. They believe in your solution and are willing to spend their political capital to help you because they see how it helps them win.

- The Economic Buyer: The person who signs the check. They control the budget and focus on financial impact, ROI, and alignment with the company's strategic goals.

- The Influencer: A subject matter expert or respected leader without direct budget authority, whose opinion carries significant weight. They can make or break your deal.

- The Blocker (or Skeptic): This person can derail your progress due to loyalty to an incumbent, resistance to change, or a belief that you're not the right fit. Identifying them early is critical.

Your mission is to build a coalition around your Champion, neutralize opposition, and prove undeniable business value to the Economic Buyer.

Using Signals to Understand What People Care About

How do you figure out who’s who and what they care about? Tune into the signals they send. This intelligence turns your generic pitch into a relevant conversation about their world and their problems.

Start listening for clues from these sources:

- LinkedIn Activity: What are they posting, sharing, or commenting on? A VP of Operations sharing articles about supply chain efficiency is telling you their priorities.

- Press Releases & Company News: Did the company announce a new strategic initiative? The executive leading that project is now a high-value contact.

- Earnings Calls & Investor Reports: When a CEO tells Wall Street they are focused on cutting operational costs by 10%, you now know a key metric for the entire leadership team.

- Podcasts & Conference Appearances: When executives speak publicly, they often share unfiltered views on industry challenges, giving you a direct line into their thinking.

When you connect your solution to an individual's publicly stated goals, you stop being a vendor and become a strategic partner. This is how you build consensus and win the deal.

For example, you find the CFO mentioned "improving data analytics capabilities" on their last earnings call. At the same time, the Director of IT you've targeted shares a LinkedIn article about the headaches of data silos.

You can now connect those two dots and craft a message that speaks to a known, cross-departmental priority. That’s far more powerful than a cold email listing your software's features.

Building Your Stakeholder Map in Practice

Let's make this tangible. Imagine you're selling a project management platform to a large enterprise.

- First, you identify the VP of Engineering as a potential Economic Buyer. Her LinkedIn profile shows a history of leading large-scale digital transformation projects.

- Next, a press release announces a major new product launch in nine months. The Senior Director of Product spearheading this is your likely Champion, as his success depends on a smooth, on-time launch.

- Digging deeper, you find a Principal Engineer in that department who has blogged about the limitations of their current tools. He could be a critical Influencer who can validate the technical need for your platform.

- Finally, you learn the Director of IT, who manages existing tools, is a long-tenured employee resistant to new software. He's a potential Blocker you'll need to approach with a careful strategy.

This detailed mapping gives you a clear playbook. You know who to talk to, what matters to them, and how to frame your value for each conversation. Building a strong relationship with your advocate is a key part of this, and there are specific strategies for effective champion tracking to ensure they have what they need to sell for you internally.

Turning Account Intelligence Into Actionable Sales Plays

Great intelligence is a starting point, but intelligence without action is just trivia. This is where your research and planning must translate into pipeline and revenue. It’s about bridging the gap between knowing about an account and knowing what to do with that information.

You need a playbook of specific, trigger-based "sales plays" that your team can run the moment they spot a signal. This shifts your team from reactive to proactive, giving them a compelling reason to reach out every time. It’s the difference between a generic "checking in" email and a message that proves you’ve done your homework.

Decoding Signals to Launch Your Play

The key is to connect specific signals to pre-defined outreach strategies. Instead of reps wondering, "What do I do with this?" they'll have a clear, repeatable process. This is how you operationalize insights and ensure consistency.

Here are a few common signals and the high-impact plays they should trigger:

- The Signal: A target account hires a new executive (e.g., a CIO or CFO) from a company that was one of your best customers.

- The Play: This is a warm intro. Immediately reach out with a congratulatory note referencing their positive past experience with your solution. The message: "We helped you achieve X at your last company; we can help you make a fast impact here, too."

- The Signal: An earnings call reveals a new strategic initiative to "reduce operational overhead by 15%."

- The Play: This is a direct line to the economic buyer's top priority. Your outreach should hit this pain point head-on, framing your solution as a path to their cost-saving goal. Back it up with a relevant case study.

- The Signal: A key decision-maker posts on LinkedIn asking for recommendations for software you provide.

- The Play: This is a clear buying signal. Engage immediately on the platform with a helpful, non-salesy comment, then follow up with a direct message or email. Your outreach should be specific to their post, showing you're paying attention.

The most effective sales plays aren't just about what you say, but when you say it. Timing and context are everything. A well-timed, relevant message based on a real signal will outperform a hundred cold emails.

Crafting Outreach That Gets Replies

Once you've identified the play, craft the message. Generic templates are the enemy. Your messaging must be tailored to the specific signal and the stakeholder’s priorities.

Use a simple framework: Context + Value + Call to Action.

- Context: "I saw your company announced a new focus on supply chain optimization in your Q2 earnings call..."

- Value: "...we recently helped a similar company in your industry reduce logistics costs by 12% in six months."

- Call to Action: "Are you open to a brief conversation next week to explore if a similar approach could support your new initiative?"

This structure proves you're not just blasting emails. It shows you’ve listened, understood their goals, and have a relevant idea to share.

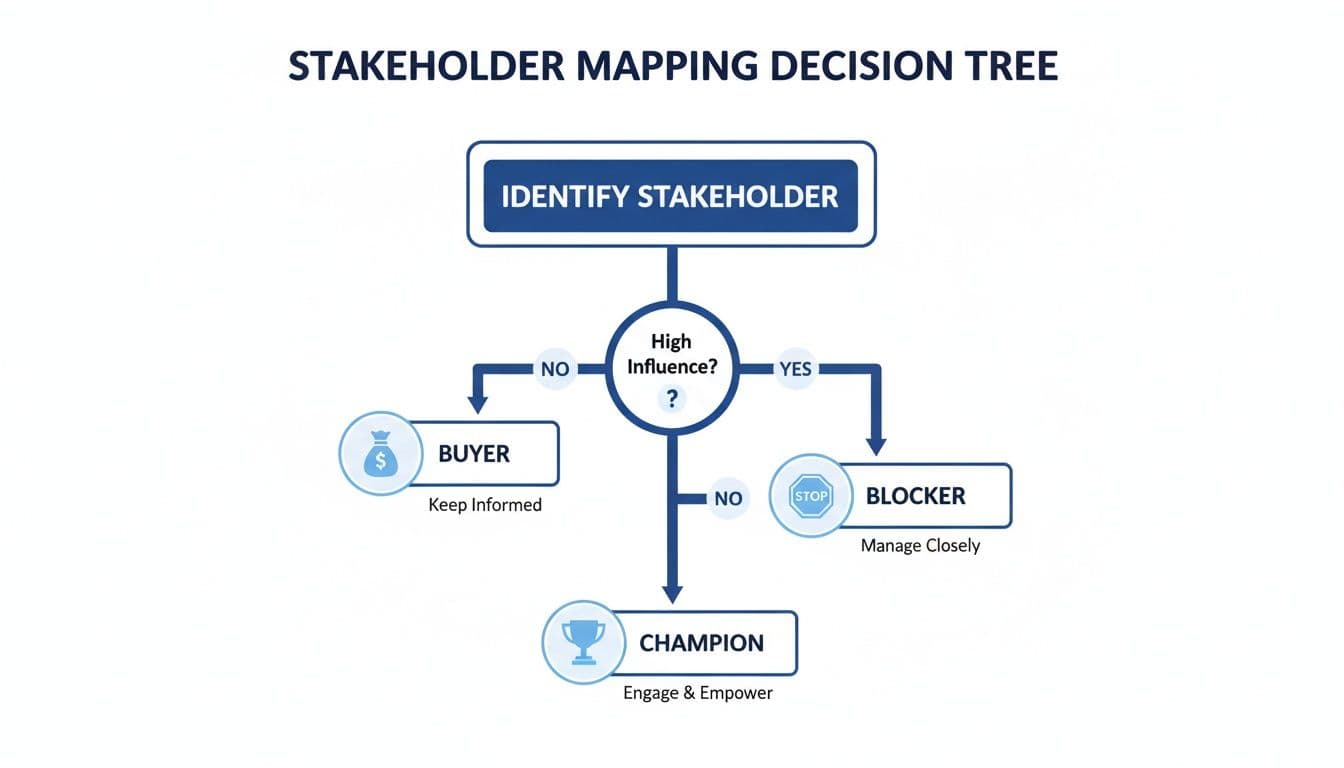

This visual decision tree shows how to categorize key players—Champions, Blockers, and Buyers—to tailor your engagement strategy.

Understanding these roles helps you direct the right message to the right person, ensuring your value proposition resonates with their specific concerns.

Operationalizing Plays with Modern Tools

Manually tracking signals across hundreds of accounts is impossible at scale. This is where modern account intelligence platforms are essential. They automate monitoring, filter out the noise, and deliver actionable alerts directly into your team's workflow—whether in Slack, email, or your CRM.

The technology supporting modern account planning in sales is scaling rapidly. The global sales intelligence market was valued at USD 4.40 billion and is projected to reach USD 10.25 billion by 2032. The account planning software market has reached approximately USD 2.15 billion, showing that organizations are adopting software-enabled processes over spreadsheets. Discover more insights about these market trends on fortunebusinessinsights.com.

These tools do more than send alerts. The best can auto-generate a "point of view" or a draft email based on a trigger. This saves reps time and ensures a consistent, high-quality response to every signal. Instead of spending hours digging for a reason to reach out, your team gets a notification with the "so what" already explained, ready to be personalized and sent. This is how you scale relevance and make every seller as effective as your best one.

“All of the vendors that I've worked with, all of the onboarding that I have had to deal with, I will say, hands down, Salesmotion was the easiest that I have had.”

Lyndsay Thomson

Head of Sales Operations, Cytel

How to Operationalize Your Plan and Drive Team Adoption

A brilliant account plan is worthless if it sits in a folder on a shared drive. This is where most planning initiatives fail. The real challenge is weaving this process into the daily rhythm of your revenue team.

This is for the leaders, RevOps pros, and sales enablement managers tasked with making the new process stick. It’s about turning planning from an administrative task into a competitive advantage by removing friction, proving value, and making the right way to sell the easiest way to sell.

Choosing the Right Tech and Integrating It Deeply

Your CRM is the center of the sales universe. Any account planning effort that lives outside of it is doomed.

Integrate your process directly into the tools your team already uses daily. Build your templates and dashboards inside your CRM. When a rep opens a Tier 1 account record, the plan should be right there—not buried in a separate PowerPoint. The goal is to make planning a natural part of their workflow, not an extra step.

A successful account planning rollout isn’t about forcing reps to adopt a new tool. It’s about making their primary tool—the CRM—smarter and more valuable to their success.

When rolling this out, you also have to consider the structure and motivation of your sales force. The nuances of different compensation models, like managing commission-only sales representatives, can be critical for getting adoption right across different teams.

Establishing a Rhythm for Plan Reviews

Consistency is everything. Without a regular cadence for reviewing and updating plans, even the best intentions will fade. You have to establish a clear rhythm for how and when account plans are discussed.

This isn't about adding more meetings; it's about making existing meetings more strategic.

- Weekly Pipeline Reviews: Spend five minutes on a key account. Ask, "What new signal have we seen this week, and how are we acting on it?"

- Monthly 1-on-1s: Dedicate a portion of every manager-rep 1-on-1 to a deep dive into one or two strategic accounts. This makes planning a core part of coaching.

- Quarterly Business Reviews (QBRs): Make the account plan the centerpiece of your QBRs. This elevates its importance and ties it directly to performance.

Tracking KPIs That Actually Matter

Revenue is a lagging indicator; it tells you what already happened. To measure the health of your account planning efforts, track the leading indicators that show if your team's behaviors are changing.

Go beyond the final number. Focus on metrics that reveal engagement and pipeline quality.

- Meeting-to-Opportunity Conversion Rate: Are your signal-driven conversations turning into real pipeline more effectively?

- Multi-Threading Engagement: How many key stakeholders are you actively engaged with per target account? Is that number growing?

- Pipeline Velocity: How quickly are deals moving through the pipeline in planned accounts versus unplanned ones? The difference is often significant.

- Contact Coverage: What percentage of the identified buying committee have you successfully engaged?

Tracking these KPIs proves your account planning process isn't just creating busywork—it's building a healthier, more predictable pipeline.

Getting Buy-In by Answering "What's In It for Me?"

Your sales team will only adopt this process if they believe it helps them hit their number and make more money. You have to sell them on the "why" by showing them how it makes their lives easier, not harder.

Frame account planning as a time-saving tool. Modern platforms can auto-populate plans with intelligence, saving reps hours of manual research. Share the wins. Highlight success stories where an insight from a plan directly led to a closed deal.

When reps see that a well-executed plan gives them a clear path to crushing their quota, adoption follows. This requires a robust support system, which is where a well-structured sales enablement framework is essential for providing ongoing training and resources.

The results of a well-operationalized plan can be massive. One global IT company unlocked approximately $1.4 billion in new pipeline within 18 months after rolling out a new, standardized approach for its 400 priority accounts. Within that segment, they achieved 11% year-over-year growth, 2–3x higher than the market average. You can learn more about their impressive account planning findings. That's the power of turning an idea into a core business process.

Key Takeaways

- Traditional annual account planning is broken because it produces static snapshots that become outdated within weeks; a signal-driven, always-on approach is the modern alternative.

- A simple Tier 1, 2, and 3 framework aligns your effort to opportunity size: deep strategic planning for top accounts, validation for mid-tier, and automated monitoring for the rest.

- Stakeholder mapping must move beyond org charts to identify each person's role in the buying committee, their individual motivations, and the signals they send through LinkedIn activity, public statements, and hiring patterns.

- Specific trigger-based sales plays convert intelligence into pipeline by connecting signals like executive hires, earnings call priorities, and LinkedIn posts directly to pre-defined outreach strategies.

- Successful operationalization requires embedding account plans inside the CRM, establishing a regular review cadence, tracking leading KPIs like multi-threading engagement and contact coverage, and demonstrating clear value to reps.

Frequently Asked Questions

Why is traditional annual account planning considered broken?

Traditional annual account planning produces static snapshots that become outdated within weeks as contacts leave, executives arrive, strategies pivot, and market pressures shift priorities. Research shows that 71% of companies saw sales improve by less than 26% after launching account management programs, revealing a huge gap between intent and impact. The core failure is treating planning as a one-time event rather than a continuous, always-on process fueled by real-time intelligence.

What is signal-driven account planning?

Signal-driven account planning replaces periodic deep dives with a system for continuous intelligence. Instead of relying on static data, you build a system that monitors your accounts for real-time events like executive hires, earnings call revelations, and strategic initiative announcements. These signals give your team a timely, relevant reason to connect and provide the "why now" that turns generic outreach into a warm, relevant conversation.

How should sales teams tier their accounts?

A simple Tier 1, 2, and 3 framework works best. Tier 1 accounts (top 10 to 15%) are your crown jewels with the best ICP fit and highest deal potential, deserving deep strategic planning. Tier 2 accounts (next 20 to 30%) are strong contenders that require validation before heavy investment. Tier 3 accounts (remaining 50 to 60%) get efficient, largely automated monitoring with periodic check-ins, waiting for signals that could move them to a higher tier.

What are the most effective sales plays triggered by buying signals?

The most effective plays connect specific signals to pre-defined outreach strategies. When a target account hires a new executive from a company that was your customer, send a warm intro referencing their past experience. When an earnings call reveals a cost-reduction initiative, frame your solution as a path to that goal. When a decision-maker posts on LinkedIn about a challenge you solve, engage with a helpful comment followed by a personalized direct message.

How do you get a sales team to actually adopt account planning?

Adoption boils down to demonstrating clear value and removing friction. Integrate account plan templates directly into the CRM so they are part of the rep's existing workflow. Use tools that auto-populate fields with account intelligence, saving reps from tedious manual research that can take up to 40 hours per account. Share success stories where an insight from a well-maintained plan led directly to a closed deal to show reps that strategic planning is a direct path to a bigger commission check.

What KPIs should you track to measure account planning effectiveness?

Track leading indicators that reveal behavioral change rather than just lagging revenue metrics. Key KPIs include meeting-to-opportunity conversion rate (are signal-driven conversations creating pipeline), multi-threading engagement (how many stakeholders per target account are actively engaged), pipeline velocity (how fast deals move in planned versus unplanned accounts), and contact coverage (what percentage of the identified buying committee has been engaged).

Common Questions About Account Planning

Even with a solid framework, questions always come up. Let's tackle a few of the most common ones I hear from sales professionals getting serious about modern account planning in sales.

How Often Should I Update a Strategic Account Plan?

The short answer: not on a set schedule. Forget the annual or quarterly review cycle.

Your account plan should be a living document, not a static file. The best teams update their plans based on real-time events, not a rigid calendar.

A key trigger—a leadership change, a merger, or a surprising earnings report—should prompt an immediate refresh. These signals can change your entire strategy overnight, so you need to adapt quickly.

For a more regular rhythm:

- Before any major meeting: Give it a quick review. Make sure your talking points are fresh and informed by the latest intelligence.

- Monthly with your manager: For Tier 1 accounts, a deeper dive during your 1-on-1 is a great way to maintain focus and get strategic input.

What Is the Difference Between Account Planning and Call Planning?

It’s easy to confuse these two, but they serve different purposes. Think of it as strategy versus tactics.

Account planning is the long-term, strategic blueprint for the entire relationship. It defines your revenue goals, maps the political landscape, identifies risks, and outlines your engagement strategy over months or years. It’s the "why" and "what" behind your actions.

Call planning is tactical and short-term. It’s about the objective of a single conversation. What do you need to learn in this meeting? What value will you provide? What is your desired outcome? Your daily call plans should be direct outputs of your larger account plan.

How Can I Get My Sales Team to Actually Adopt Account Planning?

True adoption boils down to two things: demonstrating clear value and removing all possible friction.

Reps won't adopt a process they see as busywork. They will eagerly adopt a process that is easy, saves them time, and helps them hit their quota.

First, make it easy. Integrate your account plan templates directly into your CRM. Use tools that auto-populate fields with account intelligence, saving reps from the tedious manual research that can take up to 40 hours per account.

Second, show them what’s in it for them. Share success stories where an insight from a well-maintained account plan led directly to a closed deal. When your reps see that strategic planning is a direct path to a bigger commission check, adoption stops being an issue. It becomes the way you win.

Tired of manual research and inconsistent planning holding your team back? Salesmotion is an AI-powered account intelligence platform that turns real-time signals into actionable sales plays. We help your team stop guessing and start engaging with the right context, at the right time.

Learn how Salesmotion can automate your account planning today