Your pipeline coverage is the fuel gauge for your sales engine. It’s a simple ratio that tells you if you have enough qualified deals in your pipeline to hit your quota. Think of it as the foundation for predictable revenue and accurate forecasting.

What Is Sales Pipeline Coverage and Why It Matters

Let's keep it simple. If your sales quota is a destination, your pipeline is the fuel in your tank. Pipeline coverage tells you if you have enough gas to get there.

A ratio of 1x means you have to win every single deal to make your number—an unrealistic and stressful scenario. A healthier ratio, like 3x or 4x, gives you a necessary buffer, because let's face it, not every deal closes.

This metric is more than just a number. It's a critical health check for your sales operation. It moves your team from reactive, end-of-quarter scrambling to proactive, strategic planning.

The Problem with a "Full" Pipeline

A pipeline packed with deals feels productive, but volume alone can be a dangerous illusion. A bloated pipeline often hides major problems that can derail your quarter.

- Low-Quality Leads: Many "opportunities" might be unqualified, wasting valuable time and resources.

- Stalled Deals: Some deals have gone cold, artificially inflating your numbers without any real chance of closing.

- Inaccurate Forecasting: Without understanding your true coverage, revenue forecasts become pure guesswork.

This is where pipeline coverage brings clarity. It forces you to look beyond the total dollar value of your deals and start considering their quality and the actual likelihood of them closing.

A healthy pipeline coverage ratio isn't about having the most deals; it’s about having the right amount of qualified deals to ensure you consistently meet and exceed your targets.

To get a handle on the key terms, this table breaks down the core components of the pipeline coverage metric.

Core Components of Pipeline Coverage at a Glance

| Component | Definition | Why It's Important |

|---|---|---|

| Sales Pipeline | The total value of all active, qualified opportunities currently being worked on by your sales team. | This represents the raw potential revenue your team is pursuing. |

| Sales Quota | The revenue target that a salesperson or team is expected to achieve within a specific period (e.g., a quarter). | This is the finish line—the number you're aiming to hit. |

| Coverage Ratio | The result of dividing the total value of your sales pipeline by your sales quota. | This simple ratio provides an instant health check on your ability to meet your revenue goals. |

Understanding these pieces is the first step. Putting them together is what unlocks real strategic insight.

From Jargon to Practical Insight

Getting a firm grip on your pipeline coverage is the first step toward building a predictable revenue machine. It helps you answer the critical questions that drive your sales strategy.

Do we need to generate more leads? Is our qualification process strong enough? Are our sales targets realistic?

To see how pipeline coverage fits into the bigger picture, you can learn more about sales pipeline management and see how all the pieces connect.

This concept isn't just for sales leaders. It's a vital tool for every account executive. For benchmarks and formulas, read our deep dive on healthy pipeline coverage. A clear view of your individual pipeline coverage helps you manage your time effectively and focus on the activities that will have the biggest impact on hitting your number. You can dive deeper into the structure of a successful sales funnel by checking out our guide on sales pipeline stages.

See Salesmotion on a real account

Book a 15-minute demo and see how your team saves hours on account research.

Calculating Your Pipeline Coverage Ratio

Calculating your pipeline coverage ratio isn't complex math—it's about getting an honest look at where your sales team stands. The calculation is simple and gives you an instant snapshot of your sales health. Let's break down the formula and see how it works in the real world.

The basic formula is straightforward:

Pipeline Coverage Ratio = Total Qualified Pipeline Value / Sales Quota

This tells you how many times your current pipeline "covers" your revenue target. For instance, if your quarterly sales quota is $250,000 and your total qualified pipeline is $750,000, your pipeline coverage ratio is 3x ($750,000 / $250,000).

This means you need to win one-third of your pipeline's total value to hit your goal. It's a powerful starting point for knowing if you have enough fuel in the tank.

What “Qualified Pipeline” Really Means

The secret to an accurate number hinges on one word: qualified. If you add up every lead that ever showed a flicker of interest, you'll get a dangerously inflated number and a false sense of security.

A qualified pipeline only includes opportunities that have been properly vetted. This means the prospect has a clear need, a real budget, the authority to buy, and a realistic timeline (often captured in frameworks like BANT or MEDDIC). Sticking to genuinely qualified deals ensures your ratio reflects reality, not wishful thinking. A bloated, unqualified pipeline is the fastest way to miss your target.

Bringing the Calculation to Life with Examples

To see how this works in practice, let's look at a few scenarios. Your business context—from typical deal size to sales cycle length—directly shapes how you should interpret the numbers.

1. The Ambitious Startup

A SaaS startup has a quarterly quota of $100,000. Their team has built a pipeline of qualified deals totaling $400,000.

- Calculation: $400,000 (Pipeline) / $100,000 (Quota) = 4x Coverage

- Interpretation: For a startup, this is a healthy spot. It provides a solid buffer for a lower-than-average win rate, which is common when a company is still finding its place in the market. To learn more, check out our guide on how to calculate your win rate and see how it connects to your coverage needs.

2. The Scaling Mid-Market Team

A mid-market company with a proven sales process has a quarterly team quota of $1,000,000. Their qualified pipeline is $2,500,000.

- Calculation: $2,500,000 (Pipeline) / $1,000,000 (Quota) = 2.5x Coverage

- Interpretation: While lower than the startup's ratio, this might be perfectly fine. This team likely has a higher, more predictable win rate. Still, a 2.5x ratio doesn't leave much room for error. It’s a signal that pipeline generation needs to remain a top priority.

3. The Enterprise Sales Division

An enterprise team is chasing a $5,000,000 annual quota. Their pipeline consists of fewer, larger deals totaling $17,500,000.

- Calculation: $17,500,000 (Pipeline) / $5,000,000 (Quota) = 3.5x Coverage

- Interpretation: For enterprise sales, where deals are long and complex, a 3.5x ratio provides a necessary cushion. Because these deals can take months or even years to close, a higher coverage ratio is essential for reliable forecasting.

By applying this simple formula to your own business, you can move past guesswork and start making data-driven decisions.

“Consolidation of prospect company information that I can use frequently to be way better informed when I'm doing my outbound, preparing for a meeting, or building relationships. Ease of use and Customer Support is excellent.”

Werner Schmidt

CEO & Co-Founder, Lative

How to Set the Right Pipeline Coverage Target

So, you've calculated your pipeline coverage ratio. Now what? The big question is, "Is my number any good?" It’s easy to chase a magic, one-size-fits-all number, but the reality is, there isn't one. The right target depends on your business.

Your average sales cycle length, historical win rates, and typical deal size are the real drivers. A team selling transactional products might be fine with 2x coverage. An enterprise team navigating nine-month sales cycles will probably need 4x or 5x coverage to feel secure.

The goal is to stop chasing generic benchmarks and set a data-driven target that reflects how your team actually sells.

Reverse-Engineering Your Target from Your Win Rate

The smartest way to set a pipeline coverage target is to work backward from your historical win rate. This grounds your goal in what your team has actually accomplished, not just industry chatter.

The logic is simple. If your team has a historical win rate of 25%, you know you close one out of every four qualified deals. To hit your quota, you’ll need at least four times that quota value in your pipeline.

Your Ideal Pipeline Coverage = 1 / Your Historical Win Rate

This formula gives you a clear, defensible starting point. A 20% win rate means you need 5x pipeline coverage. An efficient team closing at 50% might only need 2x. It's a direct reflection of your sales process's effectiveness.

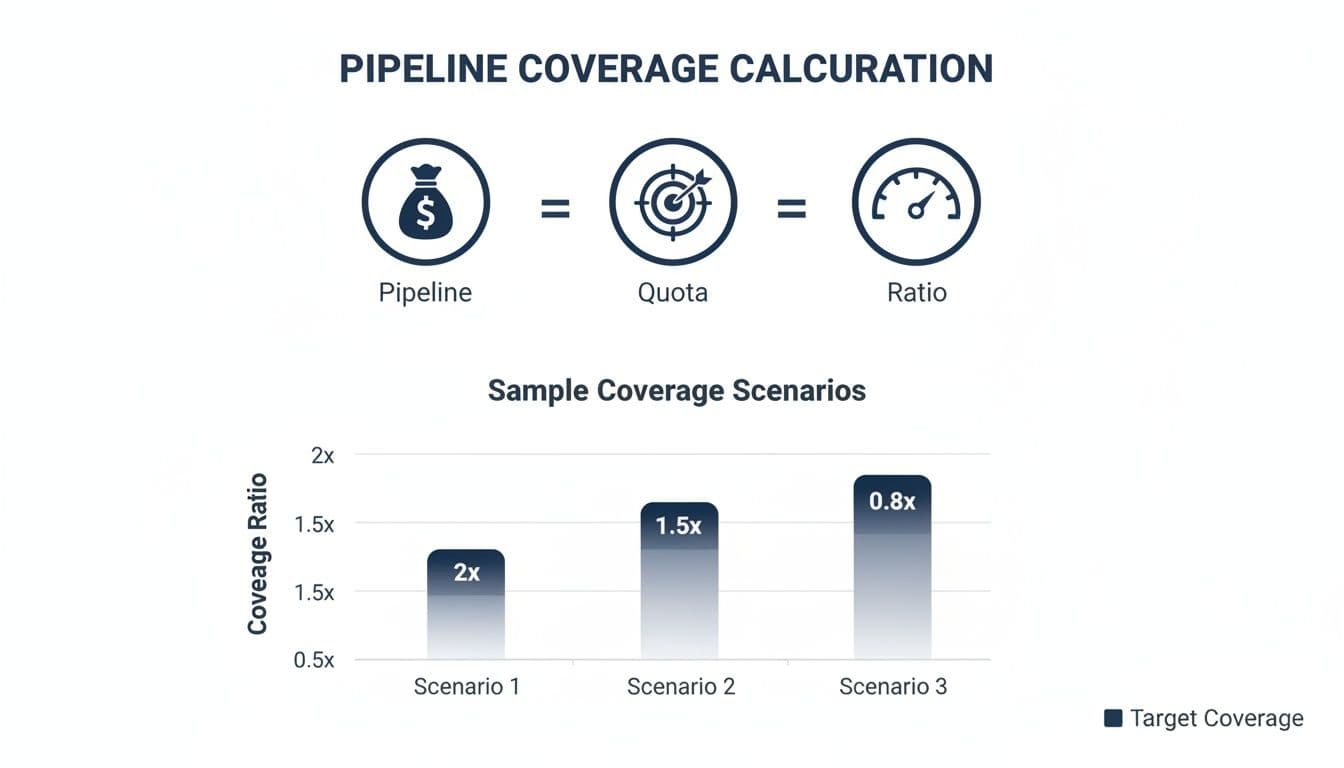

The breakdown below shows how these pieces fit together. It’s all about the relationship between the pipeline you build and the quota you need to hit.

This visual reinforces the core idea: pipeline coverage directly links the opportunities you create to the revenue you need to deliver.

Considering Sales Cycle Length and Deal Size

While your win rate is the main ingredient, a few other factors add crucial context. Your sales cycle length is a big one.

- Short Sales Cycles (Under 60 days): Teams that close deals quickly can often operate with lower coverage. They can generate and close new pipeline within the same quarter, giving them more flexibility.

- Long Sales Cycles (6+ months): Enterprise teams with long sales cycles need much higher coverage. The pipeline you start the quarter with is largely what you have to work with, so building a solid buffer is non-negotiable.

Your average deal size also plays a role. A pipeline full of small deals means you'll need more of them—and therefore higher coverage—to hit a big quota. Conversely, a couple of "whale" deals can make your coverage look great, but they also add risk if one stalls. Getting this balance right is key, which is why we have guides on setting powerful sales goals and how top teams set targets.

Using Industry Benchmarks as a Guidepost

Your own data is king, but industry benchmarks can be a helpful sanity check. Think of them as guideposts, not rigid rules.

A good way to start is by looking at benchmarks through the lens of your sales model and cycle length. Different go-to-market motions have different win rates and require different levels of pipeline coverage.

Benchmark Pipeline Coverage Ratios by Sales Cycle

| Sales Model / Cycle Length | Typical Win Rate | Recommended Coverage Ratio | Industry Example |

|---|---|---|---|

| Transactional / < 30 Days | 30-40% | 2.5x - 3.5x | SMB SaaS, self-serve upgrades |

| Mid-Market / 30-90 Days | 25-35% | 3x - 4x | Marketing automation, HR software |

| Enterprise / 90-180 Days | 20-25% | 4x - 5x | CRM platforms, cloud infrastructure |

| Strategic / > 180 Days | 10-20% | 5x - 6x+ | ERP systems, large-scale digital transformation |

These numbers provide a general framework. If your win rate for a six-month enterprise sales cycle is only 15%, a 4x pipeline coverage target is likely too low. Use these benchmarks to ask the right questions and refine the target you calculated from your own win rate.

Ultimately, setting the right target is about building a strategic plan for consistent, predictable revenue.

Diagnosing Common Pipeline Coverage Problems

Think of a low pipeline coverage ratio as a warning light on your dashboard. It tells you something is wrong, but not what. A low number is just a symptom; the real problem is deeper in your sales process.

To figure out what’s going on, you have to look past the numbers. Is there a specific stage where good deals consistently stall?

By spotting the usual suspects, you can pinpoint the root cause and take targeted action instead of just shouting, "We need more leads!" This is how you build a resilient sales engine.

The Lumpy Pipeline

One of the sneakiest problems is the lumpy pipeline. This is where your overall coverage ratio looks great, but it’s propped up by one or two massive "whale" deals.

A 3.5x coverage ratio feels like a win. But if a single, huge deal makes up half that value, your pipeline is fragile. If that one big deal slips or is lost, your entire forecast implodes.

A lumpy pipeline creates a false sense of security. True pipeline health comes from a balanced mix of deal sizes, ensuring the loss of any single opportunity doesn't derail your revenue forecast.

This often points to inconsistent prospecting. Building a healthy mix of small, medium, and large deals is the only way to create predictable success.

The Stalled Pipeline

Another classic culprit is the stalled pipeline, where deals enter but never leave. These "zombie deals" have been sitting in the same stage for months with no signs of life.

They artificially inflate your pipeline coverage, making the numbers look better than they are. A pipeline full of stale opportunities signals a few underlying problems:

- Weak Qualification: The deals were never a good fit, and reps are holding on out of hope.

- Lack of Urgency: The salesperson hasn't built a compelling case for why the prospect needs to act now.

- Poor Deal Management: There’s no clear plan with defined next steps to move the deal forward.

The cure is regular pipeline hygiene. Set up rules in your CRM to flag or archive deals that have been inactive for a set period, like 45-60 days. This forces honest conversations about which deals are real and which are just clutter.

The Bloated Pipeline

Finally, there's the bloated pipeline, a direct result of weak qualification standards. Your pipeline is full, but it’s stuffed with low-quality leads that have almost no chance of closing.

This is common when sales development reps (SDRs) are paid for the quantity of meetings they book, not the quality of opportunities. It’s a massive time-waster for your account executives, who end up sifting through unqualified prospects instead of focusing on deals they can actually win.

Just as the energy sector uses tech to keep physical pipelines healthy, sales leaders need to monitor their sales funnels with the same discipline. In fact, the market for pipeline monitoring systems is expected to grow from USD 2.73 billion in 2025 to USD 5.34 billion by 2034, driven by the need for efficiency. You can learn more in the latest pipeline monitoring system market report on custommarketinsights.com.

Diagnosing these common issues is the first step toward a solution. Once you know what’s wrong with your pipeline coverage, you can prescribe the right fix.

“All of the vendors that I've worked with, all of the onboarding that I have had to deal with, I will say, hands down, Salesmotion was the easiest that I have had.”

Lyndsay Thomson

Head of Sales Operations, Cytel

Actionable Strategies to Improve Pipeline Coverage

Diagnosing the problem is one thing; fixing it is another. Improving your pipeline coverage isn't about a single magic bullet. It’s about making smart, targeted improvements across your entire sales motion.

Think of your sales process as an assembly line. A weak link at any station slows the whole thing down. By strengthening each part, you create a more efficient system for generating predictable revenue. Let's break down the key areas for impact.

Sharpen Your Lead Qualification Process

The fastest way to boost pipeline coverage is to stop wasting time on deals that were never going to close. A bloated pipeline of junk leads creates a false sense of security and burns your team's time.

A structured qualification framework is non-negotiable. Frameworks like MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion) or BANT (Budget, Authority, Need, Timeline) force reps to ask the tough questions early. This step ensures every opportunity in your pipeline has been properly vetted and has a realistic shot at closing.

By prioritizing quality over quantity at the top of the funnel, you improve your win rate and reduce the overall coverage you need to hit your target.

Diversify Your Prospecting Channels

Putting all your eggs in one prospecting basket is a recipe for disaster. If inbound leads dry up or an outbound tactic stops working, your pipeline generation grinds to a halt. The key to consistency is a balanced, multi-channel approach.

A healthy mix of sources protects you from market shifts and keeps your pipeline full. Aim for a solid blend of these channels:

- Targeted Outbound: Personalized email sequences, strategic cold calling, and social selling on platforms like LinkedIn. These efforts put you in control.

- Inbound Marketing: Content, SEO, and paid ads attract prospects who are already looking for a solution like yours, leading to higher-quality conversations.

- Partnerships and Referrals: Tapping into your network of customers and partners can be a powerful source of warm, high-intent introductions.

Diversification creates a stable foundation for growth. For a deeper dive, check out our guide on outbound lead generation.

Boost Sales Process Efficiency

Sometimes the problem isn't a lack of opportunities—it's a leaky bucket. Inefficiencies in your sales process can cause good deals to stall and fall through the cracks, wrecking your pipeline coverage. Boosting efficiency is about making it easier for your reps to sell.

Start with your CRM. Is it a helpful tool or a chore? Enforcing strong CRM discipline is essential. This means every deal has clear next steps, accurate close dates, and detailed notes. When your data is clean, you can spot bottlenecks and coach your team effectively.

Streamlining administrative tasks is another huge win. Sales reps spend a shocking amount of time on non-selling activities like manual data entry. Automating these tasks frees them up to do what they do best: talk to prospects and close deals.

Implement Targeted Sales Coaching

Your sales team is your greatest asset. Targeted coaching can sharpen their skills where they're struggling. Forget generic training; use data to pinpoint weaknesses and provide personalized guidance.

Use your pipeline data to identify coaching moments:

- Stalled Deals: If a rep's deals consistently get stuck in one stage, they may need coaching on negotiation or demonstrating value.

- Low Conversion Rates: A low conversion rate from discovery to demo could signal a need for better qualification techniques.

- Inconsistent Prospecting: If a rep struggles to build their pipeline, they may need help with time management or outreach strategies.

Regular, data-driven coaching transforms managers from forecasters into performance multipliers. By continuously leveling up your team, you build a more effective sales force that can manage a healthier pipeline.

Key Takeaways

- Pipeline coverage is the ratio of total pipeline value to your revenue target. A healthy ratio, typically between 3x and 5x, indicates you have enough opportunities to absorb natural deal attrition and still hit your number.

- The right coverage target depends on your historical win rate, average deal size, and sales cycle length. A blanket 3x rule can be misleading without adjusting for your team's actual conversion data.

- Common pipeline problems include top-heavy funnels filled with unqualified leads, stalled deals that inflate coverage numbers, and inconsistent prospecting that creates feast-or-famine cycles.

- Data-driven coaching, using coverage metrics to diagnose individual rep challenges, transforms sales managers from passive forecasters into active performance multipliers.

- Account intelligence platforms accelerate pipeline growth by replacing manual research with automated signal detection, helping teams engage the right accounts at the right time.

Using Account Intelligence to Accelerate Pipeline Growth

Trying to manually build enough pipeline to hit your coverage targets is a slow grind. What if you could stop guessing and start talking to accounts that are actively looking for a solution like yours right now? This is where account intelligence platforms change the game.

These tools are a force multiplier for your sales team. They shift your strategy from high-volume outreach to precise, insight-driven engagement. This smarter approach is one of the most effective ways to improve your pipeline coverage, because you’re focusing only on the highest-quality opportunities.

From Manual Research to Real-Time Signals

Instead of your team spending hours on manual research, imagine them getting real-time alerts about your target accounts. Account intelligence automates this discovery process, monitoring a massive range of signals to find the triggers that mean an opportunity is emerging.

This isn't just basic company info. Real account intelligence finds the critical "why now" moments that create urgency.

- Buying Intent Signals: Pinpoint which accounts are researching your competitors or related keywords, showing they are already in-market.

- Technology Usage Data: Identify companies using complementary or outdated tech that makes them a perfect fit.

- Key Personnel Changes: Get an alert when a past champion moves to a new target account, giving you a warm path in.

These insights let your team prioritize their time with surgical precision, engaging the best-fit accounts at the exact moment they're most receptive.

Account intelligence transforms pipeline generation from an art into a science. By replacing manual effort with automated insights, you can consistently fill your funnel with more qualified opportunities, directly boosting your pipeline coverage.

Turning Insights into Opportunities

The real power of account intelligence is how it helps your team connect signals to a specific business pain. For example, a spike in hiring for data scientists at a target company signals a growing investment in analytics—a perfect opening to position your data visualization software.

By using a platform like Salesmotion, reps can move beyond generic outreach and lead with context. This targeted approach doesn't just increase response rates; it accelerates the sales cycle because you’re starting conversations with accounts that already have a recognized need. Ultimately, that means a healthier, more robust pipeline that helps you consistently smash your coverage targets.

Ready to stop guessing and start building a predictable, high-quality pipeline? Salesmotion's account intelligence platform gives your team the real-time signals they need to focus on the best opportunities at the perfect time. Learn how to accelerate your pipeline growth with Salesmotion.

Frequently Asked Questions

What is a good pipeline coverage ratio?

There is no universal magic number. The right target depends on your historical win rate, average deal size, and sales cycle length. As a general benchmark, transactional sales teams may be fine with 2.5x to 3.5x coverage, mid-market teams typically need 3x to 4x, and enterprise teams with long sales cycles often require 4x to 5x or higher.

How do you calculate pipeline coverage?

The formula is straightforward: divide your total qualified pipeline value by your sales quota. For example, if your quarterly quota is $250,000 and your qualified pipeline is $750,000, your coverage ratio is 3x. The critical word is "qualified," meaning only properly vetted opportunities with a realistic chance of closing should be included.

How often should a sales team check pipeline coverage?

Do a deep-dive analysis weekly, but a quick daily check is a smart habit for individual reps. Think of it as a pulse check that keeps you from being blindsided by a sudden gap and helps you spot trouble before it becomes a major problem for the quarter.

Do MQLs count toward pipeline coverage?

Marketing Qualified Leads do not count toward pipeline coverage directly. An MQL only enters your coverage calculation after a sales rep has qualified it and converted it into a sales-accepted opportunity with a real dollar value attached. Pipeline coverage measures confirmed, qualified opportunities, not raw lead potential.

What causes a pipeline that looks healthy but still misses quota?

Three common culprits are a lumpy pipeline propped up by one or two massive deals, a stalled pipeline full of zombie deals that have been sitting in the same stage for months, and a bloated pipeline stuffed with low-quality leads that have almost no chance of closing. Each artificially inflates your coverage ratio and creates a false sense of security.

How should a new sales team set pipeline coverage targets without historical data?

Start with industry benchmarks, aiming for a 3x to 4x coverage ratio for your first one or two quarters. Track every opportunity meticulously, including wins and losses. After your first quarter, calculate your actual win rate and use the formula (1 divided by your win rate) to set a more accurate, data-driven coverage target going forward.