For B2B sales teams prospecting into pharmatech, the best way to find clinical trials isn’t just about combing through public registries. It's about spotting real-time signals that show a company is ready to buy. Every new trial, phase progression, or funding announcement is a buying signal, creating the perfect window for smart outreach.

The Untapped Goldmine in Clinical Trial Data

If you sell into Life Sciences, clinical trial data is more than just research—it's a detailed roadmap to your next big deal. While competitors send generic emails from stale lists, you can pinpoint the exact moment a biotech company urgently needs your services. For hands-on outreach tactics, see our guide to cold outreach to biotechs, whether it's data management, patient recruitment, or specialized lab equipment.

Every milestone tells you about a company's immediate priorities.

A new Phase II trial for an oncology drug means a specific set of needs. A protocol amendment signals a potential problem you can solve. This is the difference between cold prospecting and intelligent engagement.

From Public Data to Actionable Insights

The problem isn't a lack of information; it's the overwhelming noise. Public databases are huge, but they're static. The edge comes from turning data points into actionable sales triggers. Stop simply looking for trials and start identifying the commercial intent behind them.

This guide helps you move past sifting through registries and start using trial milestones as 'why now' triggers for outreach. Platforms like Salesmotion are built to automate this, spotting trial updates, progress reports, and other critical signals your team can act on instantly.

A Real-World Example with Cytel

Let's look at Cytel, a leader in statistical software for clinical trial design. Their team needed to connect with biotech companies at the precise moment they started planning new trials. Instead of guessing, they used Salesmotion to track key triggers—like Series A funding or new clinical leadership hires.

When a target company announced funding for a new Phase I trial, the sales team didn't just see a name on a list. They got an automated brief with everything they needed:

- The key stakeholders involved

- The specific goals of the new trial

- Tailored talking points to make their outreach instantly relevant

This intelligence let them craft a message that resonated, positioning their software as essential for that trial phase. By using the right tools, they turned a data point into a pipeline opportunity. Doing this consistently is core to modern sales, as detailed in guides on market intelligence software. This approach shortens sales cycles and improves win rates in the hyper-competitive pharmatech world.

See Salesmotion on a real account

Book a 15-minute demo and see how your team saves hours on account research.

Why Traditional Prospecting Fails in Pharmatech

Relying on public registries like ClinicalTrials.gov to find new sales opportunities is like navigating a city with an old map. You see the major landmarks, but you're always a step behind what’s actually happening.

For B2B sales teams in pharmatech, this delay is everything. It’s the difference between winning a deal and showing up after key vendor decisions have been made.

These databases are dense, slow to update, and stripped of the commercial context you need. This forces your team to pay a heavy "manual research tax"—burning hours digging through entries, trying to guess which ones are timely opportunities. By the time a trial's status is officially updated, the sponsor has likely already locked in their key vendors.

The Problem with Lagging Indicators

Manual prospecting is reactive. You're always looking in the rearview mirror, seeing what has already happened, not what’s about to.

Here's a typical screenshot from ClinicalTrials.gov, the most common starting point for manual research.

While it's a huge repository of data, it requires you to know exactly what you're looking for and offers zero clues about purchasing intent or urgency. You're stuck sifting through lagging indicators instead of acting on real-time intelligence.

The global clinical trials market is growing fast, projected to expand at a CAGR of 7.48% from 2025 to 2033, hitting USD 158.41 billion by 2033. For teams stuck with outdated methods, that growth just means more missed opportunities. You can get a deeper look at the latest clinical trial statistics and trends on xtalks.com.

Manual Prospecting vs Signal-Based Intelligence

The difference is stark. One is about digging through archives; the other is about getting real-time alerts. A platform like Salesmotion is built to spot the earliest whispers of commercial activity—protocol updates, progress reports, and other buying signals—long before they become common knowledge.

This is exactly what the team at Cytel needed. Instead of manually combing through registries, they used Salesmotion to spot early signals like new funding rounds or key leadership changes. This let them engage with precision and relevance, positioning themselves as the perfect solution right when the need arose.

By focusing on buying signals instead of static database entries, you shift from "Are they running a trial?" to "Why do they need my help with this trial right now?" This transforms your outreach from a cold interruption into a timely, valuable conversation.

Let’s break down the two workflows.

Manual Prospecting vs Signal-Based Intelligence

| Attribute | Manual Prospecting (e.g., ClinicalTrials.gov) | Signal-Based Intelligence (Salesmotion) |

|---|---|---|

| Timing | Reactive (based on lagging, public data) | Proactive (based on real-time buying signals) |

| Data Context | Lacks commercial intent and buying urgency | Rich with "why now" context and stakeholder info |

| Efficiency | High manual effort, time-consuming research | Automated alerts delivered into your workflow |

| Relevance | Generic outreach based on broad criteria | Hyper-relevant messaging tied to specific events |

Ultimately, trying to find clinical trials through public registries alone is inefficient. A signal-based approach closes the gap between public information and genuine commercial opportunity, empowering you to act on insights, not just data.

“Salesmotion has been a game-changer for me. I used to spend 12 hours a week on prospect research, now it's down to 4. Plus I'm finding stuff I was totally missing - podcasts, news mentions, the good bits.”

George Treschi

Account Executive, FY25 President's Club, Sigma

Using AI to Uncover Hidden Sales Opportunities

Modern sales teams need an edge. In pharmatech, that edge comes from AI-powered account intelligence. It’s about shifting from manually trying to find clinical trials to automatically spotting the events that signal "buying intent."

This is how you move faster and with more relevance than your competition.

Imagine getting a real-time Slack alert the moment a target account kicks off a new trial, lands fresh funding, or hires a new Head of Clinical Operations. That’s how platforms like Salesmotion are changing the game for B2B revenue teams.

Beyond Scraping Public Registries

Instead of scraping public registries weeks after the fact, our AI constantly monitors diverse sources: press releases, investor calls, executive LinkedIn updates, and industry news.

The system doesn't just find a signal; it interprets it. This gives you the crucial context you need to act immediately. A funding announcement tied to a Phase II oncology trial tells you the company has fresh capital and an immediate need to support that therapeutic area. That's your cue to engage with a tailored solution.

Translating AI Signals into Actionable Outreach

The real magic is connecting disparate information into a coherent story sales teams can use. It’s not just about data collection; it’s about synthesis.

Here's how it works:

- Signal Detection: The AI flags a "New Trial Initiation" for a target biotech company.

- Contextual Analysis: It simultaneously identifies the therapeutic area (e.g., cardiology), the trial phase (Phase I), and recent leadership changes.

- Automated Briefing: This intelligence is packaged into an actionable brief and sent straight to the account executive. The brief includes key stakeholders, potential pain points, and tailored talking points.

This workflow transforms a simple data point into a fully-baked opportunity. The global clinical trials market saw a dramatic surge in 2025, driven by stronger biotech funding. The market jumped from USD 59 billion in 2024 to USD 62.4 billion in 2025, with projections hitting USD 87.42 billion by year's end.

A Practical Example: The Cytel Case Study

Consider the case of Cytel, a leader in statistical software for clinical trial design. Their sales team needed to engage biotech companies at the precise moment they were planning new trials—not after decisions were locked in.

Using Salesmotion, they moved beyond generic prospecting. They set up specific alerts for high-value signals like Series A/B funding rounds, FDA meeting announcements, and new hires in key clinical roles. This created a proactive, automated system for opportunity discovery.

When a target company announced a funding round for a specific Phase I trial, the account executive didn't just get a notification. They received an automated brief with stakeholders, company goals, and tailored talking points, enabling an outreach that was both timely and deeply relevant.

This allowed them to position Cytel's solution as the perfect fit for that specific trial phase, significantly shortening the sales cycle. To efficiently process complex information and extract key insights quickly, an AI research paper summarizer can be an invaluable asset.

By leaning on an AI-driven platform, you equip your team to act on the most impactful buying signals. To learn more about identifying these triggers, check out our guide on the best signals for enterprise sales. This strategic approach ensures you engage accounts at the moment of highest need, turning intelligence into revenue.

How Cytel Gets Ahead of the Trial Pipeline

Theory is great, but let's talk about what works. Here’s a real-world example of how Cytel, a major player in statistical software for clinical trial design, transformed its prospecting strategy.

Their sales team was stuck in a common trap: engaging biotech companies after they had already started planning new trials. By the time a trial shows up in a public database, key decisions are often locked in. Trying to manually find clinical trials this way was slow and almost always too late.

They needed to shift from reactive to proactive. The goal was to spot the earliest signs of intent, letting them start conversations when their expertise was most needed.

Setting Up the Right Triggers

Using Salesmotion, the Cytel team stopped chasing old news and started setting up automated alerts for high-value buying signals. Instead of just looking for new trial listings, they zeroed in on the events that happen before a trial is publicly announced.

These were their most powerful triggers:

- Series A/B Funding: Fresh capital is almost always tied to specific R&D goals, making it a strong predictor of an upcoming trial.

- FDA Meeting Announcements: A scheduled meeting with the FDA is a clear signal that a clinical development plan is moving forward.

- Key Clinical Hires: You don’t hire a new VP of Clinical Operations unless you’re getting ready for new studies.

These signals gave them the "why now?" that was missing. Every alert was a concrete reason to believe a target account was actively planning its next move.

From Signal to Scheduled Meeting

This wasn't just about getting a notification. It was about turning a raw signal into a tailored opportunity.

When a target company announced funding for a new Phase I trial, the account executive received a comprehensive, automated brief right in their workflow. This brief packaged all the essential context:

- Key Stakeholders: It instantly identified decision-makers, from the new Head of Clinical Development to the CEO.

- Company Goals: The brief pulled highlights from press releases, clarifying the goals of the funding and upcoming trial.

- Tailored Talking Points: It provided talking points connecting Cytel’s software directly to the challenges of designing a Phase I study.

This level of intelligence meant the account executive could craft an outreach message that was not just perfectly timed but deeply relevant. They could lead by congratulating the company on their funding and immediately pivot to how Cytel could help them hit their new milestones.

The result? The first conversation felt like a strategic partnership, not a cold pitch. This repeatable workflow—moving from signal to informed outreach—led to more booked meetings and a healthier pipeline.

By focusing on the right signals, Cytel aligned its sales motion with the customer's journey. They proved that the best way to find clinical trials is to spot the opportunities before they even become trials.

Want the full breakdown? You can explore the full Cytel case study to see how they turned intelligent signal monitoring into measurable revenue growth.

“Automatic account profile detail I can use to manage my territory. Using Salesmotion AI to generate value statements per persona, account, etc. Using Salesmotion to give me a starting point based on new hires, or news alerts is critical.”

Adam Wainwright

Head of Revenue, Cacheflow

Building Your Signal-Based Sales Playbook

Knowing about buying signals is one thing. Using them to consistently build pipeline is another. This is where you move from theory to execution.

Understanding clinical trial site selection is critical for teams that want to win more studies. Building a signal-driven sales playbook creates a repeatable, scalable process around clinical trial intelligence. It gets your entire revenue team—from sales and marketing to rev ops—aligned around the real-time needs of your target accounts. When you find clinical trials through their early signals, you're not just finding leads; you're uncovering strategic opportunities.

Defining Your Ideal Customer Profile by Trial Signals

Your standard Ideal Customer Profile (ICP) probably includes firmographics like company size and location. For pharmatech, you have to go deeper. A signal-based ICP is defined not just by who the company is, but by what they are doing right now.

Start by sharpening your ICP with specific trial characteristics:

- Therapeutic Area: Do you specialize in solutions for oncology, cardiology, or rare diseases? Prioritize signals from trials in your strongest areas.

- Trial Phase: A company launching a Phase I trial has completely different needs than one entering Phase III. Map your solutions directly to the challenges of each phase.

- Company Size and Stage: An emerging biotech fresh off a Series A funding round has different buying triggers than a massive pharmaceutical company.

By layering these attributes onto your ICP, you can use an intelligence platform like Salesmotion to track only the most impactful triggers. This stops your team from drowning in noise and keeps them focused on high-potential opportunities.

The core idea is simple: Stop chasing every company that might run a trial and start focusing on the ones whose trial activities signal an immediate and specific need for your solution.

This strategic filtering is the first step in turning a flood of data into a manageable stream of qualified opportunities.

From Alert to Outreach A Practical Framework

So, you’ve identified the right signals. Now what? The next step is building a structured response. Turning an alert about a "protocol amendment" or a "new site activation" into compelling outreach requires a clear framework.

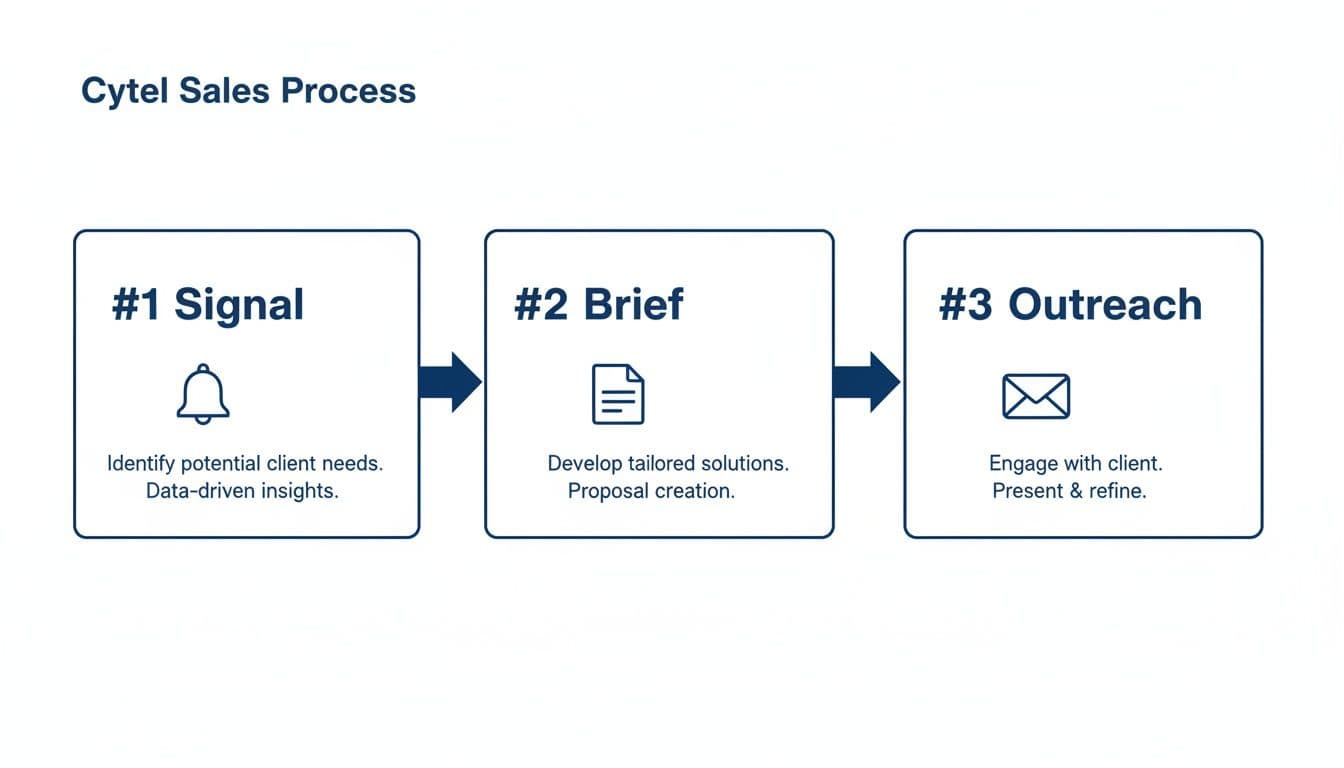

Effective sales teams, like Cytel's, use a simple three-step process to put signal intelligence into action.

This model is brilliant in its simplicity. An automated signal triggers a contextual brief, which empowers a highly relevant outreach message. It’s a repeatable workflow that scales personalization and relevance across your team.

Creating Trigger-Based Sequences

A generic sales sequence won't cut it. Each signal requires its own messaging track that speaks directly to that trigger. Your playbook should include templates and frameworks for these sequences so your reps can quickly customize and send them.

Here’s a practical guide showing which signals to monitor and the corresponding sales action.

Key Clinical Trial Sales Triggers and Actions

This table breaks down common clinical trial signals, what they mean, and how your team should respond.

| Clinical Trial Signal | What It Means | Recommended Sales Action |

|---|---|---|

| New Trial Initiation | The company is actively investing in a new study and needs vendors for execution. | Outreach with solutions specific to the trial phase and therapeutic area. Reference the trial directly. |

| Protocol Amendment | A change in the study design often signals a challenge or operational hurdle. | Offer solutions that can help them overcome the specific challenge (e.g., patient recruitment, data management). |

| New Site Activation | The trial is expanding, creating needs for site management, logistics, and technology. | Contact the clinical operations team to discuss how you support multi-site trial efficiency. |

| Key Clinical Hire | A new leader (e.g., VP of Clinical Ops) is likely reviewing processes and vendors. | Welcome them to their new role and share insights relevant to their new responsibilities. |

| Positive Phase Results | Good news means they will be planning for the next, more complex phase of the trial. | Congratulate them and proactively offer solutions that scale for larger, later-phase studies. |

When a "New Site Activation" signal comes through, your AE’s first email shouldn't be a generic product pitch. It should be a targeted message like: "Congratulations on activating the new Dallas site for your XYZ trial. Managing data consistency across multiple sites can be a challenge; our platform ensures seamless integration from day one."

This approach instantly shows you’ve done your homework. To dig deeper into this strategy, check out our guide on the fundamentals of signal-based selling.

By building out these trigger-based plays, you equip your team to respond to opportunities with speed and relevance, dramatically increasing their chances of booking that first meeting.

Key Takeaways

- Public clinical trial registries are lagging indicators -- by the time a trial appears on ClinicalTrials.gov, key vendor decisions have often already been made, making traditional prospecting too slow for competitive pharmatech sales.

- The most effective way to find clinical trials for sales purposes is to monitor the real-time signals that precede them: funding announcements, FDA meeting schedules, key clinical hires, and protocol amendments.

- AI-powered account intelligence platforms automate signal detection across diverse sources like press releases, investor calls, and executive LinkedIn updates, delivering contextual briefs that turn data points into actionable outreach.

- Each clinical trial milestone creates a distinct selling opportunity -- new trial initiations, protocol amendments, site activations, and positive phase results all signal specific, urgent needs your solution can address.

- Building a signal-based ICP that filters by therapeutic area, trial phase, and company stage ensures your team focuses on high-potential opportunities instead of drowning in noise from the massive and growing clinical trials market.

Questions We Hear All The Time

If you're a sales leader in pharmatech, you know using clinical trial data is a huge advantage. Here are a few common questions we get about making this strategy a core part of your sales workflow.

How Can a Platform Find Trials Faster Than Public Registries?

This is the most important question. Public registries like ClinicalTrials.gov are lagging indicators. By the time a trial is listed, key vendor selections have often been made.

An intelligence platform like Salesmotion doesn't just scrape these sites. It casts a wider net, monitoring real-time sources that signal intent long before a trial is announced.

We’re talking about signals like:

- Press releases announcing funding for new research.

- Investor calls where executives map out their R&D pipeline.

- Key executive hires for roles critical to running a new clinical program.

- Company blog posts that telegraph a new therapeutic focus.

By picking up on these early clues, your team gets a massive head start. You can start conversations during the planning phase, not after the ship has sailed.

How Does This Strategy Fit Into an Existing Sales Workflow?

This is simpler than it sounds. The idea is to enhance your current process, not replace it.

Salesmotion feeds actionable alerts directly into the tools your team already uses—Slack, email, or your CRM. An alert about a "new trial initiation" or "positive phase 2 result" lands in their queue as a high-value, automated task.

Your reps get a contextual brief with the signal, allowing them to craft a highly relevant email or call script in minutes. It becomes a smarter part of their daily prospecting routine.

Can We Track More Than Just Trial Initiations?

Absolutely. And you should. The entire clinical development lifecycle is packed with moments to engage.

The most successful teams don't just find clinical trials; they follow them. A "protocol amendment" signals a potential challenge you can help solve, while a "new site activation" points to urgent logistical needs. Every stage is a new door opening for a valuable conversation.

Take our work with Cytel. Their team configured Salesmotion to flag not just new trials, but also early-stage triggers like Series A/B funding rounds and upcoming FDA meeting announcements. This let them engage with surgical precision, positioning their solution as essential from the very beginning of the trial design process. Tracking these nuanced updates, progress, and changes gives your team continuous, legitimate reasons to connect with an account and build a stronger relationship.

Ready to stop chasing old data and start acting on real-time buying signals? Salesmotion transforms how B2B revenue teams find opportunities in the life sciences sector. Learn how our AI-powered account intelligence platform can help you turn clinical trial activity into measurable pipeline growth. Get a demo today.

Frequently Asked Questions

Why is ClinicalTrials.gov not enough for pharmatech sales prospecting?

Public registries like ClinicalTrials.gov are lagging indicators that report on trials after key decisions have already been made. By the time a trial's status is officially updated, the sponsor has often already selected its vendors. Sales teams relying solely on these databases are always a step behind, missing the critical window when their solutions are most relevant.

What are the best buying signals to track in the clinical trials space?

The most powerful signals include Series A/B funding announcements tied to specific R&D goals, FDA meeting schedules that indicate a clinical development plan is advancing, new hires in key clinical roles like VP of Clinical Operations, and protocol amendments that suggest operational challenges. These events happen before trials are publicly listed and create the "why now" urgency for outreach.

How does AI-powered intelligence find clinical trials faster than manual research?

AI platforms monitor diverse real-time sources beyond public registries, including press releases, investor calls, executive LinkedIn updates, and industry news. The system does not just detect signals; it interprets them by connecting funding announcements to specific therapeutic areas and trial phases, then packages the intelligence into actionable briefs with stakeholder information and tailored talking points.

What is a signal-based ICP for pharmatech sales?

A signal-based Ideal Customer Profile goes beyond standard firmographics to define target accounts by what they are doing right now. This includes filtering by therapeutic area, trial phase, and company stage. For example, an emerging biotech fresh off Series A funding has different needs than a large pharmaceutical company entering Phase III, and your ICP should prioritize signals that match your solution's strengths.

How did Cytel use signal-based intelligence to improve their sales results?

Cytel configured automated alerts for high-value buying signals like funding rounds, FDA meeting announcements, and key clinical hires. When a target company announced funding for a new Phase I trial, their account executive received an automated brief with stakeholders, company goals, and tailored talking points. This allowed them to engage during the planning phase rather than after vendor decisions were locked in, significantly shortening their sales cycle.

Can you track more than just trial initiations for sales opportunities?

Yes, and you should. The entire clinical development lifecycle is filled with selling opportunities. Protocol amendments signal potential challenges you can help solve, new site activations point to urgent logistical needs, and positive phase results indicate the company will be planning for the next, more complex phase. Each milestone creates a distinct and timely reason to engage.