Mastering account research as an Enterprise AE means moving beyond just gathering data. It's about focusing on signals. For broader context on where this discipline is heading, see our piece on the future of account research. The goal is to swap tedious hours digging through earnings reports for a smarter system—one that feeds you actionable intelligence so you can build a powerful "why now" message for every prospect.

TL;DR: Stop burning hours on manual research. Modern enterprise AEs use signal-based intelligence -- funding rounds, exec moves, earnings call insights -- to build a compelling "why now" message for every account, replacing busywork with strategic conversations that close deals.

Why Old-School Account Research Fails in Modern Sales

Enterprise sales moves fast, but most account research is stuck in the past. The best AEs know that breaking through the noise isn’t about working harder—it’s about working smarter. The old method of manually stitching together insights just doesn't cut it anymore.

The Crushing Weight of the "Manual Tax"

Every hour you spend manually sifting through earnings calls, press releases, and LinkedIn profiles is an hour you aren't selling. This "manual tax" is a massive drain on productivity. It leads to half-baked account plans and weak outreach that goes nowhere. For a deep dive into techniques like SEC filing analysis and competitive signals, see our guide to advanced account research techniques.

The problem is simple: we're drowning in data but starved for wisdom. Reps struggle to connect a line in a financial report to a compelling reason to pick up the phone. This leads to generic messages that busy executives delete on sight. Even a great tech stack can’t solve the problem if the inputs are weak.

The old playbook of surface-level research leads to generic outreach that gets ignored. In today's market, your ability to translate raw information into a credible point of view is what separates top performers from the rest.

Shifting from Manual Labor to Actionable Intelligence

The solution isn't another dashboard. It’s a fundamental shift from reactive data collection to proactive, AI-powered intelligence. Think of it as evolving from a data historian to a strategic advisor.

Here's how the game has changed:

Old School vs Modern Account Research

| Attribute | Traditional Method (The Manual Tax) | Modern Method (AI-Powered Intelligence) |

|---|---|---|

| Process | Manual, repetitive data gathering | Automated, continuous signal monitoring |

| Output | Raw, disconnected data points | Actionable insights with context ("why it matters") |

| Timing | Reactive, often based on outdated info | Proactive, based on real-time events |

| AE Focus | Data collection and synthesis | Strategy, messaging, and building relationships |

| Efficiency | High time investment, low ROI | Low time investment, high strategic ROI |

By automating the grunt work, you can focus on the high-value conversations that close deals. Instead of spending your Sunday nights prepping, imagine getting real-time alerts that tell you what happened, why it matters to your deal, and how to use it to start a conversation.

This shift pays off. According to Outreach's Sales 2025 Data Report, 100% of AI-powered SDR users saved time, with nearly 40% saving 4-7 hours per week. That’s a full workday reclaimed every month.

To stay ahead, Enterprise AEs must leave these outdated methods behind. This guide is your new playbook for turning random account activity into a predictable pipeline.

See Salesmotion on a real account

Book a 15-minute demo and see how your team saves hours on account research.

Building Your Account Intelligence Framework

Effective account research is more than a few Google searches. It’s about building a systematic framework to catch the signals that matter.

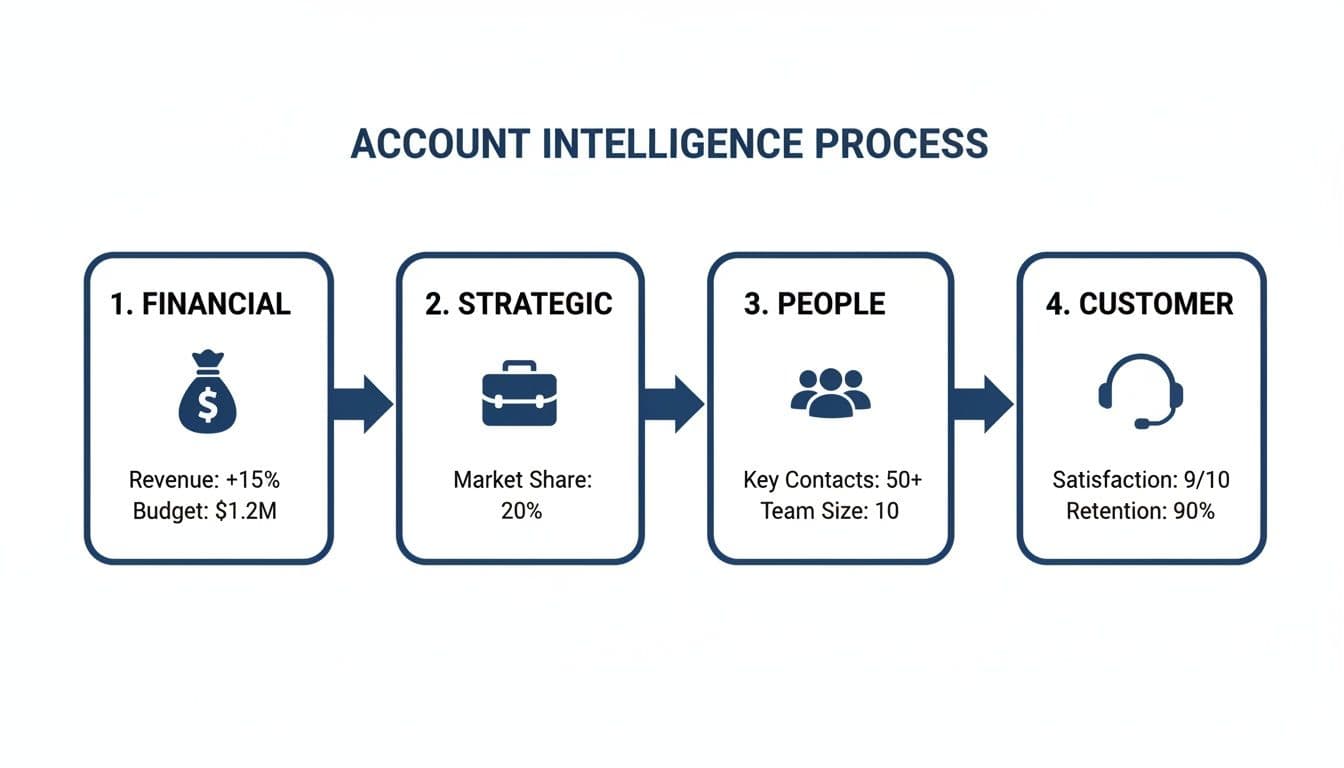

To move from information overload to strategic clarity, every Enterprise AE needs to monitor four key pillars of intelligence. This structure helps you turn noise into a compelling point of view for your outreach.

Think of it like building a legal case. You wouldn't walk into a courtroom with just one piece of evidence. You need multiple, corroborating data points to tell a convincing story. The same is true when you're trying to win a major account.

Financial Signals: Follow the Money

First, understand an account’s financial health and priorities. This isn't about becoming a stock market guru; it's about connecting their financial direction to pain points you can solve. Money dictates strategy, and strategic shifts create opportunities.

Key financial signals to watch:

- Earnings Calls and Reports: Listen for mentions of new investments, cost-saving initiatives, or challenges in specific business units. A CEO talking about “supply chain optimization” is your cue to bring up efficiency.

- Funding Announcements: For private companies, a new funding round is a massive trigger. It signals growth, expansion, and a fresh budget for new projects.

- Analyst Reports and Investor Days: These give you a third-party perspective on the company's strengths and weaknesses, often revealing priorities that don't make it into press releases.

These financial cues are the bedrock of your "why now" message. They provide hard evidence that a company has a compelling, budget-backed reason to talk to you right now.

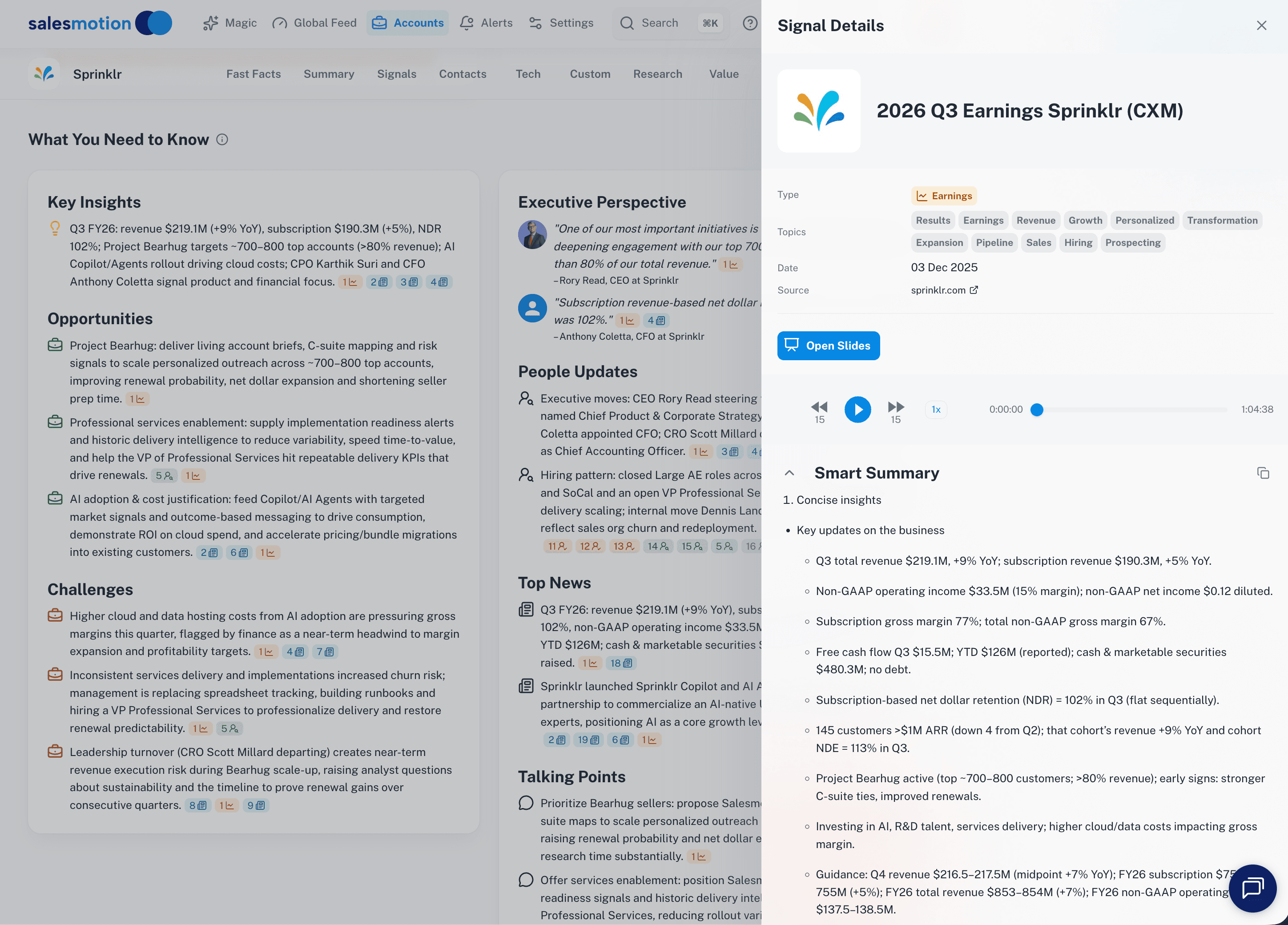

Salesmotion extracts and summarizes key strategic themes from earnings calls, giving AEs the financial context they need without hours of manual analysis.

Salesmotion extracts and summarizes key strategic themes from earnings calls, giving AEs the financial context they need without hours of manual analysis.

"A company's financial report is more than just numbers; it's their corporate diary. It tells you what they're proud of, what keeps them up at night, and where they're placing their bets. Your job is to read between the lines."

Strategic Signals: Understand the Mission

While financial signals tell you where the money is going, strategic signals tell you why. This pillar is about the company's public goals, initiatives, and market position. You need to understand their mission to align your solution with their vision.

Look for these strategic indicators:

- Press Releases and Major Announcements: Are they launching a new product line? Expanding into a new market? Announcing a major partnership? These events often require new tools and processes.

- New Company Initiatives: Watch for terms like "digital transformation," "sustainability goals," or "customer experience overhaul." These are high-level initiatives that create buying cycles across multiple departments.

For instance, a press release about a new sustainability initiative is a green light to contact the Head of Operations with a solution that improves efficiency. You're not just selling a product; you're helping them achieve a stated corporate goal.

A modern platform can help you cut through the noise and deliver these strategic insights directly to you.

This dashboard shows how platforms like Salesmotion can surface key signals like "IT services" and "consulting," letting you quickly grasp a company's strategic focus. Automating this research lets you spend less time searching and more time crafting a message that aligns with their mission.

People Signals: Follow the Talent

Enterprise deals are made by people, not companies. Monitoring personnel changes is one of the best ways to find an entry point. A new executive often means a new budget, a new strategy, and a mandate to make an impact—fast.

A new SVP of Engineering isn't just a personnel update; it's a sign of a potential technology review. They will likely evaluate their entire tech stack within the first 90 days.

- Executive Moves: A new C-level executive or VP is your number one trigger. They are brought in to drive change and are often more open to new ideas.

- Key Department Hires: Is the company hiring a dozen data scientists? That signals a major push into analytics. Are they building a new cybersecurity team? That points to a new security initiative.

Customer Voice Signals: Hear Their Story

Finally, understand the company from the outside in. What are their leaders saying in public forums? This is where you find the unscripted priorities that don't always make it into a press release.

- Podcasts and Interviews: Executives often share their biggest challenges and future plans more candidly in interviews.

- Conference Presentations: When a director presents at an industry event, they are showcasing their team's priorities and successes. This is a goldmine for understanding their metrics.

This four-pillar framework transforms your approach. To modernize your process, consider leveraging AI for modern marketing and sales to change how you analyze data. By interpreting these signals, you stop being just another salesperson and start becoming a trusted advisor.

“The talking points are gold. If they're in Salesmotion, I know they're being discussed inside that business. That makes it easy to spark a real conversation, which is 90 percent of the battle.”

Andrew Giordano

VP of Global Commercial Operations, Analytic Partners

Turning Research Insights into Revenue Opportunities

Collecting intelligence is only half the battle. Raw data doesn't create pipeline. It’s what you do with that data that builds trust and opens doors. Top-performing Enterprise AEs separate themselves by turning scattered signals into a cohesive, compelling story.

The goal isn't just to know what’s happening at an account. It’s to build a credible "why you, why now" narrative that resonates with executives. This means connecting your solution directly to their most pressing strategic initiatives.

This simple four-step flow is a great way to structure your account intelligence, moving from the big financial picture down to specific customer-level insights.

This process shows that a holistic view—combining financial health, strategic direction, key people, and customer feedback—is essential for crafting a message that lands.

Crafting Your "Why Now" Narrative

Every piece of research should help you answer one critical question for your prospect: "Why should I care about this right now?" A generic value prop won't cut it. You need a trigger—a specific event or signal—that creates a window of opportunity and gives you a legitimate reason to get in touch.

Think of it as building a case with solid evidence. A new product launch, a dip in quarterly earnings, or a new executive hire are all powerful triggers. They signal change, and change creates pain your solution can address.

For instance, say a company announces a major international expansion. Your trigger-based narrative could sound like this:

- The Trigger: Company X just announced its expansion into the APAC region.

- The Implied Pain: This expansion will create logistical hurdles, new compliance headaches, and the need to scale their infrastructure—fast.

- Your "Why Now" Message: "Saw the news about your APAC expansion—congratulations. When companies scale that quickly, managing cross-border data compliance becomes a major bottleneck. We helped [Similar Company] navigate this and cut their deployment time by 40%."

This approach shows you’ve done your homework and understand the unique pressures they're facing at this moment.

Integrating Research into a MEDDICC Framework

For AEs who use a structured sales methodology like MEDDICC, deep account research is the foundation. Each piece of your research strengthens your qualification process. Your intel turns MEDDICC from a checklist into a practical roadmap.

Here’s how your research translates:

- Metrics: That earnings call where the CFO mentioned a 5% drop in customer retention? That's your Metric. You can now quantify the cost of their problem and tie your solution's ROI to a number that matters to the C-suite.

- Economic Buyer: Digging into their annual report will reveal who owns the P&L for the problem you solve. You can then map the reporting structure to confirm who has the authority to sign off.

- Champion: Who is talking about the problem publicly? A director speaking on a podcast about "improving operational efficiency" is a prime candidate. They are already advocating internally for a solution, making them a potential champion.

This methodical approach ensures your sales efforts align with the customer's reality. It shifts your role from a vendor to a strategic partner.

A Real-World Scenario in Action

Let's walk through an example. Imagine you sell a cybersecurity platform, and your target is a mid-sized fintech company.

Your intelligence platform sends an alert: "FintechCorp just hired a new CISO, Jane Doe, from a major bank."

This single trigger kicks off a multi-threaded outreach sequence:

- Initial Research: You find that Jane's previous company was known for its strong security. Her LinkedIn shows a history of implementing forward-thinking security frameworks.

- Crafting the Outreach: Your message to Jane is specific: "Congrats on the new role at FintechCorp. Given your background at [Previous Company], I imagine you'll be evaluating your current security stack. Leaders in your position often focus on consolidating vendors in the first 90 days to improve visibility."

- Multi-Threading: You don't stop with the CISO. You research her team and find a new Director of Security Operations. Your message to him is different: "With Jane Doe coming on board, I'm sure there's a new mandate for improving security posture. My team put together a brief on how similar fintechs are tackling [specific problem] to meet new compliance standards."

This is how you turn one signal into a coordinated, value-driven strategy. To dig deeper into buying signals, check out our guide on B2B intent data.

The global CRM market is projected to hit $163.16 billion by 2030, a surge driven by AI integration. This growth is happening because most companies now compete on customer experience. For Enterprise AEs, using a CRM with integrated AI for account intelligence is no longer an advantage—it's a requirement. Platforms like Salesmotion deliver crisp alerts with context directly into Slack, email, and your CRM, turning it into a dynamic revenue engine. Discover more insights about CRM market growth on kixie.com.

Mastering Stakeholder Mapping and Multi-Threading

Enterprise deals are rarely won by a single person; they're won by a committee. Your success hinges on your ability to connect with the entire buying team. Focusing only on the C-suite is a recipe for a stalled deal. Real account research means mapping the entire organization to find your champions, influencers, and potential blockers.

This process, multi-threading, is non-negotiable in complex sales. It's about building genuine relationships at multiple levels and across different departments. A single point of contact is also a single point of failure—if that person leaves, your deal can evaporate overnight.

Moving Beyond the Obvious Contacts

Look past the usual suspects. While the CIO or CFO might be the economic buyer, the people who feel the pain you solve every day are often directors or managers. These are the people who can give you invaluable ground-level intelligence.

Let your research guide you. If you see a company is hiring data scientists, the Director of Analytics is a key person to know. Their priorities are likely centered on scaling infrastructure and improving data quality—pain points you can address.

Consider this scenario:

- The Signal: A target account’s VP of Operations mentions "improving supply chain visibility" in a podcast.

- The Obvious Contact: The VP of Operations.

- The Better Contacts: The Director of Logistics and the Senior Supply Chain Manager who report to that VP.

By engaging the Director and Manager, you can learn their specific day-to-day headaches. This intel lets you craft a much more powerful message for their VP, showing you have a deep understanding of their operational world.

Mapping the Influence Landscape

Once you identify key players, map their roles within the buying committee. This isn’t just about titles; it’s about influence.

You need to pinpoint:

- Champions: The people who will sell for you internally when you're not there. They understand the value and are willing to spend political capital to push your solution.

- Influencers: These individuals might not control the budget, but their opinions carry weight. Think of subject matter experts whose buy-in is essential.

- Blockers: Stakeholders who might resist change or have a favorite competitor. Finding them early is critical so you can build a strategy to win them over.

A simple way to track this is to build a stakeholder map in your CRM or a spreadsheet.

Every conversation should help you fill in the puzzle. Ask questions like, "Who else on the team would be involved in evaluating something like this?" or "Whose budget would this impact?" These questions help you build out your map and uncover hidden players.

This mapping process is dynamic. As you learn more, you'll refine your understanding of internal politics. The goal is to build a strong coalition of support. Effective champion tracking is a core skill for any AE, helping you focus your energy on the relationships that drive the deal forward.

Building a Multi-Threading Action Plan

With your stakeholder map, you can create a deliberate multi-threading plan. This ensures you build broad support and aren't reliant on one contact. Your plan should outline who to engage, what message will resonate, and the best channel to use.

An effective plan should include:

- Tiered Messaging: You need distinct value propositions for each stakeholder. The CFO cares about ROI, while the end-user cares about ease of use.

- Strategic Introductions: Ask your champion for a warm introduction to another key influencer. A friendly intro is always more powerful than a cold email.

- Consistent Engagement: Stay in regular contact with multiple stakeholders. Share relevant articles, invite them to webinars, or connect them with other customers.

This multi-threaded approach de-risks your deal. If one contact goes quiet, you have other avenues to keep the conversation—and your deal—moving forward.

“This is my singular place that very simply summarizes a company's top initiatives, strategies and connects them to my solution. Something I would spend hours researching manually, now it's automated.”

Derek Rosen

Director, Strategic Accounts, Guild Education

Your Pre-Meeting Prep Workflow: From Hours to Minutes

We’ve all been there: 30 minutes before a major call, frantically toggling between a dozen browser tabs, trying to stitch together a coherent point of view. It’s a chaotic scramble that kills your credibility before you even say hello.

Rushed prep leads to generic openings and missed opportunities. You might recall a headline but lack the depth to connect it to the stakeholder's role. This is where an efficient, intelligence-driven workflow separates the best from the rest.

From Frantic Searching To Automated Briefs

The old way of prepping was a manual, time-consuming hunt. You’d search for news, dig through their website, and scan LinkedIn profiles. It was messy and often yielded only surface-level information.

Modern tools flip this dynamic. Instead of you hunting for information, the right information finds you. An AI-powered platform like Salesmotion can automatically generate a comprehensive account brief in minutes, pulling all critical intelligence into one actionable document. For a structured approach to building these briefs, see our executive briefing template.

This brief becomes your single source of truth, covering top initiatives, recent news, and a rundown of stakeholders. What used to take hours becomes a quick, focused review, freeing you up to think about strategy.

The 15-Minute Meeting Prep Checklist

With an automated brief, your pre-call workflow becomes a simple, repeatable checklist. This isn’t about glancing at data; it’s about internalizing key points so you can guide the conversation with confidence.

Here’s what every Enterprise AE should know before dialing in.

| Checklist Item | Key Question to Answer | Where to Find the Info (Modern Way) |

|---|---|---|

| Top Strategic Initiatives | What are the company's 2-3 biggest corporate goals right now? (e.g., global expansion, cost reduction) | Automated brief, sourced from earnings calls and investor presentations. |

| Recent Key News | What significant events (product launches, partnerships) happened in the last 30-60 days? | Real-time news alerts pushed to your Slack or email with source links. |

| Primary Stakeholders | Who is on the call, what are their roles, and what are their likely priorities based on their function? | Auto-generated stakeholder map with insights from LinkedIn and interviews. |

| Tailored Talk Tracks | What are 2-3 research-backed opening lines or questions that show you've done your homework? | Generated talk tracks in the account brief, tied directly to recent signals. |

| Potential Risks/Pains | Based on the signals, what are their most likely business challenges you can address? | AI-synthesized summary of potential pains mentioned in public statements. |

This structured approach ensures you never walk into a meeting cold. You have the context needed to ask smarter questions and prove you’re a partner, not just another vendor.

Your goal isn't just to recite facts. It's to use those facts to build a bridge between their stated problems and your proposed solution. The automated brief gives you the building materials.

Crafting a Powerful Opening

How you open the call sets the tone. A powerful, research-backed opening instantly establishes your credibility. It proves you’re a strategic partner who invested time to understand their business.

Ditch the generic, "Thanks for your time, tell me about your challenges." Instead, try something grounded in your research.

Example Talk Tracks:

- For a VP of Operations: "I saw your CEO's comments in the Q3 earnings call about optimizing your supply chain. When we've seen companies make similar pushes, managing data integration often becomes a key hurdle. Is that on your radar?"

- For a new CIO: "Congratulations on the new role. I noticed you hired several new directors in cybersecurity. With that focus on scaling your security team, how are you thinking about vendor consolidation to improve visibility?"

This type of opening is a game-changer. It shows you understand their world, respect their time, and have a clear point of view. It’s the result of a modern, efficient pre-meeting workflow that takes minutes, not hours.

Key Takeaways

- The "manual research tax" of hours spent digging through news, LinkedIn, and earnings reports is the single biggest drag on enterprise AE productivity and can be eliminated with AI-powered intelligence.

- A four-pillar intelligence framework covering financial signals, strategic signals, people signals, and customer voice signals gives you a complete, multi-dimensional view of any target account.

- Every piece of research should help you build a credible "why you, why now" narrative that connects a specific trigger event to a pain point your solution addresses.

- Multi-threading across champions, influencers, and potential blockers is non-negotiable in complex enterprise deals where a single point of contact is a single point of failure.

- An automated pre-meeting brief that surfaces top initiatives, key stakeholders, and tailored talk tracks can compress hours of manual prep into a focused 15-minute review.

Your Account Research Questions, Answered

Even with the best game plan, practical hurdles come up. Let's tackle the most common questions from Enterprise AEs doing account research.

How Much Research Is Really Enough Before That First Email?

It depends, but it's probably less than you think. Your goal isn't to become the world's leading expert on the company overnight. It’s to find one compelling trigger and a credible point of view. You just need enough ammo to build a relevant "why you, why now" story.

I recommend the "3x3 rule": find three key insights in three minutes. That’s it.

This could be:

- A recent C-level hire.

- A key strategic initiative from their last earnings call.

- A public statement from a department head about a specific challenge.

Once you have that single, powerful hook, you have enough to start a conversation. Don't fall into the "analysis paralysis" trap. Get in, get your insight, and get out.

What If My Target Account Is A "Black Box" With No Signals?

True, not every company is public about its plans. Private companies or those in less-publicized industries can be tough to crack. When public signals are quiet, pivot your strategy and focus on people signals.

Start digging into hiring trends on LinkedIn. Is the company suddenly building out a new data science team? That tells a story their website won't. Look for employees speaking at smaller industry conferences or appearing on niche podcasts. These appearances often give you more candid insights than a polished corporate press release.

When the external company signals go dark, zoom in on the people. A single job description for a new role can reveal more about a company's true priorities than its own marketing materials.

How Do I Keep All This Research Organized Across Dozens Of Accounts?

Trying to manage this with spreadsheets and sticky notes is a recipe for disaster. This is where technology becomes essential. The only way to scalably manage research across a large territory is with a dedicated account intelligence platform.

These tools are your central nervous system for your territory, automatically tracking signals and organizing them by account. You can set up custom alerts for your top-tier accounts, making sure you never miss a critical trigger. This shifts research from a manual chore to a streamlined, automated workflow, freeing you up to sell.

How Often Should I Refresh My Research On An Account?

Account research is not a one-time task. It’s a living process. A company’s priorities can pivot in a single quarter.

For your top 10-15% of target accounts, check for new signals weekly. For the rest of your territory, a monthly or quarterly refresh is a reasonable cadence. The modern way to handle this is through automated, real-time alerts. A platform that pushes notifications to you when something important happens means your research is always fresh, without you having to search for it.

Frequently Asked Questions

How much time should an enterprise AE spend on account research per deal?

For a first touch, the "3x3 rule" works well: find 3 key insights in 3 minutes. For major enterprise deals, deeper research before a discovery call should take no more than 15 to 20 minutes when you have an automated account brief. The goal is to find one compelling trigger and a credible point of view, not to become the world's leading expert on the company overnight.

What are the best free sources for enterprise account research?

LinkedIn for people signals, Google News alerts for company events, and SEC filings for public companies' financial priorities are the strongest free sources. Podcast appearances and conference presentations by target account executives are also goldmines for unscripted insights into their challenges and goals. These free sources give you a solid foundation even before investing in dedicated intelligence platforms.

How do I research a private company that does not file public earnings reports?

Focus on people signals and strategic signals instead of financial ones. Monitor hiring trends on LinkedIn, track press releases and partnership announcements, and look for executive appearances on industry podcasts. Job postings are especially valuable for private companies because they reveal tech stack, team structure, and strategic priorities that the company would not otherwise publicize.

How often should I refresh my research on a top-tier account?

For your top 10 to 15 percent of target accounts, check for new signals at least weekly. For the rest of your territory, a monthly or quarterly refresh is reasonable. The most efficient approach is to use automated real-time alerts that push notifications when something important happens, so your research stays current without requiring manual effort.

Stop wasting hours on manual research and start building pipeline with actionable intelligence. Salesmotion delivers real-time account signals and automated meeting briefs directly into your workflow, so you can focus on what you do best: selling. See how Salesmotion can transform your account research process.